EUR/USD

Moving sideways.

EUR/USD has moved sharply higher after Draghi's comments last week Yet, the pair is now consolidating. Hourly resistance lies at 1.1218 (10/03/2016 high). Hourly support can be located a 1.1080 (11/03/2016 low). Expected to show further consolidation.

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

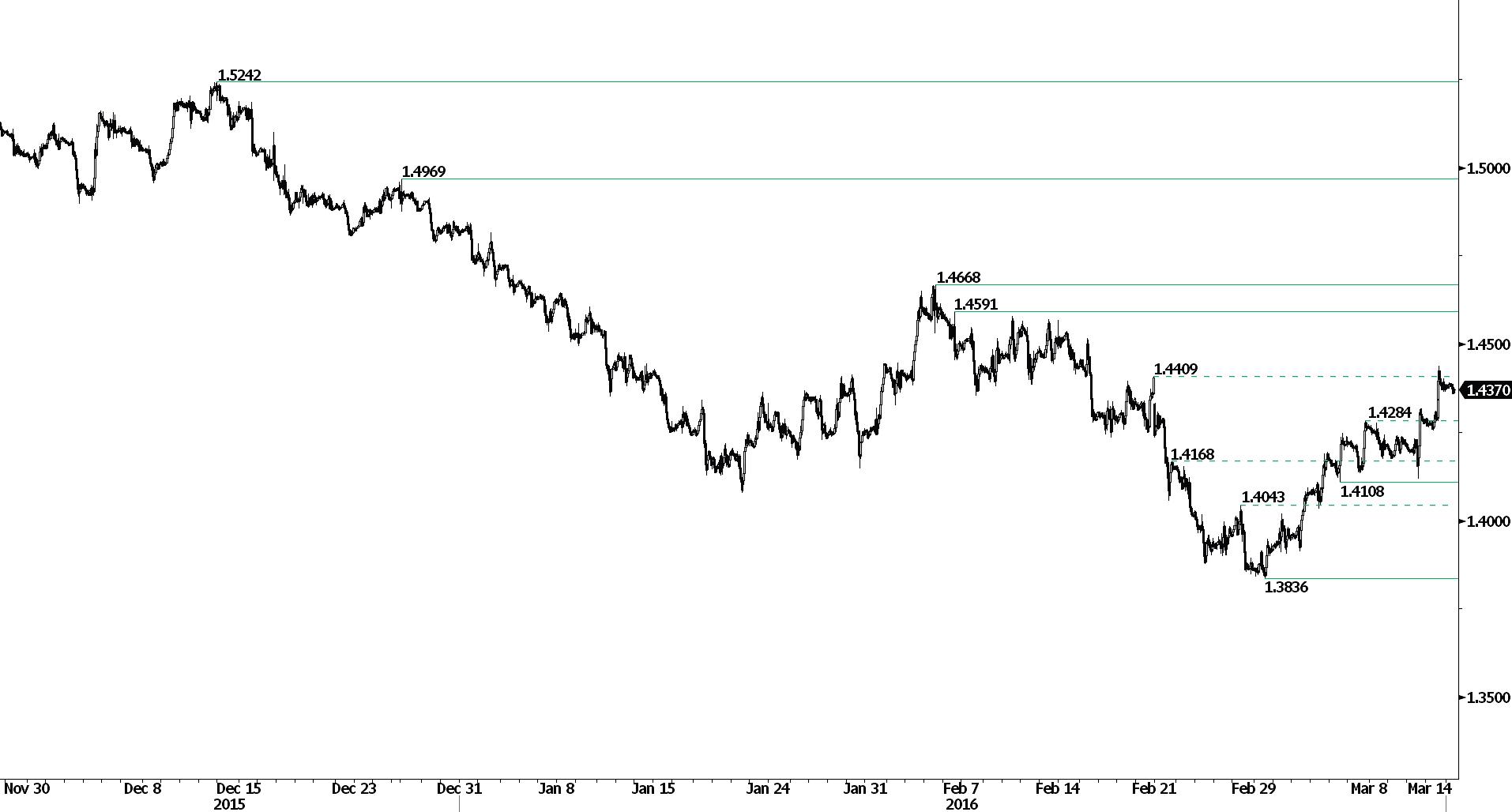

GBP/USD

Bearish consolidation.

