Today's Highlights

- Oil down to 2003 lows

- Share markets still sliding

- US holiday, so quiet markets likely

FX Market Overview

After a tumultuous week in which shares tumbled, analysts predicted the end of the world as we know it and both oil and commodities slumped. Monday feels like a damp squib. It is not just the fact that it is a US holiday (Martin Luther King Day), the lack of data means there are few reasons for traders to chance their arms.

That won't be the case for the whole week; far from it. Overnight into Tuesday, we will see enough Chinese data to get pulses racing. Another drop in industrial production is expected, a small drop in retail sales, a tiny dip in GDP growth and flat levels of investment will be enough to keep the pressure on the Yuan and to further weaken commodities.

The rest of the week brings a whole heap of UK data including inflation of both producer and consumer variety, retail sales, unemployment data and public sector borrowing levels. The Bank of England will be watching all of that with interest but Sterling is unlikely to get the rebound it probably deserves. Sterling has been hit by the strength of the US Dollar and the weakness of export markets like China and Europe. Fundamentally thought, the UK economy is in relatively good form. Sterling seems to have been hard done by and is now looking much oversold. If you are a Sterling buyer, if I were you, I would have a good look at my needs and protect yourself against the Pound rebounding.

This week also brings a likely interest rate cut from the Bank of Canada in response to slowing exports and poor domestic activity. Look out for opportunities if you are a CAD buyer.

We will get an interest rate and QE announcement from the European Central Bank but no change is expected. That doesn't mean they shouldn't add further stimulus to the economy but they have announced a plan and are likely to stick with it for now. They will have Eurozone inflation and purchasing managers indices to mull over before they decide but I think we know the outcome.

And that is about it. Oh other than the fact that anglers may be flocking to the island of Rum off the West Coast of Scotland. Scientists have discovered earth worms that measure 16 inches long (that's 400mm in new money). It's the perfect spot; massive bait, remote location and every chance of coming back with stories of fish that were Th-i-i-i-i-i-i-i-i-i-i-i-i-i-s big but got away.

