Recommendations:

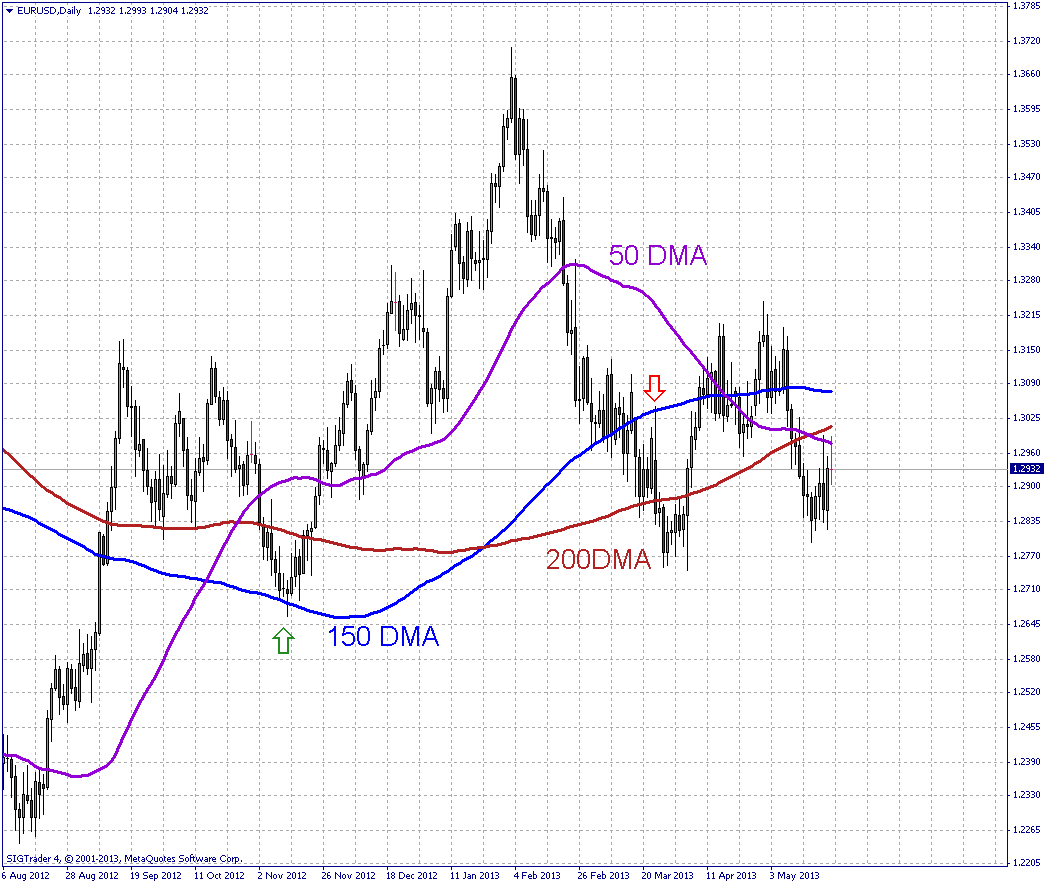

Risky: Sell the EURUSD at 1.3075, SL 1.3125, targets 1.3015, 1.2900, 1.2790, 1.23(!).

Very risky: buy the AUDUSD at 0.9485, SL 0.9445, targets 0.9550, 0.9600, 0.97.

Analysis:

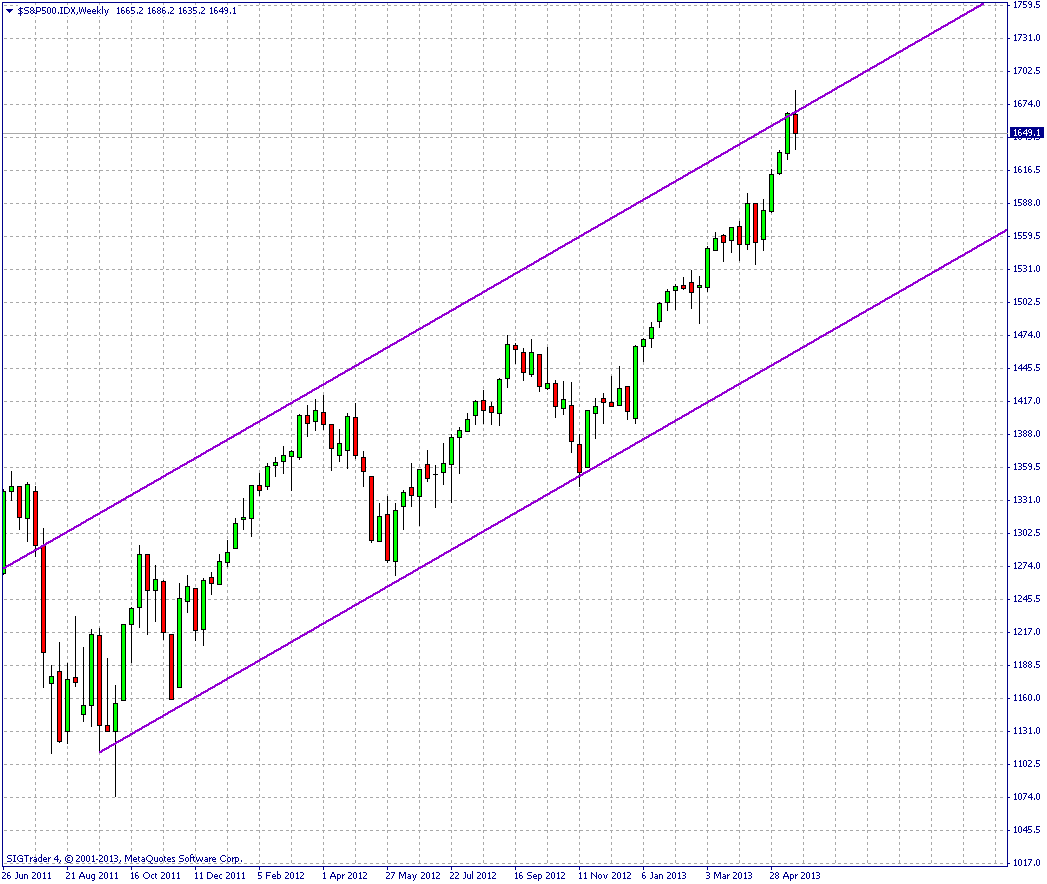

After reaching very high levels around 169x, the SP500 started correcting back towards 1600-1650. The market is psychologically ready for a healthy 5%-10% correction that should lead us to below the area in between 1550-1600 where we would book some profits. In the meantime, the Australian dollar rebounded on the 0.96 level that we suggested, before getting down again.

We would consider another risky long entry in case the Australian dollar falls during the first days of the coming week below 0.95. Regarding the yen, it is now very difficult to find entry points.

We continue to be bearish on EURUSD. The major head and shoulder pattern has not yet been triggered and we still might revisit the area of 1.30-1.31 next week. We would consider a short entry close to the trend line resistance from the last tops at 1.37x and 1.32x, which would be in between 1.3050 and 1.31. A possible area of entry could be the 150-DMA at 1.3075 as well as the 61.8% Fibonacci retrace from the last top at 1.32x to the last bottom at 1.279x. A bearish golden cross is also now in place.

SP500 Weekly chart

EURUSD Daily chart 1

EURUSD Daily Chart 2

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.