The Canadian dollar was uneventful in the final week of 2015, as USD/CAD was unchanged. The pair closed at 1.3830. There are seven events this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

US numbers were not impressive last week, as unemployment claims and housing reports were short of expectations. There was some better news from consumer confidence, which beat the forecast. There were no Canadian releases during Christmas week.

Updates:

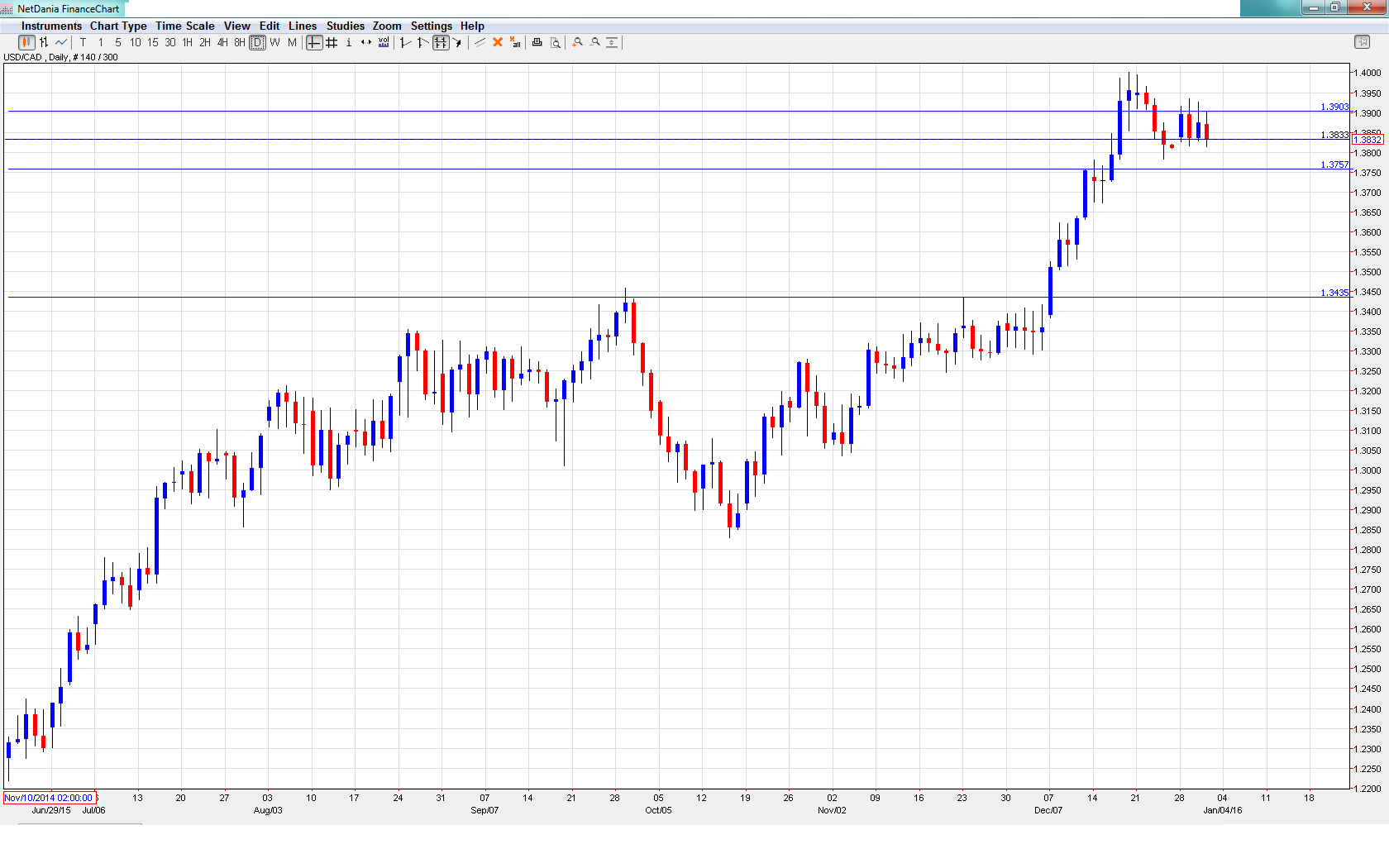

USD/CAD daily chart with support and resistance lines on it.

RBC Manufacturing PMI: Monday, 9:30. Manufacturing PMI has posted four straight readings below the 50-point level, indicative of ongoing contraction in the manufacturing sector. The indicator came in at 48.6 points in the November report. Will we see an improvement in December?

RMPI: Tuesday, 8:30. RMPI measures inflation in the manufacturing sector. The index posted a gain of 0.4%, matching the forecast. The markets are bracing for a sharp downturn, with an estimate of -2.3%.

Trade Balance: Wednesday, 8:30. Trade Balance is closely linked to currency demand, as foreigners must buy Canadian dollars in order to purchase Canadians goods and services. The trade deficit ballooned to C$2.8 billion, marking a five-month high. This figure was much higher than the estimate of C$1.7 billion. Another weak reading is expected, with an estimate of C$2.6 billion.

BOC Governor Stephen Poloz Speaks: Wednesday, 8:25. Poloz will deliver remarks at an event in Ottawa. The markets will be listening for clues as to the BOC’s future monetary policy.

Ivey PMI: Thursday, 10:00. Ivey PMI sparkled in November, surging to 63.6 points. This crushed the forecast of 55.3 points. The indicator is expected to retract to 56.7 points in the December report, which would still point to expansion.

Building Permits: Friday, 8:30. Building Permits broke a streak of three declines in October, with an excellent gain of 9.1%, crushing the estimate of 3.0%. The markets are expecting a sharp reversal in October, with a forecast of -3.2%.

Employment Change: Friday, 8:30. Employment Change is one of the most important economic indicators, and an unexpected reading can have a sharp impact on the movement of USD/CAD. The indicator had a dismal November, coming in at -35.7 thousand, much weaker than the estimate of -9.7 thousand. Better tidings are expected in December, with an estimate of +10.4 thousand. The Unemployment Rate is expected to remain pegged at 7.1%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3837 and quickly dropped to a low of 1.3813. It was all uphill from there, as the pair climbed to a high of 1.3935, testing resistance at 1.39 . USD/CAD closed the week at 1.3833.

Technical lines, from top to bottom

We begin at with resistance at 1.4310.

1.4157 was an important cushion in April 2003.

1.4003 is the next resistance line, just above the psychologically important 1.40 level.

The round number of 1.39 remains busy and was tested last week in resistance. It could see further action earlier in the week.

1.3759 continues to provide support.

1.3587 was a cap in March 2004.

1.3435 has held firm since early December. It is the final support line for now.

I am bullish on USD/CAD

The Canadian dollar held its own last week, but the US currency could resume its rally and push towards the symbolic 1.40 line. Even if US figures are mediocre, the Fed is set to raise rates again early in the New Year, which is bullish for the greenback.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.