The Canadian dollar posted modest gains last week, as USD/CAD closed the week at 1.3845. This week has three key indicators – Manufacturing Sales, Core CPI and Core Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, employment numbers bounced back with solid readings, while retail sales reports were soft but met expectations. In Canada, Building Permits posted a strong gain.

Updates:

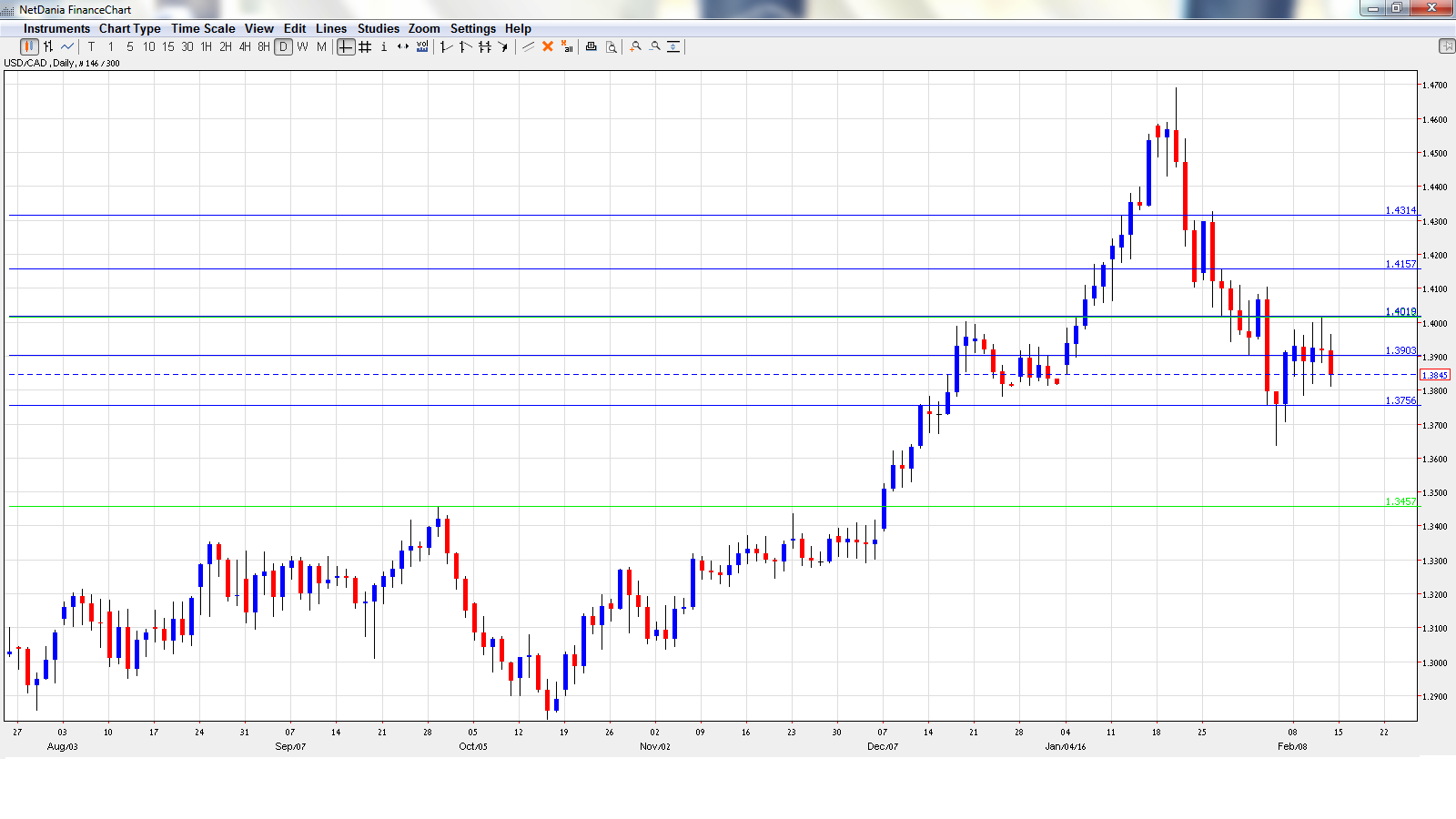

USD/CAD daily graph with support and resistance lines on it.

Manufacturing Sales: Tuesday, 13:30. The indicator posted a gain of 1.0% in November, after two straight declines. This strong reading easily beat the estimate of 0.5%. Another strong release is expected in December, with an estimate of 0.9%.

Foreign Securities Purchases: Wednesday, 13:30. The indicator dropped to C$2.58 billion in November, well short of the forecast of C$12.10 billion. Will we see a rebound in the December report?

Wholesale Sales: Thursday, 13:30. Wholesale Sales is a leading indicator of consumer spending. In November, the indicator posted an excellent gain of 1.8%, breaking a nasty streak of three straight declines. The markets are expecting a much softer reading in December, with an estimate of 0.1%.

Core CPI: Friday, 13:30. Canadian inflation numbers remain very low, and this key index has posted two straight declines. The markets are expecting better news in the January report, with an estimate of 0.2%.

Core Retail Sales: Friday, 13:30. Core Retail Sales excludes the most volatile items which comprise Retail Sales. In December, the indicator bounced back with an excellent gain of 1.1%, crushing the estimate of 0.4%. However, the markets are expecting a downturn in the January release, with an estimate of -0.5%.

CPI: Friday, 13:30. CPI has been struggling, posting three declines in the past four readings. The December release of -0.5% was the weakest showing since December 2014. The estimate for the January report stands at 0.0.%.

Retail Sales: Friday, 13:30. Retail Sales is the primary gauge of consumer spending. The indicator posted an strong gain of 1.7% in December, easily beating the estimate of 0.3%. The markets are braced for a downturn in January, with an estimate of -0.7%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3883 and dropped to a low of 1.3784, as support held firm at 1.3757 (discussed last week). The pair then reversed directions and climbed to a high of 1.4016. USD/CAD softened late in the week and closed at 1.3845.

Technical lines, from top to bottom

We begin with resistance at 1.4310, which has held since late January.

1.4159 is the next line of resistance.

1.4019 has strengthened in resistance as the pair trades at lower level.

The round number of 1.39 has switched to a resistance role. It is a weak line and could see further action during the week.

1.3757 was a cap in December.

1.3587 is the next support line.

1.3457 is the final support level for now.

I am bullish on USD/CAD

Recent US numbers have been lukewarm, but the markets continue to speculate about a March rate hike in the US, a move which would bolster the greenback. Canadian inflation and retail sales reports are expected to be soft, and unless there are some positive surprises from these indicators, the Canadian dollar could head back towards the 1.40 level.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.