EUR/USD

Anyone who has expected an increase of EUR/USD in the past week, was wrong. Last week, wave A was breached and the market weakened and dropped below 1.2700. This week we are expecting a consolidation and return to wave A, however the overall trend will be rather decreasing. If wave C is breached, we can expect a decrease up to the 1.2500 level.

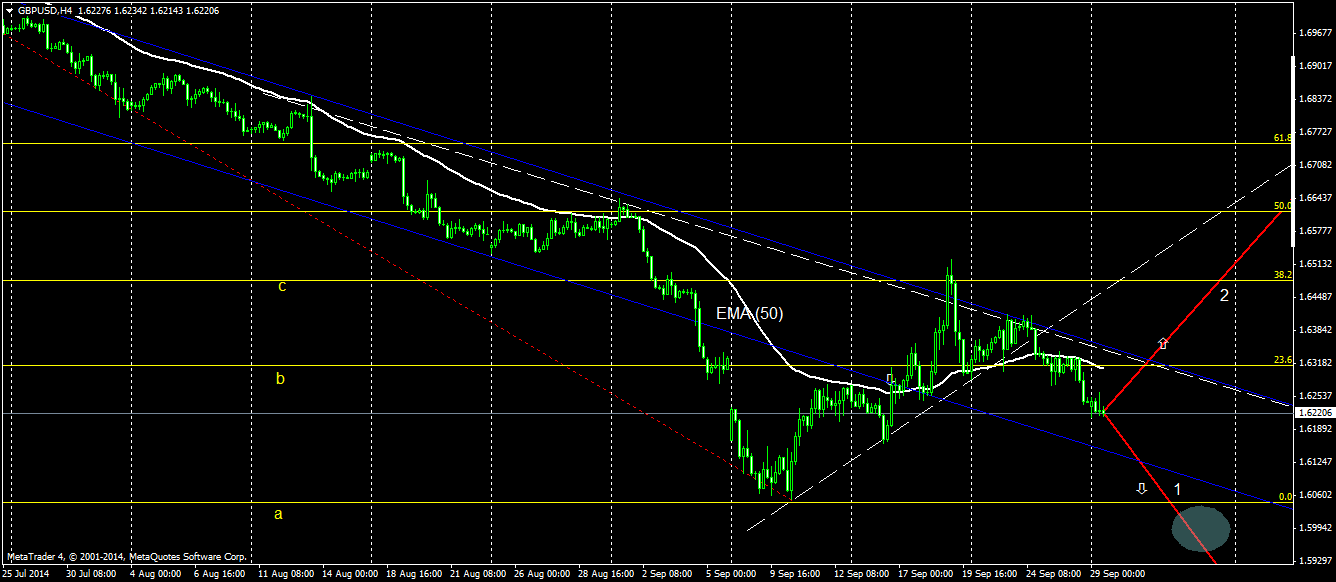

GBP/USD

Although GBP/USD seemed to start to grow in the past week, its breath run out and opposite happened. It tested the 1.6200 level. In a long run the GBP/USD has decreasing trend, therefore we expect a movement from wave B toward wave A during this week. The decrease trend will probably stop at this point and have attempt the support level of 1.6000.

USD/JPY

The USD/JPY is still following a growing trend. After several breakouts and a rapid movement of wave B towards wave A we expect a cooling of the growing trend followed by consolidation. If consolidation is accompanied by attempts to break the EMA (50), it can lead to a decline up to wave B, and if it is breached it can likewise breach wave C.

GOLD

As wave C was not breached last week (did not drop below 1200USD), a strong support has surfaced. If there is no breach of wave C during this week, we can expect a stagnation below the EMA(50) level and slight growth, which should not exceed 1250 USD.

By utilizing this website, you agree to be bound by these terms and conditions. This is a legal agreement (“Agreement”) between you and Leconte, sro.. (“Gurulines”) for use of the website, data, Gurulines electronic trading platform, and products and services which you selected or initiated, which may include the Gurulines trading platform and third party signal providers (“Products and Services”). If you do not agree with the terms of this Agreement, do not use this website or any of the Products and Services.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.