This Week's Highlights

Federal Reserve is relaxed

German IFO shows expected improvement

Sterling boosted by UK retail sales

FX Market Overview

It seems there is almost nothing Russell Brand won't do to promote his rather pointless book (in my opinion). I say that not because he doesn't raise a lot of points in the book but because he doesn't proffer any solutions. Anyway, his latest stunt was to 'storm' the London offices of RBS to protest about capitalism. To be fair, with his level of wealth, Brand does know a thing or two about capitalism and with his connections, he could probably have got an appointment if he had asked but he chose to arrive unannounced with a megaphone in hand before berating the bank's employees during their lunch break. One of the people he accosted has hit back with a terrific open letter in which he likens Brand to a school bully and described him as puerile. I couldn't agree more.

The Greek government failed to get approval for their candidate for President and that has caused some concern. If they fail to reach agreement, that will prompt a general election which this government may well lose. The Euro is, thus far, unaffected but that may change if the anti-euro Syriza party looks like taking control. This morning's German IFO business sentiment indices were a tad stronger than expected so the euro is fairly stable right now.

There were no surprises in the Bank of England minutes which were released yesterday morning. We are not expecting any early interest rate hikes and why would we when inflation is down at 1.0% and may well fall further. The twin facts that unemployment is at a 6 year low and wages are starting to rise above inflation may cause some concern but the fall in the value of the Pound is a sign that traders are not even thinking about interest rate hikes for a long time to come. This morning's UK retail sales data was phenomenally strong but after the post thanksgiving day sales, that was to be expected. Nevertheless, Sterling rallied a little in early trade before settling back a tad.

The US Federal Reserve Bank gave the US equities markets an early Christmas pressy by announcing a cool calm slow approach to rate hikes. They ruled out any hikes in Q1 of 2015 and many believe we may even make it to the end of next year before inflation and growth is sufficiently strong to prompt a hike. The US Dollar remains pretty strong but that also has something to do with the fall in oil prices and tensions elsewhere.

The Swiss Franc weakened sharply today when the Swiss National Bank moved its base rate into negative territory. So all the investors sweeping cash into Switzerland from the beleaguered Russia are going to pay for the privilege of depositing funds into Swiss banks. The knee-jerk reaction was a cent of weakness in the Swissie but when the alternative is to hold roubles which are slumping in value, a 0.25% premium seems miniscule.

And Christmas has long been known as a time of family tension but don't mess with granny, Gillian Leeden or she'll kill your ....(drum roll)....your artichokes. I know! Dreadful! She had an argument with her sister which escalated to the point where Gillian took revenge on her sister by pouring weed killer on her crop of artichokes. The court ordered her to pay £5 compensation and to cover £325 in court costs. She is apparently mounting an appeal.

And finally; as this is the last report before Chrstmas, can we wish you all a very Happy Christmas and a happy and prosperous 2015.

