Fundamental Forecast for Euro: Neutral

- The EURUSD rally was kickstarted by the disappointing Q1’15 US GDP release on Wednesday.

- A double bottom technical pattern may see EURUSD extend itsgains above $1.1500.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

The Euro was easily the top performing major currency this past week, gaining +2.58% against the Australian Dollar, +2.91% against the US Dollar, and +3.85% against the Japanese Yen, the worst major performer. While there’s no single event or series of data that can be pointed to as the catalyst, it’s evident that a massive short squeeze is underway as the European Central Bank’s QE ‘trade unwinds’: short Euro, long European equities, and long European bonds. In concert with the Euro rally, European equity markets slid this past week, while both core and peripheral yields jumped.

Accordingly, as the ECB’s QE-driven trade has unwound, we’ve seen a sizeable (-7.9%) decline in speculative net-short positions in the futures market: there were 197.8K contracts as of the week ended April 28, 2015, a number that likely shrunk even further as EURUSD rallied +1.94% from the close on Tuesday through the end of the week alone.

Perhaps the most noticeable catalyst was the rise in medium-term inflation expectations, with the 5-year, 5-year inflation swap rising from 1.685% at the beginning of the week to as high as 1.797% by Thursday. Higher inflation expectations are further reducing the real return on already low-yielding fixed income assets; investors may have simply found themselves in the undesirable situation of holding low- or negative-yielding bonds in a rising inflation environment, provoking the sell off in the belly and long-end of yield curves in the Euro-Zone.

In the short-term, if rising inflation expecations proliferate, equity market and bond market weakness might continue, and the Euro may rally further. Even though Euro short positions have moderated, they still remain relatively stretched compared to positioning seen in other major currencies versus the US Dollar. From a charting perspective, the technical consolidation seen during March and April may have given way to a double bottom formation, opening the door for a potential EURUSD rally above $1.1500 over the coming weeks. The table is set for such a move, given postioning and correlated asset performances.

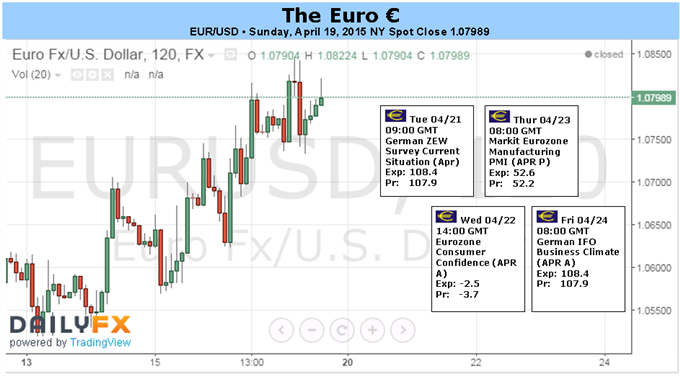

Over the next few days, there are relatively few obstacles in the way for the Euro to continue its covering move. Greece remains a concern, but barring its exclusion from the Euro-Zone, investors have more or less become comfortable (or complacent) with the day-to-day headlines regarding the debt negotiations. On the European data side, there is nothing truly noteworthy that may provoke investors to reassess their short-term trade horizon, although the European Commission’s updated economic forecasts on May 5 will be worth paying attention to. Outside of the Euro-Zone, the Reserve Bank of Australia rate decision on Tuesday and the US Nonfarm Payrolls report on Friday should be the most significant catalysts for price action this week. Truly, only a strong NFP report could slam the breaks on the EURUSD’s covering move, but after several weeks of disappointing data that haven’t abated at the start of Q2’15, the headline US labor market reading may only prove to be a minor impediment this week.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.