- UK data should strengthen Pound

- Euro weaker on ECB dovishness

Meanwhile, The European Central Bank is hinting heavily that further monetary stimulus is on its way. A similar hint a few years ago would have caused a Euro slump but it would seem that Euro traders are relatively sanguine because the Euro hasn't weakened that much. Sterling – Euro is up to €1.29 again and the Euro – US Dollar rate is down to $1.11 but these are both levels within the current trading ranges.

As far as the Pound is concerned, we have UK retail sales data this morning which should show an improvement on the December figures which were disappointing to say the least. We will also get UK government borrowing data which is expected to show improvement as employment hits a record high and tax receipts follow. January is also the last payment date for self-assessment tax; hence the influx of moolah for the treasury.

This afternoon brings US inflation data. It's minimal and will remain so unless commodity prices pick up, demand picks up and energy costs rise. The US Dollar is more heavily influenced by the prospects for an extended period without interest rate movement and the hints of a reversal of the December rate hike.

This afternoon also brings Canadian retail sales data. The data has been very mixed of late but a marginal improvement is forecast. The Canadian Dollar has had a volatile week; C$2.005 at the top and C$1.95 at the bottom. If this data is good, we can expect another dip to the lower end of that range.

And I mentioned spin doctors earlier; well see if you think this may be a similar case. Islamic Exorcists, Mallam Luthfi Jamal-Baba and Mallam Mohammad, based in Ghana, have stated that beautiful women who soak up the sun in their bikinis are much more likely to be possessed by evil demons. Well I don't know about you but I think this needs looking into in more depth and I am willing to risk assault by evil demons and mortal danger and I volunteer for the task of watching beautiful women in bikinis to see if they get possessed. What do you mean, 'join the queue?'

The talk

Peter joins a new rugby club and, after his first game as a starting player, he is told that the club has an initiation tradition. During the team meal that evening, Peter will have to give a talk to the whole club and the subject of the discussion is 'Making love'.

The chap is a bit shocked. He is married and has some experience but is really not sure what to say. Nonetheless, he stands up after the main course when prompted by the club captain and gives a 20 minute presentation on the subject. It goes down very well and he gets a cheer and a round of applause at the end.

He arrives home very late and quite drunk but the next morning; his wife, Brenda asks how it went. He is still a bit blurry from the beer and the late night and before he thinks it through, be blurts out that he had to make a speech and of course she asks "about what?"

Not wanting to lie to her but a bit embarrassed to tell her the whole truth he says the first thing that comes into his head. "I spoke about...erm.... sailing."

So, whilst Brenda never knew he had a clue about sailing, she nods and gets on with her day. During the afternoon, she bumps into the wife of one of the other players. Alice says, "Ooh I hear your Peter's talk was a bit good last night."

"Oh was it?" said Brenda.

"Oh yes, Sounds like he is really... experienced," says Alice with a very naughty gleam in her eye.

"Yes I was surprised he would talk about that," says Brenda. "He's only done it twice. The first time he was sick and the second time his hat blew off."

AUD

As you can see from the chart above, the Sterling – Australian Dollar exchange rate has recently been trying to break below a trend channel that has contained this pair for nearly 3 years. However, the Aussie Dollar weakened overnight after John Edwards; a member of the Reserve Bank of Australia's Board, was quoted saying the currency was too strong. He is not alone amongst central bankers in trying to use pure rhetoric to weaken their home currencies and I am sure he won't be the last. A weaker Australian Dollar would help beleaguered exporters who have taken a massive hit from China's slow down and the slump in commodity prices. However, retail and inflation data in Australia isn't as bad as it might be and that is keeping the AUD from collapsing.

CAD

The section above was written before the release of the Canadian inflation data which showed the fastest pace of retail inflation in over a year. Over the last year, the Canadian Dollar has generally weakened despite the recent rally. That weaker currency does tend to push inflation up as imports are more expensive. Nonetheless, the Canadian Dollar (loonie to its friends) is still suffering the repercussions of weaker commodity prices and weaker demand for those commodities. In addition, the USA; Canada's chief export market, is producing a lot more of its own energy products, what with fracking etc, and that is damaging demand for Canada's energy exports. So, whilst this inflation data is good for the loonie, you can see from the chart above that the upward trend in the Sterling – Canadian Dollar rate is 3 years old and still intact. Unless this pair slips below C$1.93, I suspect it will remain in force. Beware though; the 'exit' voters in the EU membership referendum have just taken a slight lead in the polls and traders are very nervous about how the UK would fare outside the EU trading bloc. If we do see Britain exit the EU, Sterling is bound to at least dip in value.

