Fundamental Forecast for Pound:Neutral

Daily OBV Divergence in GBP/USD a Concern

Video: GBPUSD Dives After UK CPI, EURUSD Awaits Clear Risk

For Real-Time SSI Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

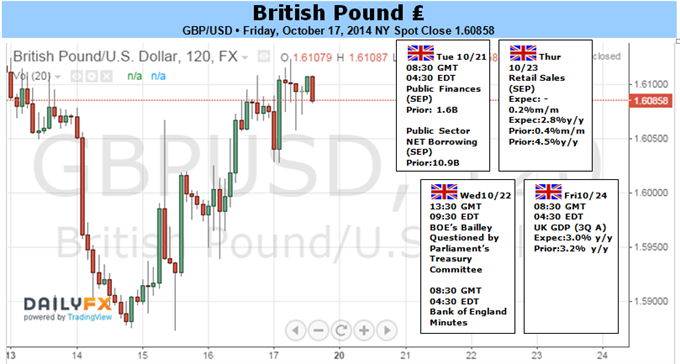

The British Pound may face additional headwinds in the week ahead should the fundamental developments coming out of the U.K. drag on interest rate expectations.

Indeed, Bank of England (BoE) Chief Economist Andrew Haldane warned ‘interest rates could remain lower for longer’ amid the uncertainly surrounding the economic outlook, and the central bank may look to preserve the highly accommodative policy stance for an extended period of time especially as the Euro-Zone, the U.K.’s largest trading partner, faces a growing risk of slipping back into recession.

As a result, the BoE Minutes are widely expected to show another 7-2 split, with Martin Weale and Ian McCafferty still voting against the majority, but the policy statement may highlight a more dovish tone for monetary policy as the headline reading for U.K. inflation slows to an annualized 1.2% in September to mark the lowest reading since 2009. At the same time, the 3Q Gross Domestic Product (GDP) report may undermine the BoE’s expectations for a faster recovery as the growth rate is projected to expand 0.7% after rising 0.9% during the three-months through June, and a marked slowdown in the real economy may generate fresh monthly lows in GBP/USD as market participants scale back bets of seeing higher borrowing costs in the U.K.

Nevertheless, the technical outlook highlights a more meaningful recovery for GBP/USD as the Relative Strength Index (RSI) breaks out of the bearish momentum carried over from the end of June, and we will continue to keep a close eye on the ongoing divergence in the oscillator amid the string of lower highs in price. - DS

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.