EUR/USD

The EUR/USD continued to decline down to 1.2828 in the past week, however it has also been a little above the 1.2990 level. That is why we can expect a rebound from wave A during this week. If EMA (50) is breached, we can expect a growth of EUR/USD up to wave D. If the macroeconomic news are positive, we can expect a stagnation of EUR/USD around wave A.

GBP/USD

Towards the end of last week the British Pound has adjusted its previous growth from wave B to wave A. This week we are expecting an imitation of the growth line above EMA (50) and growth between waves B and C. If the triangular level and wave A is breached, then we can expect a declining adjustment up to wave D.

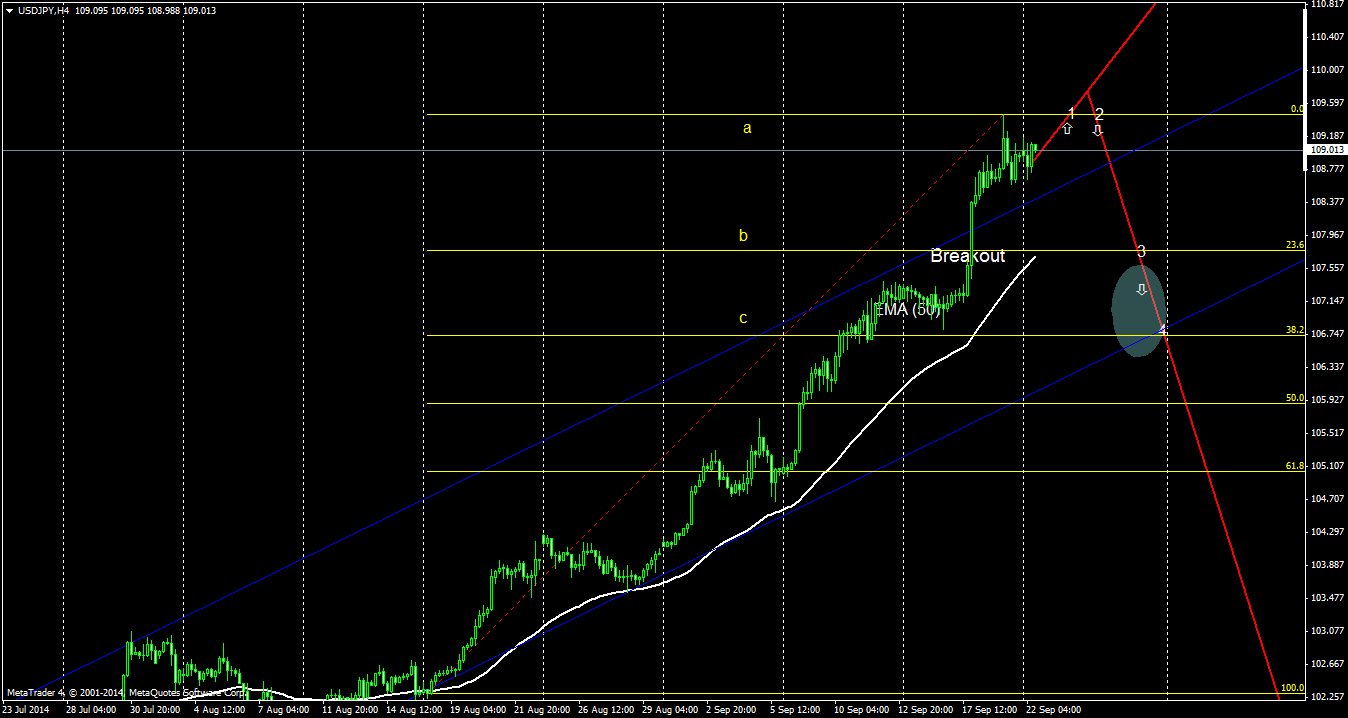

USD/JPY

Due to positive news from the American labor market the USD/JPY has grown and wave B was surpassed up to wave A. There is evidence of slight resistance forming close to wave A. If this resistance holds, then we can expect the USD/JPY to get back to the long-term growing channel and EMA (50) value. Consecutively if EMA(50) is breached, then we can expect a declining trend up to wave C.

GOLD

Gold has continued its decline towards wave A in the past week. It is currently floating below the EMA (50). This week we can expect an adjustment towards wave C. The long-term prediction is one of steady decline, and if wave A is breached we can expect a fall below 1200USD.

By utilizing this website, you agree to be bound by these terms and conditions. This is a legal agreement (“Agreement”) between you and Leconte, sro.. (“Gurulines”) for use of the website, data, Gurulines electronic trading platform, and products and services which you selected or initiated, which may include the Gurulines trading platform and third party signal providers (“Products and Services”). If you do not agree with the terms of this Agreement, do not use this website or any of the Products and Services.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.