Fundamental Forecast for British Pound: Bearish

Weakest UK Consumer Price Index inflation sinks the British Pound

One-sided sentiment warns of further GBPUSD weakness

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

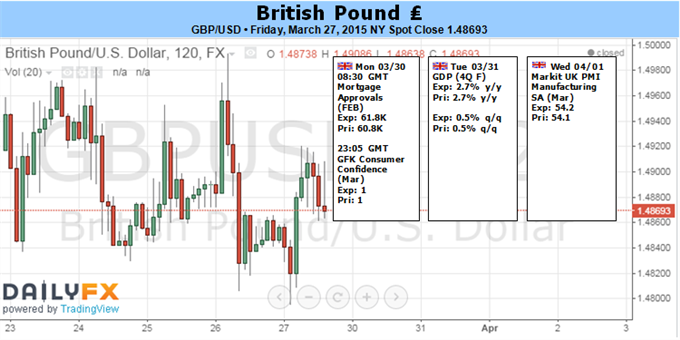

The British Pound fell for the third week of the past four versus the US Dollar, hurt by disappointing economic data and generally dour trading sentiment. Traders could push the Sterling to fresh lows on a key week ahead for the US Dollar and other currencies.

A relatively quiet week for UK economic event risk will keep traders focused on key event risk out of the United States and continental Europe. Yet any important surprises in final revisions to Q4, 2014 Gross Domestic Product growth figures could force GBP-led moves through Tuesday. Larger GBP/USD volatility nonetheless seems more likely on upcoming US Nonfarm Payrolls figures as the US Dollar itself remains volatile.

Interest rates remain the main driver of British Pound moves, and a disappointing UK Consumer Price Index inflation report sent domestic yields and the GBP noticeably lower. Traders had previously sent the British Pound and US Dollar higher versus major counterparts as the Bank of England and US Federal Reserve were the only central banks within the G10 expected to raise interest rates in 2015. Yet a significant correction in GBP/USD yield differentials helps explain recent Sterling underperformance, and it’s difficult to envision a meaningful recovery in BoE yield expectations through the foreseeable future.

Political uncertainty further clouds outlook for the British Pound with UK elections due through early May. FX options traders are clearly bracing for the political risks as GBP/USD volatility prices jump to their highest since the Scottish referendum. Traders remain skittish, and recent CFTC Commitment of Traders data showed that large speculators increased their net-short GBP position for the third-consecutive week.

The British Pound remains at risk ahead of a key week for the US Dollar, and it may take a substantial shift in trader sentiment to force a meaningful GBP recovery.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.