Fundamental Forecast for Euro: Neutral

- The Euro has seen moderately higher prices in recent days, but the longer-term outlook remains bearish.

- EURUSD traded into a key resistance level, and now the US Dollar may be searching for a bottom post-FOMC.

- Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

Continued general improvement in Euro-Zone data and a further build of commercial long positioning (now an all-time high of 271.9K net-long contracts) helped buoy Euro exchange rates for a second straight week, although the turn of the calendar from March into April may prove to be more difficult than days past. EURUSD rallied by +0.62% to close last week at $1.0885 and EURGBP jumped by +1.09% to £0.7321, yet both major EUR-crosses settled considerably lower than their high watermarks for the week ($1.1052 and £0.7385 respectively).

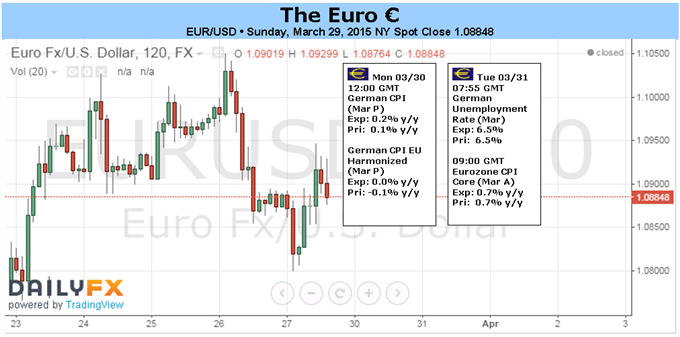

In the days ahead, the market has a chance to refocus its attention on two of the major drivers of Euro weakness in 2015: persistently low inflation in the Euro-Zone; and the sustained improvement in the US labor market that is driving a wedge between ECB and Fed policy expectations. On Tuesday, the March Euro-Zone CPI report will be released, where the CPI Estimate is due at -0.1% y/y from -0.3% y/y, and the CPI Core is expected at +0.7% y/y unch. On Friday, the March US Nonfarm Payrolls report is forecast to see job gains of +250K, the thirteenth consecutive month of at least +200K jobs growth in the world’s largest economy.

In a holiday shortened week, these data reports represent the two most obvious landmines to EURUSD traders. The propensity for these reports to impact the market is high despite the potential for diminished liquidity, as speculators have embraced the most bearish view of the Euro on record, having 221.K net-short contracts on the books for the week ended March 24, eclipsing the previous all-time high of 214.4K net-shorts set during the week ended June 5, 2012. Whereas Euro speculative shorts have grown in tandem with commercial longs digging in, speculative traders in the futures market have relinquished the aggressive bullish US Dollar view: Dollar Index (DXY) net-longs contracted by -10.7% to 71.2K contracts.

If EURUSD is to fall back, then, it will need to be due to a combination of soft Euro-Zone CPI data and strong US labor market data – not either/or, but both. Market measures of inflation expectations have steadied, but not by much: the 5-year, 5-year inflation swaps (FWISEU55) ended the week at 1.649%, just below the four-week/20-day average of 1.709%. The recent dip in inflation expectations (1.760% on March 20) can be attributed to the recent relief rally in the Euro, as data otherwise remains relatively strong.

The Citi Economic Surprise Index for the Euro-Zone hit +52.1 at the end of the past week, up from +40.2 from a week earlier. Euro-Zone data has been outpacing US data at its best clip in nearly four and a half years. Markets haven’t priced in the improved Euro-Zone data as a batch that would materially change the pace of ECB easing, however: Morgan Stanley’s ‘months to first rate hike’ index (MSM1KEEU) resides at 45.5 suggesting a December 2018 rate hike.

Overall, the big picture for the Euro remains unchanged, even as it continues to take shape: rising inflation expectations coupled with falling nominal bond yields means prospective real yields are being reduced, fueling the need for investors to search for yield outside of the region; this should accelerate capital outflows as Euros are exchanged for other currencies to as to invest in foreign assets. The time for this view to come back into focus may be nearing, as investors get a first-hand look at the policy differential between the ECB and the Fed with the data due in the days ahead.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.