Recommendations:

High risk: Buy the AUDUSD at the market, SL 0.9100, targets 0.9250, 0.930, 0.95.

Low risk: Buy the EURUSD at 1.2900, SL 1.2730, targets 1.30, 1.34, 1.40.

Analysis:

The EURUSD has fallen during last week as we expected. The weekly chart on EURUSD displays a candlestick close to a pin, and the price action during last week also showed a rather deep pocket of bulls supporting the euro. This might indicate that the retest of the lower edge of the trading range (1.2750-1.29) is unlikely at the moment. We would avoid entering any positions in EURUSD next week except if the pair falls below 1.29.

The USDJPY has broken outside its uncertainty wedge to the upside. And it would be logical for the pair to go revisit its previous high in the 103.xx. However, the bearish engulfing candle formed on a daily level and the steepness of the fall that occurred on Friday suggests that the retest of 103 either won’t happen in the coming week, either that the indecision pattern is still in formation. We would not trade this pair for now.

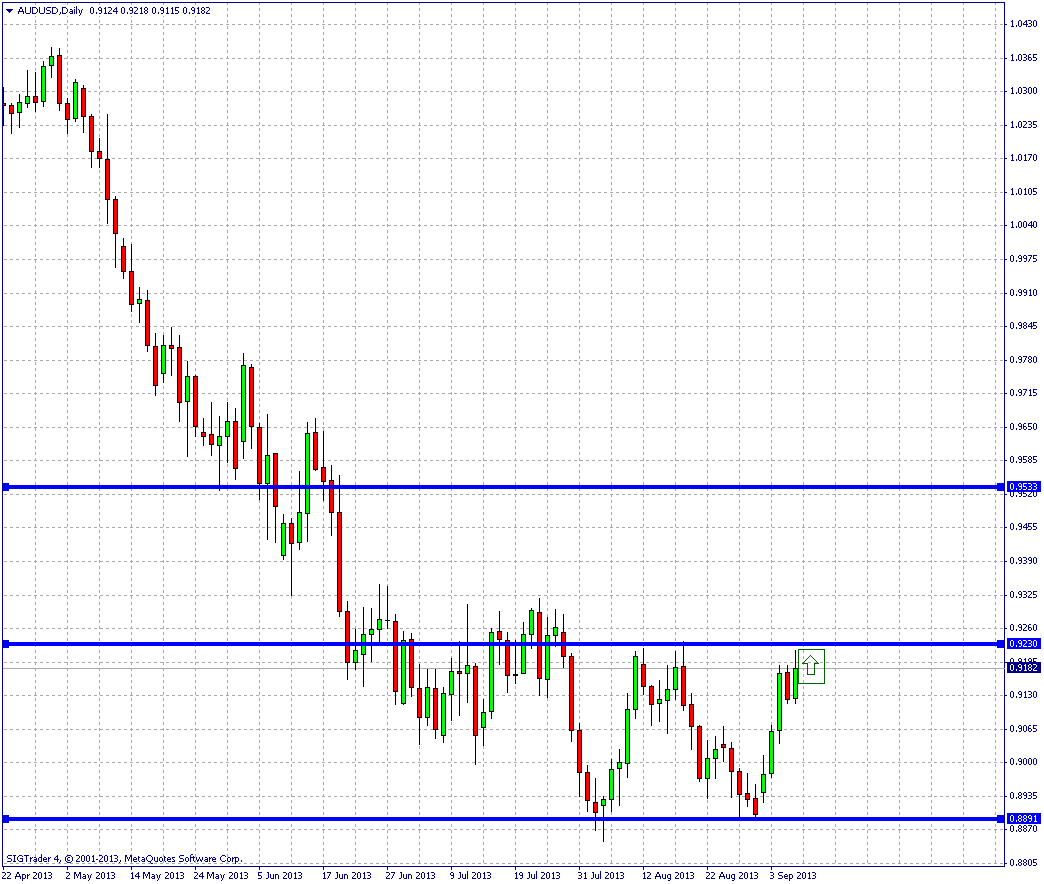

The AUDUSD finished the week closer to 0.92, and is now displaying bullish characteristics. The resistance around 0.92 has not been crossed, but once this barrier is broken, the chances that we reach 0.95 are very high. The risky way to trade this is to enter immediately long on Monday. The more conservative way is to wait for the market to close convincingly above 0.9250 and to enter in the direction of the trend.

Finally the GBPUSD is also showing signs of a bullish trend, but it is rather weak, and side way action might continue in this pair.

USDJPY Daily chart

AUDUSD Daily chart

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.