Are you trading today? Read the Forex Trading Strategies for the Day.

EUR/USD

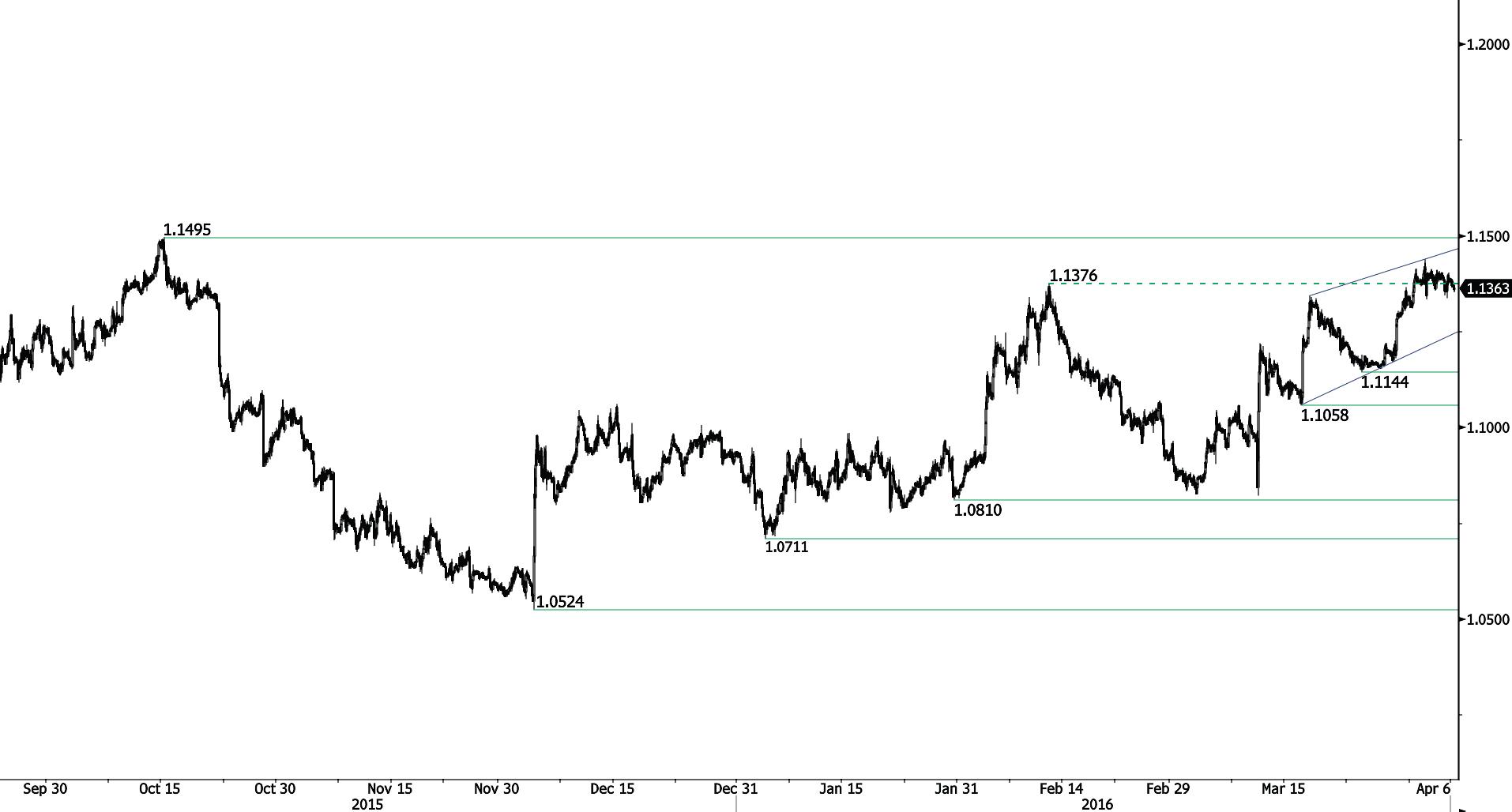

Monitoring 1.1400.

-

EUR/USD is testing below 1.1400. Hourly resistance can be found at 1.1438 (01/04/2016 high) while hourly support is given at 1.1144 (24/03/2016 low). Stronger support is located a 1.1058 (16/03/2016 low). Expected to show further test of 1.1400.

-

In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deterioration implies a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD

Short-term bearish.