EUR

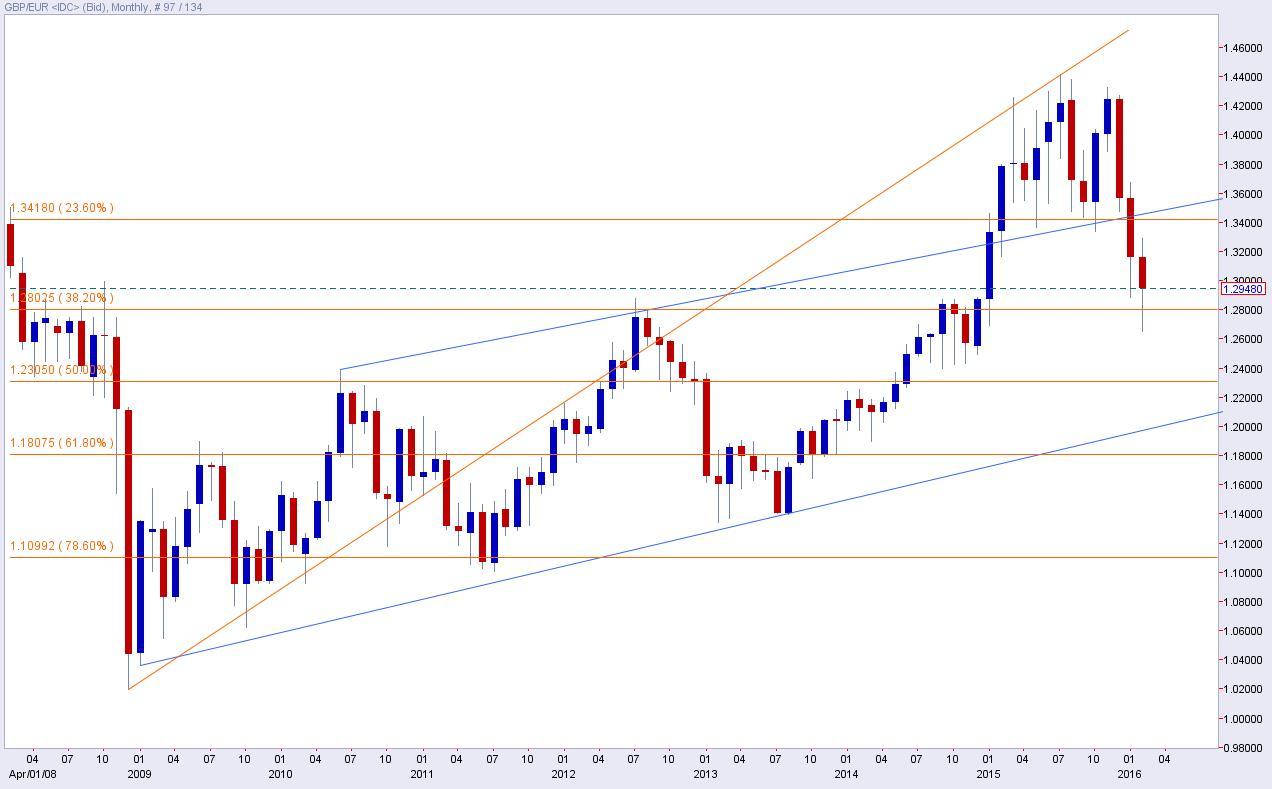

The wrangling over Britain's relationship with Europe is ongoing and no end is in sight. Whether there is an opportunity to change the dynamic between the UK and EU is a moot point at this stage but it would appear that Mr Cameron is making a damned fine attempt at doing so. In the meantime, traders are wary of the Pound and even a positive set of retail sales and government borrowing data wasn't enough to boost sterling by much. I think we have to accept that, were it not for the EU Brexit rumour mill, Sterling would be stronger than it is but, if my Granddad had owned a handbag, he may have been my Grandma. In other words, we are where we are. Sterling is likely to remain subdued until we get this referendum out of the way. However, with the 'No' voters taking a slim lead in the most recent polls, there could well be further downside for the Pound in the meantime.

NZD

Weakness in the Asian and Chinese markets hasn't dampened the New Zealand Dollar as much as you might have expected. In fact, since the spike in the GBP-NZD rate we saw last August, (NZ$2.53 at its height) this pair has created a very pronounced downward trend. That is shown on the chart above but what also evident is the significant support the Pound enjoys at or around NZ$2.15. As you can see, for the whole of 2016 thus far, the NZD has been unable to make any real gains below that level and yet the downward pattern is very consistent. Soon we will be in the situation where the downward trend line is bumping into the support and then something has to give. Until then, those of a nervous disposition may want to protect against a significant break out.

USD

The dive we saw in the GBP-USD exchange rate in January has given way to a more considered upward trend. Support for the Pound can now be seen at $1.4250 but there are clearly plenty of USD buyers at $1.45. So we are at a narrowing trading range at the moment. It certainly appears that the Federal Reserve is ruing the decision to raise their base rate in December and there seems virtually no chance of another rate hike this year. In fact, we may see growing pressure to cut the base rate again unless America's stuttering recovery gathers some pace. On this side of the world, the EU membership debate is raging and that is stopping Sterling from making substantive gains but neither is the Pound diving. It's getting a bit claustrophobic in this narrow trading range but the alternative would be scarier.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.