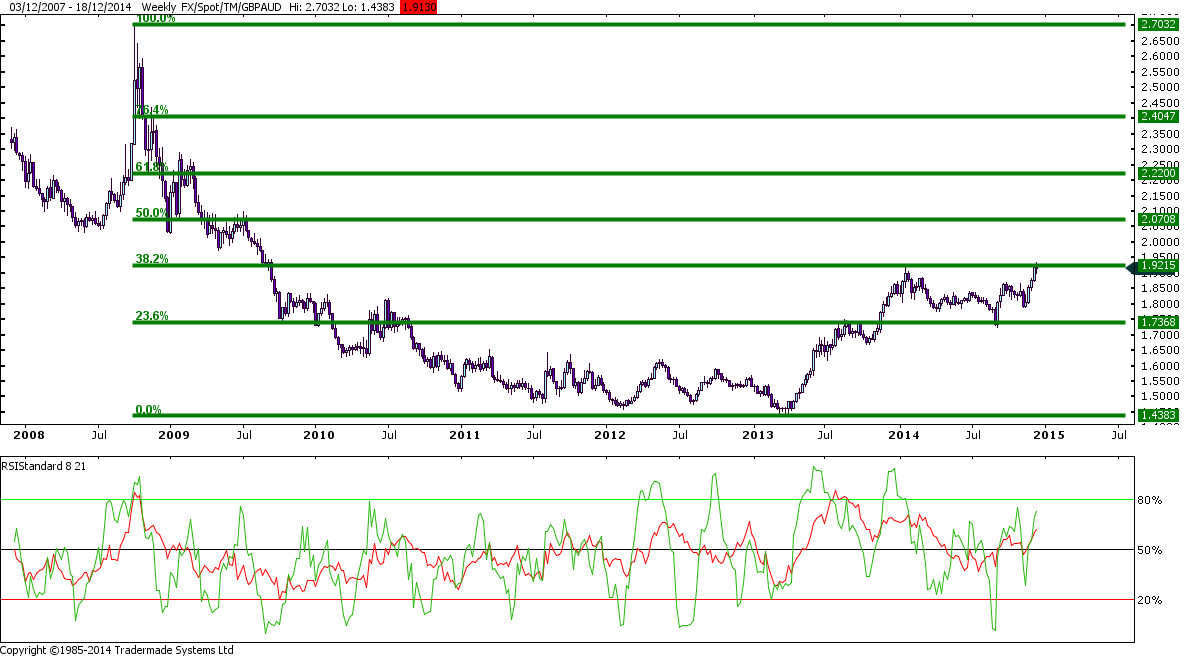

Currency - GBP/Australian Dollar

Events in Russia and China are driving the value of the Australian dollar to some degree but the Reserve Bank of Australia's apparent resilience in the face of calls for interest rate cuts is also playing its part. The RBA is worried about the strength of the Australian Dollar which is harming exports but they are resolved not to lower the base rate for fear of fuelling inflation even though a rate cut would address their prime concern – a bit maybe. I have used a longer term charts to illustrate the turning point we may be at. In December 2013, the Sterling - Australian Dollar exchange rate tested the Fibonacci retracement level that marks a 38.2% recovery of the fall from the 2008 high to the 2013 low. We are seeing that same level being tested at the time of writing and if A$1.92 breaks, there is scope for a rally to the A$2.07 level which denotes a 50% recovery. A tad more sterling strength and/or a tad more AUD weakness would do it. I know there will be a few of you sitting with fingers crossed.

Currency - GBP/Canadian Dollar

A slump in oil prices has weakened the Canadian dollar over the past 6 weeks or so. Hence the Sterling – Canadian Dollar rate tested the top of its long term trading channel this week. However, a slip in the value of the Pound was enough to drop this exchange rate by a couple of cents over the last two days. Ultimately, events in Russia, China and at the OPEC meetings will heavily influence the Canadian Dollar and events in the US and therefore the US Dollar will also impact the loonie. As long as the Pound stays below C$1.82, there is every chance we will see this pair drop back to C$1.75 in the weeks ahead. A break above C$1.84 changes that picture significantly. If that happens, traders will be focussed on the 2014 high at C$1.8650 in the first instance.

Currency - GBP/Euro

Greek election concerns and tension between Germany and the recalcitrant French and Italians are combining to keep the euro weak. At the same time, Sterling is continuing to strengthen in most areas of the market and today's remarkably strong UK retail sales figures have not damaged the Pound in any way. The significant pivot points are highlighted in red in the chart above. €1.2750 is an approximate tipping point; above which we can see scope for a rally in the mid €1.28 area. Below the current rate, there is a clear support level around €1.2475. If the market trades below there we would see pressure on the Pound to fall to €1.2340 in the first instance. In essence, this is a great level for Euro buyers.

Currency - GBP/New Zealand Dollar

Like a number of other Sterling related exchange rates, the Sterling – NZ Dollar rate is testing the top end of its short term range. After the spike high we saw in October, the Pound has tried twice more to break to higher levels but the highs are decreasing. So we are in a downward trend in the short term. The fact that the Reserve Bank of New Zealand is stressing its neutral stance on interest rates is keeping things tight for the NZD but events in China, Russia and elsewhere are weakening income from commodity exports. So NZD buyers are best to target anything above NZ$2.02 and sellers would do well to target NZ$1.96 or below.

Currency - GBP/US Dollar

A glance at the chart above shows there is an undoubted downward trend in the Sterling – US Dollar exchange rate. However, the strength of the USD may be stalling as evidence by the double bottom we have witnessed in December. $1.5550 is proving to be a solid support level for the Pound and that is good news for those who need to buy US Dollars. Sterling even tried unsuccessfully to break above the downtrend this week. Sadly for Sterling sellers, that rally failed. So we remain in the tense situation where $1.5550 looks vulnerable and Sterling could fall through there but the support at that level has held up well so far. Either the support will collapse or the Pound will eke its way through $1.5650 and break to higher levels. I confess, I don't know which will happen first.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.