-

GBP/USD's short-term momentum is growing. Hourly resistance is given at 1.4591 (05/02/2016 high) while hourly support can be found at 1.4171 (01/04/2016 low). A break of stronger resistance at 1.4668 (04/02/2016) is nonetheless needed to show a reverse in the medium-term momentum. Expected to show further approach to hourly support at 1.4033 (03/03/2016 low)

-

The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Bearish momentum is growing.

-

USD/JPY's medium term momentum is negative. The pair has exited ranged in which it was installed over the last two months. On the short-term, selling pressures keep increasing. Hourly support can be found at 109.96 (05/03/2016 low). Hourly resistance is given at 113.80 (29/03/2016 high) while stronger resistance is given at 114.91 (16/02/2016 high). Expected to further weaken.

-

We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF

Fading momentum.

-

USD/CHF has weakened over the last month which confirms increasing selling pressures. Yet, the pair is currently trading mixed. Hourly support can be found at 0.9547 (05/04/2016 low) while hourly resistance is located at 0.9788 (25/03/2016 high). Stronger resistance can be found at 0.9913 (16/03/2016 high). Expected to show further weakness.

-

In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

USD/CAD

Selling pressures are fading.

-

USD/CAD is still riding the downtrend channel. The medium-term bearish momentum is strong. Hourly support can be found at 1.2912 (30/03/2016 low) while hourly resistance is given at 1.3296 (24/03/2016 high). Expected to bounce lower on resistance implied by the upper bound of the downtrend channel.

-

In the longer term, the break of the key support at 1.2832 (15/10/2015) would indicate increasing selling. Strong resistance is given at 1.4948 (21/03/2003 high). Stronger support can be found at 1.1731 (06/01/2015 low).

AUD/USD

Failed to break short-term uptrend channel.

-

AUD/USD's momentum is bullish. Hourly resistance can be found at 0.7723 (31/03/2016 high) while hourly support is given at 0.7415 (16/03/2016 low). Buying pressures remain nonetheless important as long as the pair remains above 0.7415.

-

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair is now above the 200-dma which confirms our view that buying pressures are increasing.

EUR/CHF

Bouncing back to 1.0900.

-

EUR/CHF's selling pressures are still important while current retracement. Hourly support can be found at 1.0874 (23/03/2016 low) while hourly resistance is given at 1.1023 (10/03/2016 high). Expected to show deeper weakness.

-

In the longer term, the technical structure remains positive. Resistance can be found at 1.1200 (04/02/2015 high). Yet,the ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Consolidating.

-

EUR/JPY has broken downtrend channel. Shortterm bullish momentum is fading. Hourly support is given at 124.68 (22/03/2016 low) while hourly resistance can be found at 128.22 (31/03/2016 high). Expected to show further consolidation.

-

In the longer term, the technical structure validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Strong support is given at 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Ready to set two year-highs.

-

EUR/GBP has broken the uptrend channel and is now lying around 0.8000. Hourly support lies at 0.7830 (29/03/2016 low). Stronger support can be found at 0.7525 (22/01/2016 low). The technical structure suggests that the pair should show continued increase.

-

In the long-term, the technical structure suggests a growing upside momentum. The pair is trading well above its 200 DMA. Strong resistance can be found at 0.8066 (10/09/2014 high).

GOLD (in USD)

Short-term bearish.

-

Gold is in a short-term downtrend channel despite some retracement. Hourly support is given at 1208 (28/03/2016) while hourly resistance is given at 1260 (22/03/2016 high). A break of support at 1182 (08/02/2016 low) is necessary to confirm a deeper bearish trend.

-

In the long-term, the technical structure suggests that there is a growing upside momentum. A break of 1392 (17/03/2014) is necessary ton confirm it, A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Pausing.

-

Silver is trading mixed. Hourly resistance is given at 16.14 (18/03/2016 high) while hourly support can be found at 14.79 (01/04/2016 low). Expected to see further increase as the technical structure suggests that nonetheless buying pressures should rejuvenate.

-

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

Crude Oil (in USD)

Retracement.

-

Crude oil's bearish trend is deeper despite ongoing retracement. Hourly support is now given at 33.22 (29/02/2016 low). Daily resistance is given at 42.00 (04/12/2016 high). Expected to further weaken.

-

In the long-term, crude oil is on a sharp decline and is of course no showing any signs of recovery. Strong support at 24.82 (13/11/2002) is now on target. Crude oil is holding way below its 200-Day Moving Average (setting up at around 47). There are currently no signs that a reverse trend may happen.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.