Fundamental Forecast for Euro: Bearish

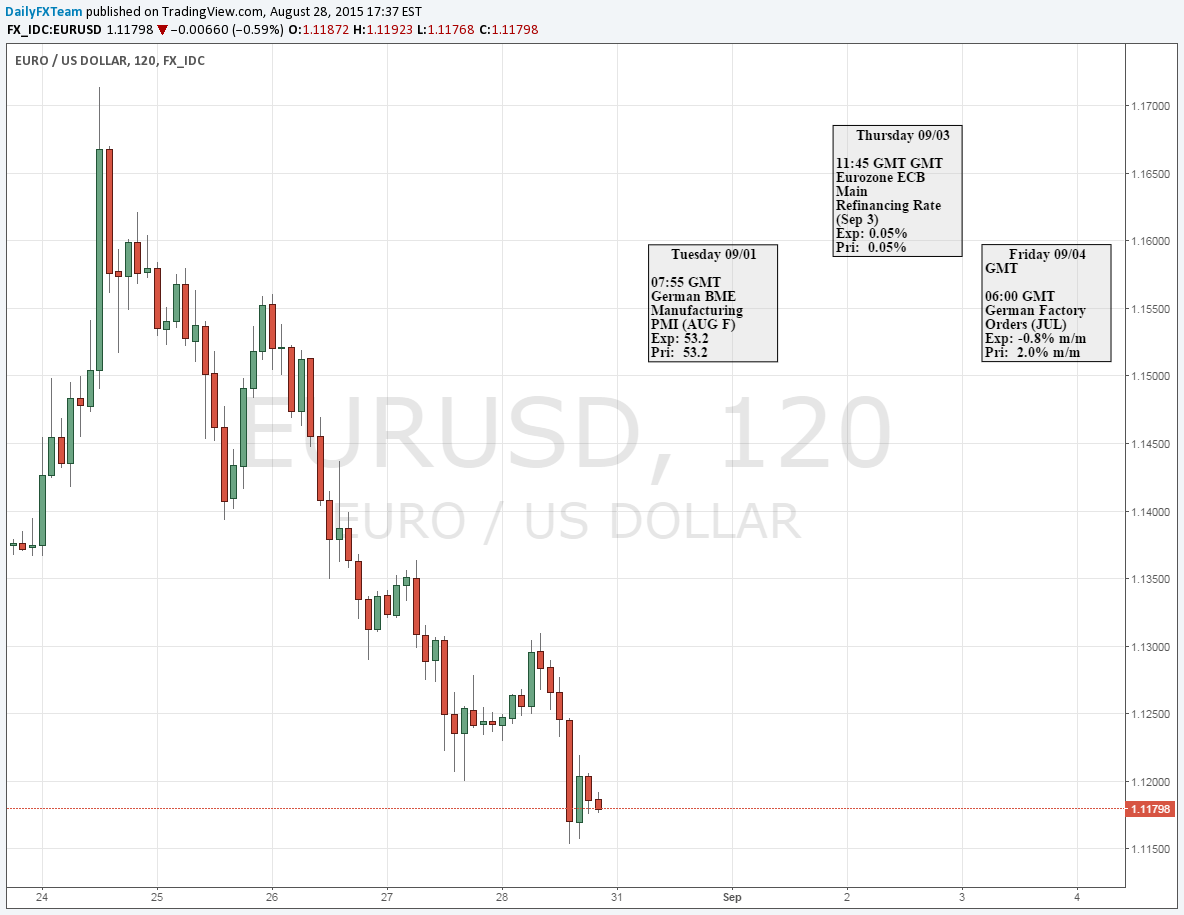

EUR/USD Downside Levels to Watch Ahead of ECB, NFP

The Weekly Volume Report: Volume Spikes With Spot

For Real-Time SSI Updates and Potential Trade Setups on the Euro, sign up for DailyFX on Demand

The sharp pullback in EUR/USD may gather pace in the week ahead should the European Central Bank (ECB) signal a further expansion of monetary policy, while another 200K+ U.S. Non-Farm Payrolls (NFP) print may boost expectations for a September Fed rate hike as the committee largely retains an upbeat outlook for the world’s largest economy.

Even though the ECB is widely expected to retain its current policy at the September 3rd meeting, the Governing Council may show a greater willingness to expand/extend the scope of its quantitative easing (QE) program as the slowdown in global growth accompanied by the renewed decline in energy prices dampens the central bank’s scope to achieve its one and only mandate to achieve price stability. As a result, a more dovish statement delivered by ECB President Mario Draghi may fuel speculation for additional monetary support, and the Euro remains at risk giving back the advance from late-July should they key developments highlight a growing deviation in the policy outlook.

With only so much data prints remaining ahead of the Fed’s rate decision, the August NFP report may play an increased role in shaping market expectations, and a further expansion in U.S. job growth paired with a downtick in the unemployment rate may boost bets for a rate hike as Fed Vice-Chair Stanley Fischer argues that September remains on the table for liftoff. However, recent comments from New York Fed President William Dudley appears to be highlighting a growing dissent within the committee as the permanent voting-member sees a ‘less compelling’ case of higher borrowing-costs, and the fundamental developments due out in the coming days may set the near-term outlook for EUR/USD as the central bank remains ‘data dependent.’

In turn, the key event risk due out next week may produce a further decline in the euro-dollar, and signs of a greater divergence in the monetary policy outlook may ultimately produce a resumption of the long-term downward trend should the Fed remains on course to remove the zero-interest rate policy (ZIRP). Moreover, the euro-dollar may continue to give back the advance from late-July amid the recent series of lower highs & lows in the exchange rate along with the failure to hold above former resistance around 1.1180 (23.6% expansion) to 1.1210 (61.8% retracement).

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.