GBP/USD's short-term bullish is finally not coming to an end despite ongoing bearish consolidation. Indeed major resistance at 1.4409 (19/02/2016 high) has been broken. New hourly resistance can now be found at 1.4437 (11/03/2016 high). while hourly support can be found at 1.4118 (10/03/2016 low). The technical structure suggests further consolidation before entering into another upside move.

The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Monitoring resistance area around 114.00.

USD/JPY remains in a range between strong resistance at 114.91 (16/02/2016 high) and support at 110.99 (11/02/2016 low). Hourly support lies at 112.61 (10/03/2016 low). The technical structure suggests a growing shortterm momentum.

We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF

Holding below parity.

USD/CHF has not been very volatile these past two days. An hourly support lies at 0.9796 (11/03/2016 low). Hourly resistance is located at 0.9891 (11/03/2016 high). Expected to show further consolidation.

In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

USD/CAD

Breaking support at 1.3229.

USD/CAD's momentum remains negative. Selling pressures are still important. Hourly resistance is given at 1.3446 (09/03/2016 high) while stronger resistance can be found at 1.3587 (29/02/2016 high). Expected to show continued weakness as hourly support at 1.3229 (09/03/2016 low) has been broken. New hourly support is given at 1.3168 (11/03/2016 low).

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Strong resistance is given at 1.4948 (21/03/2003 high). Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

AUD/USD

Bullish momentum continues.

AUD/USD is still pushing higher. The pair keeps on trading around its year-high. Strong resistance at 0.7528 (09/03/2015 high) has been broken confirming underlying bullish pressures. Hourly support is given at 0.7427 (10/03/2016 low). Expected to show continued strengthening.

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair is approaching the 200-dma which confirms fading selling pressures.

EUR/CHF

Trading slightly higher.

EUR/CHF's short-term momentum continues. Hourly support can be found at 1.0810 (290322016 low) while hourly resistance is given at 1.1023 (10/03/2016 high). Expected to further consolidate around 1.1000.

In the longer term, the technical structure remains positive. Resistance can be found at 1.1200 (04/02/2015 high). Yet,the ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Low volatility.

EUR/JPY's momentum has reversed. The pair is pushing higher. Hourly resistance can be found at 127.29 (intraday high). Hourly support is given at 123.65 (10/03/2016 low).

In the longer term, the technical structure validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key support at 124.97 (13/06/2013 low) has been broken. Stronger support is given at 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Direction-less.

EUR/GBP has lost all of its ECB meeting's gains. It seems that there is no momentum taking place right now. The pair remains above hourly support at 0.7652 (10/03/2016 low). Next support lies at 0.7525 (22/01/2016 low). Hourly resistance can be located at 0.7848 (10/03/2016 high).

In the long-term, the technical structure suggests a growing upside momentum. The pair is trading well above its 200 DMA. Strong resistance can be found at 0.8066 (10/09/2014 high).

GOLD (in USD)

Riding uptrend channel.

Gold's bullish momentum keeps going. Hourly resistance is given at 1284 (intraday high) while hourly supports lies at 1237 (10/03/2016 low). Expected to show continued strengthening toward 1300.

In the long-term, the technical structure suggests that there is a growing upside momentum. A break of 1392 (17/03/2014) is necessary ton confirm it, A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Monitoring strong resistance area at 15.80.

Silver remains very volatile, mixing large ups and downs. Hourly resistances are given at 15.80 (12/02/2016 high) & 15.93 (11/02/2016 high). Hourly support can be found at 15.15 (10/03/2016 low). Expected to keep on pushing higher.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

