Fundamental Forecast for British Pound: Bullish

An important improvement in interest rate prospects sends the British Pound higher

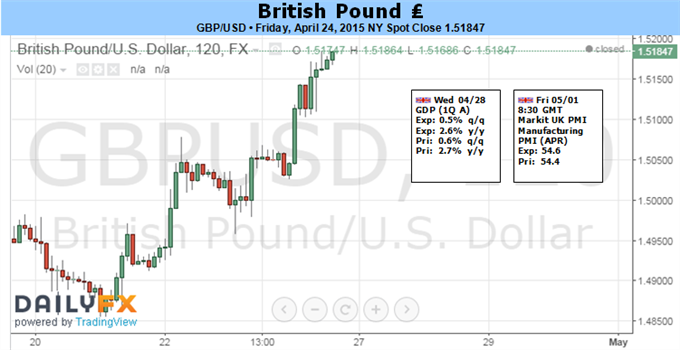

The British Pound’s volume profile suggests a break above $1.5150 targets $1.56

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

An important jump in interest rate expectations helped push the British Pound to fresh two-month highs versus the US Dollar. Yet a great deal of uncertainty surrounding upcoming UK Elections could slow gains as traders prepare for potential volatility.

The coming week will be an important one for the UK and broader financial markets as national agencies release British and US Gross Domestic Product (GDP) growth figures for the first quarter, while a highly-anticipated US Federal Reserve policy meeting and Nonfarm Payrolls report will likewise drive market volatility.

Last week we argued that fundamental strength could fuel a sustained GBP reversal, and indeed recent developments suggest the British Pound could claw back further losses through upcoming trade. The key caveat is that any number of top-tier economic data releases and events in the coming two weeks could change outlook. Any large surprises out of upcoming UK GDP figures could have an especially significant impact for Sterling pairs. And the US Fed decision as well as NFPs results always threatens major moves in USD currency pairs.

The true test for the Sterling may ultimately come in the following week as there remains a great deal of uncertainty surrounding UK Elections. A sharp jump in GBPUSD volatility prices/expectations underlines the risk, and it remains especially difficult to predict the outcomes of the elections and much less implications for the GBP itself.

We remain cautiously bullish the British Pound as recent Bank of England rhetoric suggests that domestic interest rates may rise sooner than expected. Yield-seeking investors continue to favor currencies with higher rates of return, and interest rate differentials remain one of the most important drivers of exchange rate volatility. The key question is whether upcoming data and/or political uncertainty can derail what seems to be the start of a larger reversal for the UK currency.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.