Fundamental Forecast for British Pound: Neutral

GBP/USD Rebound Stalls at Former Support- Bearish RSI Break in Focus

GBP/USD Tests Key Retracement

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

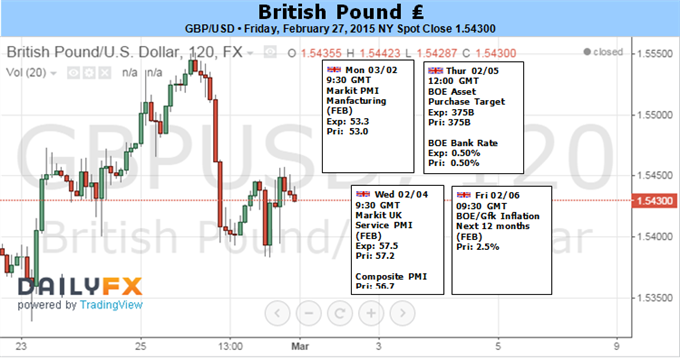

The Bank of England’s (BoE) March 5 interest rate decision may have a limited impact on GBP/USD as the central bank is widely anticipated to retain its current policy, but the fundamental developments coming out of the U.K. may continue to boost the appeal of the sterling should the data prints highlight an improved outlook for growth and inflation.

Following the BoE testimony, it seems as though the Monetary Policy Committee (MPC) will continue to move towards a rate hike especially as Governor Mark Carney only sees a ‘temporary’ decline in U.K. inflation and retains the hawkish forward-guidance for monetary policy. With that said, a further pickup in U.K. Mortgage Approvals along with a faster expansion in the Purchasing Manager Indices (PMI) may boost interest rate expectations as a growing number of central bank officials show a greater willingness to normalize monetary policy over the near to medium-term.

At the same time, the U.S. Non-Farm Payrolls (NFP) report will also largely be in focus as it remains a race between the Fed and the BoE as to who will be the first to normalize monetary policy. Indeed, another 240K expansion in U.S. employment may further the argument for a mid-2015 rate hike, but Chair Janet Yellen and Co. may ultimately share a similar fate to their U.K. counterpart especially as Average Hourly Earnings are expected to narrow to an annualized 2.1% in February. As a result, the disinflationary environment may push the Fed to further delay its normalization cycle, while a pickup in U.K. economic activity may underpin a larger rebound in the British Pound as the central bank continues to prepare households and businesses for higher borrowing-costs.

Nevertheless, the lack of momentum to push and close above the former support zones around 1.5510-55 may produce range-bound prices in GBP/USD ahead of the key event risks, but the pair may make a more meaningful effort to retrace the decline from the previous year should the fundamental developments sway the interest rate outlook for the U.S. and U.K. As we open up the March trade, the opening monthly range may dictate the short-term outlook for the pound-dollar as the Fed is scheduled to deliver its next interest rate decision on March 18.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.