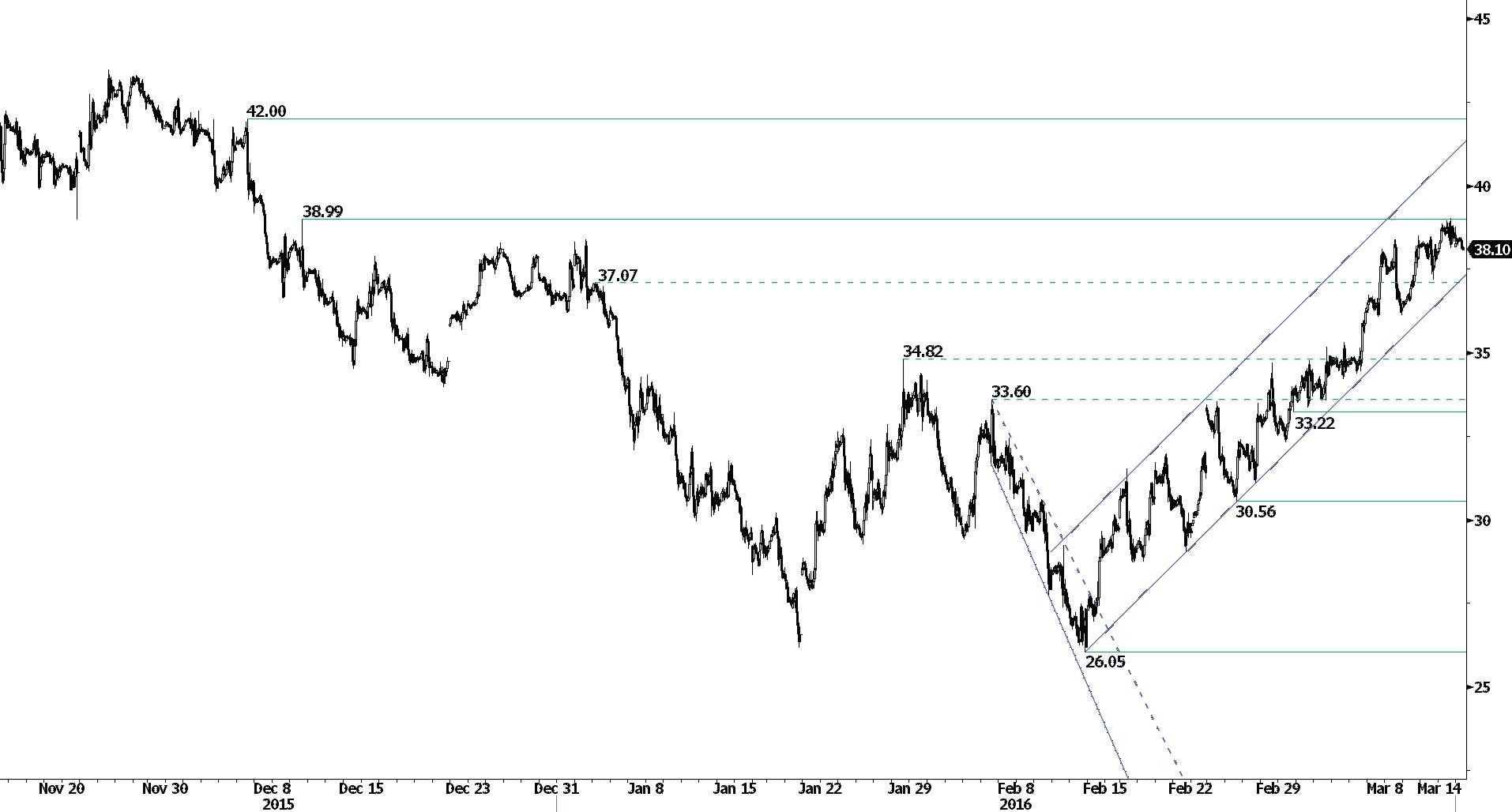

Crude Oil (in USD)

Lack of follow-through.

Crude oil continues to move within a rising channel. The black commodity has failed to erase completely hourly resistance at 38.99 (09/12/2016 high). Hourly support can be found at 36.12 (08/03/2016 low). A more significant support stands at 35 (rising channel). Expected to see continued strengthening in the shortterm.

In the long-term, crude oil is on a sharp decline and is of course no showing any signs of recovery. Strong support at 24.82 (13/11/2002) is now on target. Crude oil is holding way below its 200-Day Moving Average (setting up at around 47). There are currently no signs that a reverse trend may happen.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.