The Canadian dollar rally continued last week, gaining about 240 points against the US dollar. USD/CAD closed the week just above the 1.33 line and is trading at its lowest level since early December. This week’s highlights are the Overnight Rate and Employment Rate. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Canadian dollar received a boost from GDP, which posted a gain of 0.2%, ahead of the forecast of 0.1%. In the US, a weak services sector report weighed on the greenback, and an excellent Non-Farm Payrolls report couldn’t blunt the loonie rally. Wage growth in the US fell by 0.1%, well below predictions.

Updates:

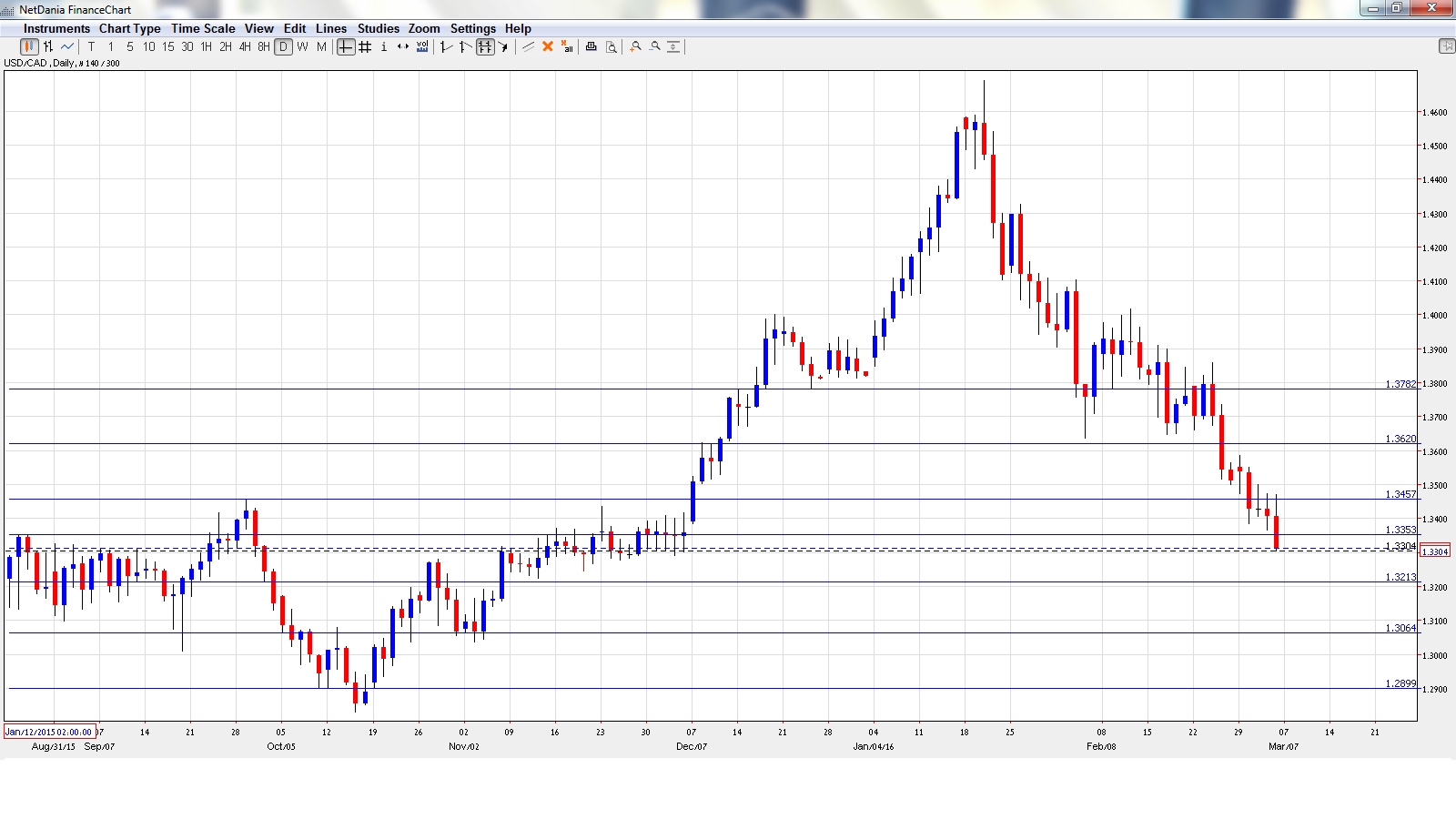

USD/CAD daily graph with support and resistance lines on it.

Housing Starts: Tuesday, 13:15.Housing Starts provide a snapshot of the strength of the housing sector. The indicator dipped to 166 thousand in January, its weakest gain in 11 months and below expectations. The markets are expecting a strong turnaround in February, with an estimate of 181 thousand.

Building Permits: Tuesday, 13:30. Building Permits continue to show strong fluctuations from month-to-month. In January, the indicator jumped to 11.3%, compared to the plunge of 19.6% a month earlier. Will the indicator repeat with a strong gain in February?

Overnight Rate: Wednesday, 15:00. There was a lot of speculation that the BoC would lower rates in January to 0.25%, but the central bank held back and the rate remained at 0.50%. The markets are not expecting any change in the upcoming decision, which will be announced in a rate announcement.

NHPI: Thursday, 13:30. This housing price index dipped to 0.1% in December, shy of the forecast of 0.3%. Another weak gain is expected, with an estimate of 0.2%.

BOC Governor Steven Poloz Speaks: Thursday, 21:15. Poloz will speak at event in Ottawa. The markets will be listening closely for any hints regarding the BoC’s future monetary policy.

Employment Rate: Friday, 13:30.The week wraps up with one of the most important economic indicators, Employment Rate. The indicator sagged in January to -5.7 thousand, well off the estimate of +5.2 thousand. The markets are projecting much better news in February, with the estimate standing at 10.2 thousand. The Unemployment Rate is expected to remain at 7.2%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3550 and quickly climbed to a high of 1.3587, as resistance held firm at 1.3620. It was all downhill from there, as the pair dropped all the way to 1.3305. USD/CAD closed the week at 1.3313.

Technical lines, from top to bottom

With USD/CAD posting strong losses, we start at lower levels:

1.3784 was a cushion in February.

1.3620 held firm as USD/USD moved upwards at the start of the week before retracting.

1.3457 has switched to a resistance line following sharp losses by USD/CAD.

1.3353 has reverted to resistance for the first time since early December. It is a weak line and could see action early in the week.

1.3213 is an immediate support line.

1.3064 is protecting the symbolic 1.30 line.

The round number of 1.2900 was a cushion in October. It is the final support line for now.

I am neutral on USD/CAD

The Canadian dollar continues to climb, but traders should keep in mind that the current rally is essentially a correction of the huge drop the currency sustained in December and early January. In the US, a March hike is unlikely, even with a strong NFP report, but the Fed bias remains towards tightening. This monetary divergence favors the US dollar. If oil prices continue to rise, the Canadian dollar could push higher.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.