USD/CAD posted sharp gains for a second straight week, gaining 220 points. The pair touched above the key 1.40 line and closed the week at 1.3955, its highest level since May 2004. This week’s key events are GDP and Core Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

After months of intense speculation, the Federal Reserve raised interest rates by 0.25 percent. The historic rate hike was not dovish as this small hike is just the start, with plans for additional hikes in 2016. Weak Canadian inflation numbers, and falling oil prices added to the woes of the Canadian dollar, as consumer inflation reports posted declines.

Updates:

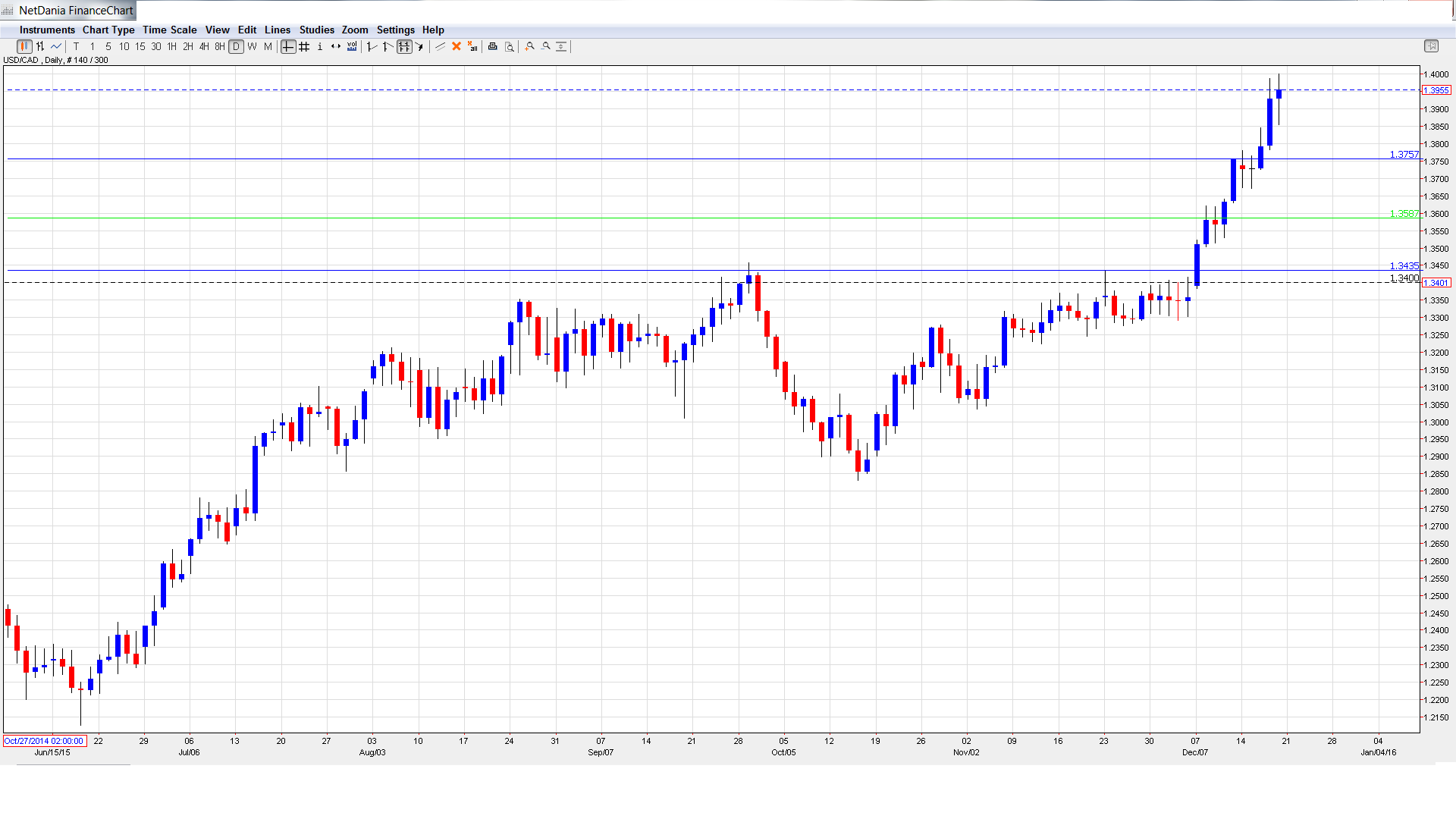

USD/CAD daily chart with support and resistance lines on it.

Core Retail Sales: Wednesday, 13:30. This indicator excludes automobile sales, which tend to be very volatile and distort the underlying trend. The indicator has not posted a gain since June, and came in at -0.5% in September, shy of the forecast of -0.3%.

GDP: Wednesday, 13:30. This key event is released monthly, and an unexpected reading could quickly affect the direction of USD/CAD. GDP looked dismal in September, contracting by 0.5%. The markets had expected a gain of 0.1%. Will we see an improvement in October?

Retail Sales: Wednesday, 13:30. This is the primary gauge of consumer spending. The indicator disappointed in October, with a reading of -0.5%, well off the forecast of +0.1%. It marked the indicator’s weakest reading in five months.

* All times are GMT

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3737 and quickly touched a low of 1.3672. The pair then reversed directions, surging to a high of 1.4001, as resistance held firm at 1.4003 . USD/CAD closed the week at 1.3955.

Technical lines, from top to bottom

We start with resistance at 1.4310.

141.57 was an important cushion in April 2003.

1.4003 follows, just above the psychologically important 1.40 level. It was under strong pressure last week as USD/CAD posted sharp gains.

The round number of 1.39 has switched to a support line. It is a weak line.

1.3759 was easily breached last week and has reverted to a support role.

1.3587 was a cap in March 2004.

1.3435 has held firm since early December. It is the final support line for now.

I am bullish on USD/CAD

The Canadian dollar has plummeted in the past two weeks, losing some 550 points against its US counterpart. The Fed rate hike has sharpened monetary divergence and marks a vote of confidence in the US economy, which should further bolster the US dollar.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.