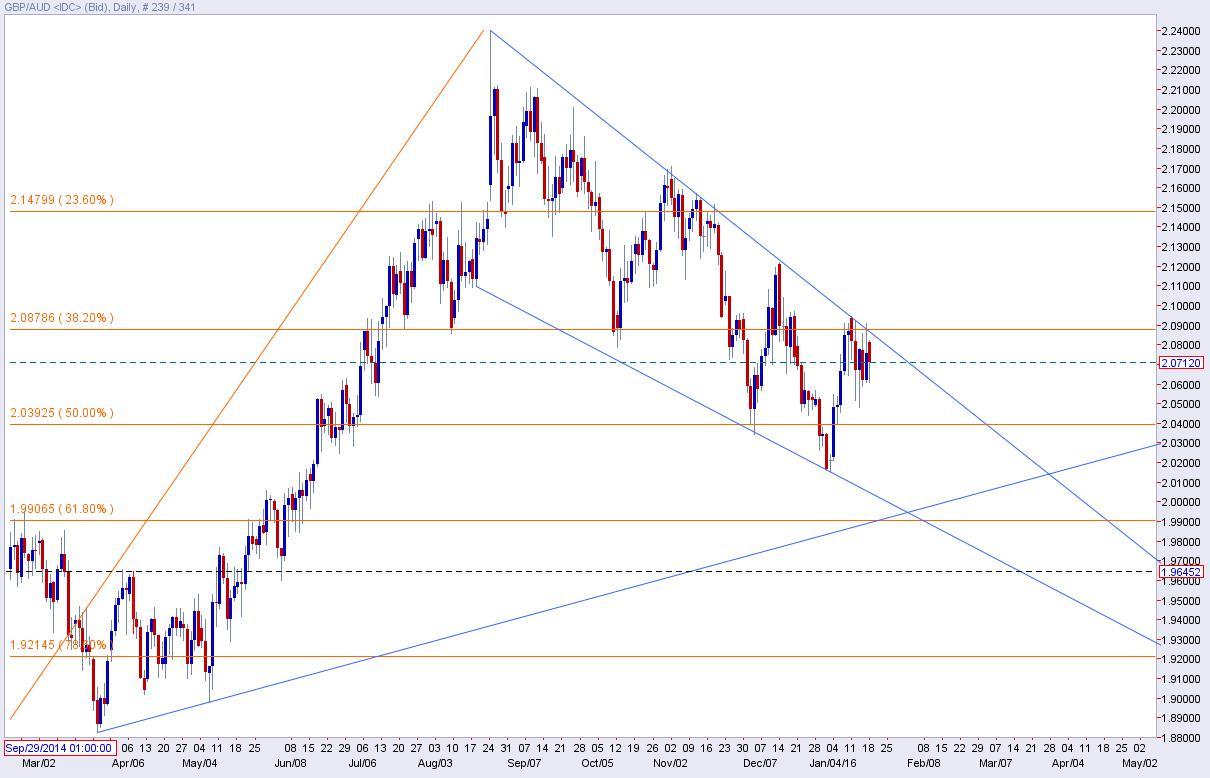

AUD

The problems for the Australian economy aren't all centred on China's slowdown but it is a massive influence. Reduced activity in China is causing a worldwide slump in energy and raw material prices. That is exacerbated by the opening of the valves on Iran's oil supply with the lifting of sanctions and that has further depressed an already weak oil market driven by Saudi Arabia's market share tactics. The result is a lot of uncertainty and that is just what the doctor didn't order for Australia. The Aussie Dollar has stopped plunging however. The Sterling – Australian Dollar rate has topped out at A$2.10 and is now pin-balling between there and A$2.00. This, for the time being at least, is the range to use for your plans. In fact the top end is slightly shy of A$2.10; A$2.08 is more likely to be achieved. The lack of Australian data this week will mean this exchange rate is largely driven by UK data and Chinese shenanigans. Good luck.

CAD

There is a distinct possibility the Bank of Canada will cut their base rate when they meet on Wednesday. As with Australia, the slump in raw material and energy prices has been harmful to Canada's exporters and has reduced Canada's export income. Domestic demand hasn't entirely slumped but it is being hit by a lack of confidence. A rate cut could well weaken the Canadian Dollar which would be helpful to exporters but would add inflationary pressures. However, lower rates might also help home buyers and encourage credit and therefore retail activity. Of course this could all amount to nothing unless consumers have enough confidence to get out there and make use of lower borrowing costs. Whether that will happen is open to debate. Either way, the Sterling – Canadian Dollar rate is poised towards the top end of its long term trading channel. It could make C$2.12 or C$2.15 if the BOC do cut the base and if the markets perceive that as 'too little too late' as some are seeing it.

EUR

Personally, I don't get it. I am at a loss to think why the Euro is in favour other than that the Eurozone data has been less scary of late. I am also at a loss to understand why Sterling has been slapped down so hard in the face of a more buoyant USD and a drop in raw material prices. Clearly the UK is an oil exporter and the oil price slump is hammering export income as it is for all oil exporters. But oil and gas are significantly diminished as a percentage of UK GDP, so the impact is perhaps overstated. Nonetheless, we are where we are; the Pound is hitting the lowest level against the Euro since this time last year and that makes the Pound a bargain. The Pound is substantially oversold on any technical measure, so there is scope for a recovery and the swathe of UK data this week (see the main section above) gives every possibility for a rebound. I guess in simple terms, if you need to buy the Pound against the euro, it is definitely worth looking at your requirements and managing the risk of a bounce in this pair.

NZD

The downward trend that the Sterling – NZ Dollar rate has been in since last August is self-evident.

If you ignore the spike into the NZ$2.50 level last August, this NZ$2.20 area is the 50% retracement of the rise that took us from around NZ$1.95 last April to that high in August. It is a bit of a magnet for traders. It supported the Pound as this rate fell and is now resisting any upward momentum now. If we see NZ$2.25 again, then the tide will have changed and further gains are highly likely. However, if we see this pair fall back to the NZ$2.15 level, there is little to stop it tumbling to NZ$2.10 in the next few months. Events in China will impact the NZD but Sterling needs to find its feet in order for the GBPNZD rate to recover its mojo.

USD

I am using this long term chart for the Sterling – US Dollar rate because it highlights the very significant $1.43 area. This has provided support for the Pound against the USD since 2009. The fact that we are testing it once again is itself a worry but, so far so good from the Pound's point of view. If Sterling doesn't benefit from UK data this week and hints grow that the BOE is going to delay any interest rate rise until 2017, Sterling could well trickle down to the lows we saw in 2008 and early 2009. $1.35 would be very painful for those who need to buy USD, so some prudent risk management may be in order. However, those who sell USD and buy Sterling are quite easy to spot these days. They have a kind of smug 'can't believe my luck' look on their faces.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.