The Canadian dollar had a week to forget, losing over 250 points last week. USD/CAD closed the week at 1.3163. This week’s key event is GDP. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

USD/CAD posted sharp gains after the BOC presented a pessimistic growth report, as low oil prices continue to hobble the Canadian economy. There was more bad news for the loonie, as Core Retail Sales and Core CPI both missed their estimates. In the US, housing data and unemployment claims were better than expected.

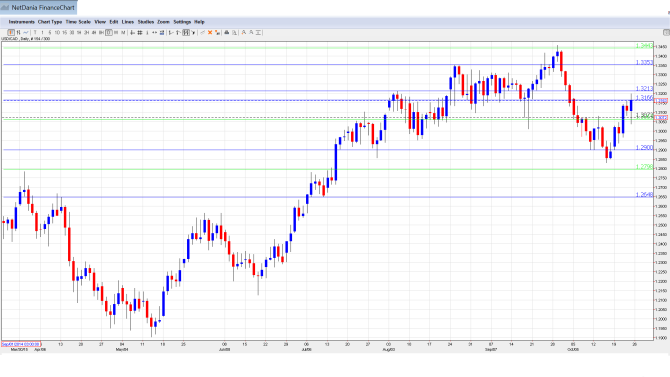

USD/CAD daily chart with support and resistance lines on it.

BOC Deputy Governor Timothy Lane Speaks: Tuesday, 15:20. Lane will speak at an event in Halifax. A speech which is more hawkish than expected is bullish for the Canadian dollar.

RMPI: Tuesday, 12:30. This index measures inflation in the manufacturing sector. The indicator has struggled, posting sharp declines in the past two months, with the August reading coming in at -6.6%. Will the indicator improve in the September report?

GDP: Friday, 12:30. Canadian GDP is released every month, unlike most Western economies which release GDP every quarter. The July reading dipped to 0.3%, just above the estimate of 0.2%. The downward trend is expected to continue, with an estimate of 0.1% for August.

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2916 and quickly touched a low of 1.2900. The pair then reversed directions, climbing all the way to 1.3198, as resistance held firm at 1.3213. USD/CAD closed the week at 1.3163.

Technical lines, from top to bottom

With USD/CAD posting sharp gains, we begin at higher levels:

1.3587 is a strong resistance line. It was last tested in June 2004.

1.3443 is next.

1.3353 was a cap in September.

1.3213 held firm as the pair posted sharp gains.

1.3165 is a weak resistance line.

1.3063 is an immediate support line.

1.2900 continues to be busy and was tested last week in support.

1.2798 is next.

1.2648 was an important cap in May and June. It is the final support line for now.

I am bullish on USD/CAD

The BOC’s dismal view of the Canadian economy pushed the pair sharply lower and Canadian dollar will have trouble recovering without strong data. The US economy continues to outperform its Canadian counterpart, and monetary divergence is also weighing on the Canadian currency.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.