What’s on our mind

- general credit market news

Risk sentiment was back on last week as the market was gearing up for the upcoming ECB announcement later this week. Despite somewhat volatile equity markets, credit markets remained fairly calm and the European IG index itraxx main was 6bp tighter w/w while the HY index (iTraxx crossover) was about 40bp tighter w/w.

We saw larger primary activity compared to the previous week. The market improved in both volumes and diversity of issuance as both core, periphery and non-European issuers entered the market.

European Court of Justice Advocate-General, Pedro Cruz Villalón, announced his opinion last week on the European Central Bank's OMT programme ahead of a ruling expected later this year by the court. Mr. Villalón found the ECB’s bond-purchase programme to be compatible "in principle" with European law, thereby contradicting the German Constitutional Court’s legal challenge and giving Draghi the green light ahead of this week’s expected QE announcement.

Due to expected portfolio rebalancing effects, we anticipate that the ECB’s announcement later this week will have a positive effect on corporate credit spreads going forward, even if the ECB decides only to include SSAs in the purchase programme to begin with.

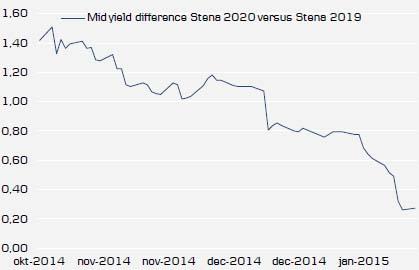

Close of relative trade (‘Buy’ Stena 2020, ‘Sell’ Stena 2019)

The yield differential is no longer ‘very’ attractive between Stena 2020 and Stena 2019. Yield pickup between the bonds has narrowed to some 0.55% p.a. (compared with a start yield differential of 1.4% p.a. when the trade was suggested on 24 October 2014).

Following healthy relative performance since initiation in October 2014, we close out and take profit on our earlier trade idea (buy Stena 2020, sell Stena 2019).

Fundamentally, we like Stena and currently view the company as a ‘BB’ credit with moderately improving credit metrics short term (<2016) but flat to declining credit metrics longer term (>2016). Following the close of the trade, we keep our absolute ‘Buy’ recommendation on the Stena bonds/CDS

(see valuation chart later in this presentation).

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.