The Canadian dollar showed some movement in both directions last week, but finished the week unchanged, as USD/CAD closed at 1.3362. This week’s highlights are GDP and Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, Unemployment claims dropped sharply, but housing and consumer data missed expectations. Still, the US economy is doing fine, so a rate hike in December is more likely than not. In Canada, manufacturing inflation matched expectations.

Updates:

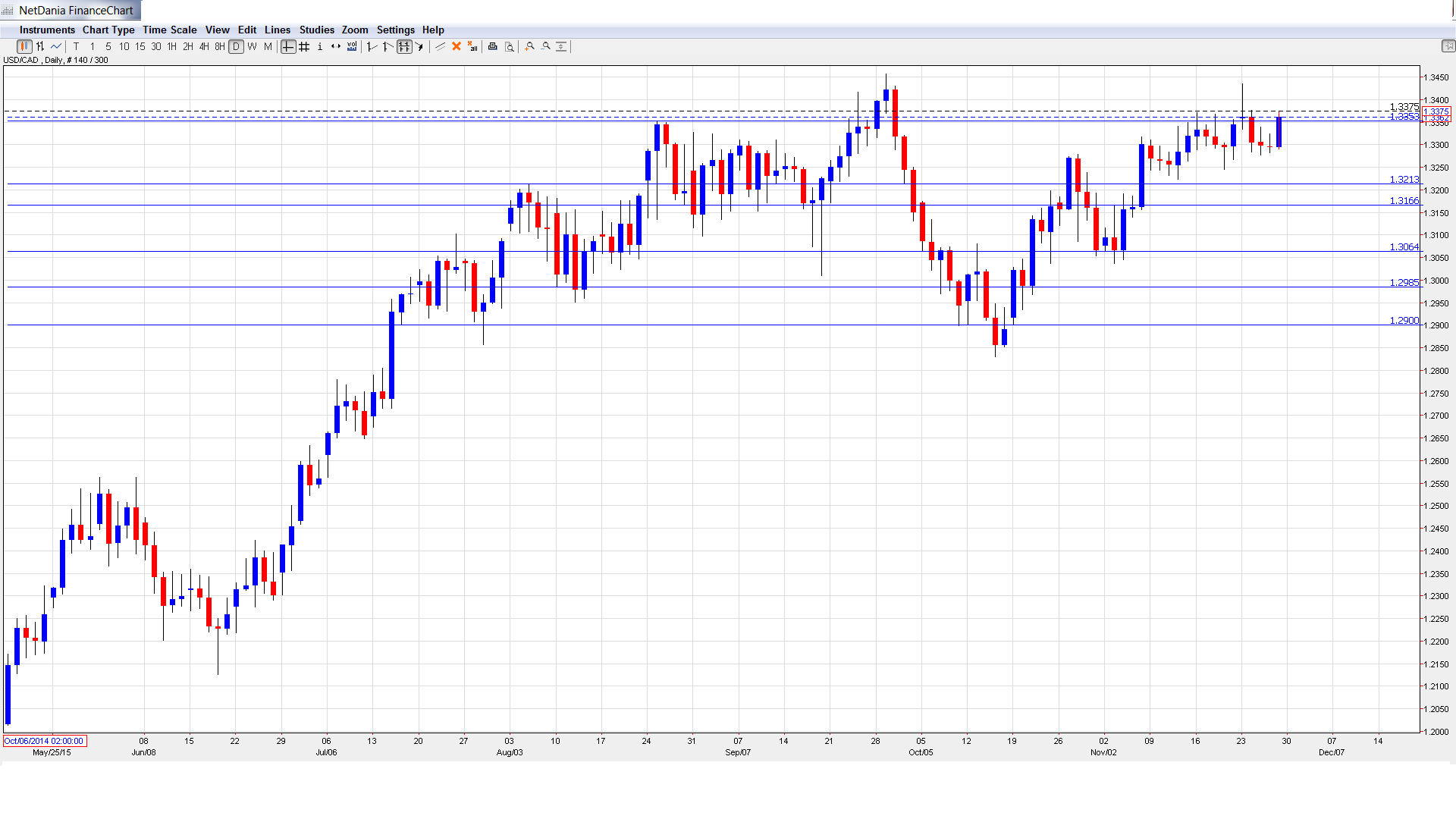

USD/CAD daily chart with support and resistance lines on it.

Current Account: Monday, 13:30. Current Account remained steady in Q2, posting a deficit of C$17.4 billion, which was within expectations. The markets are expecting a strong improvement in Q3, with a deficit estimated at C$15.2 billion.

GDP: Tuesday, 13:30. GDP is one of the most important economic indicators, and an unexpected reading can have an immediate impact on the movement of USD/CAD. GDP in September slipped to 0.1%, matching the forecast. Another gain of 0.1% is expected in the October report.

RBC Manufacturing PMI: Tuesday, 14:30. This PMI is an important gauge of the health of the manufacturing sector. The index has posted three straight readings below the 50 level, which is indicative of ongoing contraction in the manufacturing industry. Will we see an improvement in the November release?

BOC Overnight Rate: Thursday, 14:30. The BOC surprised the markets in July when it cut rates to 0.50%, down from 0.75%. The central bank is not expected to make another cut, but the accompanying rate statement could shed some light on the Bank’s view of the economy, which has not looked all that sharp recently.

Employment Change: Friday, 13:30. This key indicator should be treated as a market-mover by traders. The indicator surged to 44.4 thousand in October, crushing the estimate of 9.5 thousand. However, the markets are braced for a decline of 0.7 thousand in November. Will the indicator again surprise and beat the prediction? The unemployment rate is expected to remain at the round figure of 7 percent.

Trade Balance: Friday, 13:30. Trade Balance is closely linked to currency demand, as foreigners need to buy Canadian dollars in order to purchase Canadian goods and services. The trade deficit narrowed in September to C$-1.7 billion, slightly better than the estimate of C$-1.9 billion. No change is expected in the October release, with an estimate of C$-1.7 billion.

Ivey PMI: Friday, 15:30. Ivey PMI dipped to 53.1 points in October, shy of the estimate of 54.0 points. The markets are expecting a strong turnaround in the November release, with the estimate standing at 55.3 points.

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3357 and quickly climbed to a high of 1.3435, as resistance held firm at 1.3443. The pair then reversed directions, dropping to a low of 13277. USD/CAD closed the week at 1.3362.

Technical lines, from top to bottom

We start with resistance at 1.3759.

1.3587 was a cap in March 2004.

1.3443 was under pressure early last week. This line has held firm since late September.

1.3353 was breached and has switched to a support role. It is a weak line and could see more action next week.

1.3213 is an immediate support level.

1.3165 is the next support line.

1.3063 is protecting the symbolic 1.30 line.

1.2985 was an important cushion in September.

The very round line of 1.2900 is the final line of support for now.

I am bullish on USD/CAD

With a Fed rate hike priced in at about 75%, the greenback is set to make broad gains against its rivals. Canadian GDP and employment numbers are expected to be soft, so it could be a rough week for the loonie.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.