Next report will be published on 5th January, 2016

Are you trading today? Read the Forex Trading Strategies for the Day.EUR/USD

Last Technical Report for 2015.

Happy Holidays

2015 has been a fascinating year, full of ups and downs. We can’t wait to see what 2016 holds. In order be fresh and ready to tackle the new year demands, production of the Daily Technical Report will be paused from Dec 24th through Jan 4th 2016.

EUR/USD's short-term bullish momentum towards 1.1000 continues. Key support is given at 1.0796 (07/12/2015 low). Stronger support lies at 1.0524 (03/12/2015 low). Hourly resistance may be found at 1.1096 (28/10/2015 low). Expected to target again support at 1.0796.

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD

Bullish momentum stalls.

GBP/USD has broken support implied by the lower bound of the downtrend channel before bouncing back. Hourly support at 1.4866 (17/12/2015 low) has been broken. Hourly resistance is given at 1.5242 (13/12/2015 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Expected to further bounce back.

The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Holiday conditions dominate.

USD/JPY selling pressure continues in thin holiday conditions. Short-term technical structure suggests a stronger downside momentum. Hourly support can be found at 120.07 (28/10/2015 low). Hourly resistance lies at 123.76(18/11/2015 high). Expected to further decline.

A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF

Testing uptrend channel.

USD/CHF uptrend has paused reversing to test support.. Support is located at 0.9875 (uptrend channel floor). Hourly resistance can be found at 1.0034 (04/12/2015 high). Additional support is given at 0.9786 (14/12/2015 low). Yet, the shortterm technical structure shows an upside move. Expected to further increase.

In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.

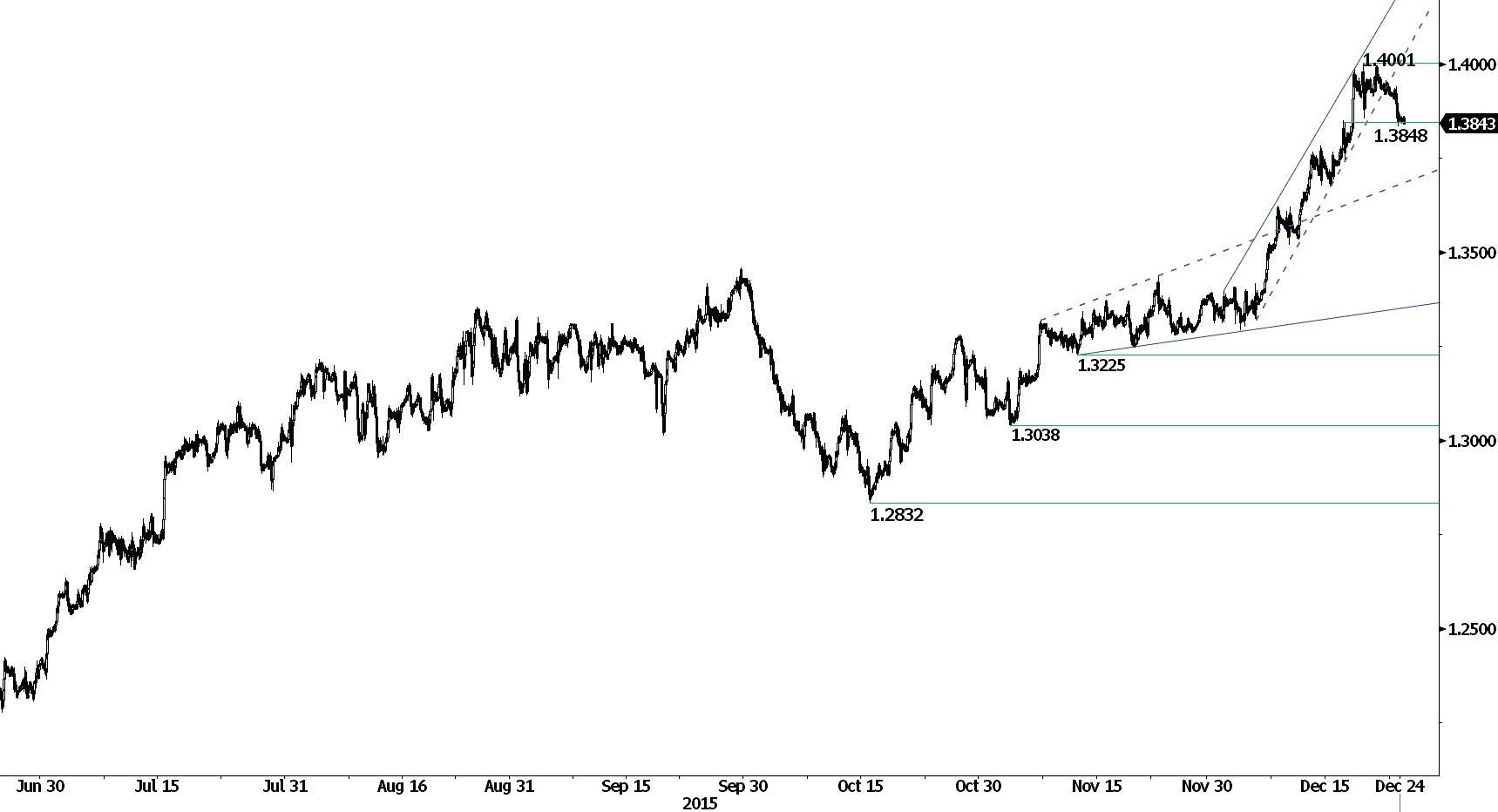

USD/CAD

Building a base.

USD/CAD is currently consolidating after failing to clear 1.4000 handle. Support is located at 1.3848, which break would trigger a sharp move to key support stands at 1.3225 (12/11/2015 low). Hourly (and long-term) resistance holds at 1.4001. Expected to keep going this consolidating phase.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Strong resistance is given at 1.4002 (18/05/2004). Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

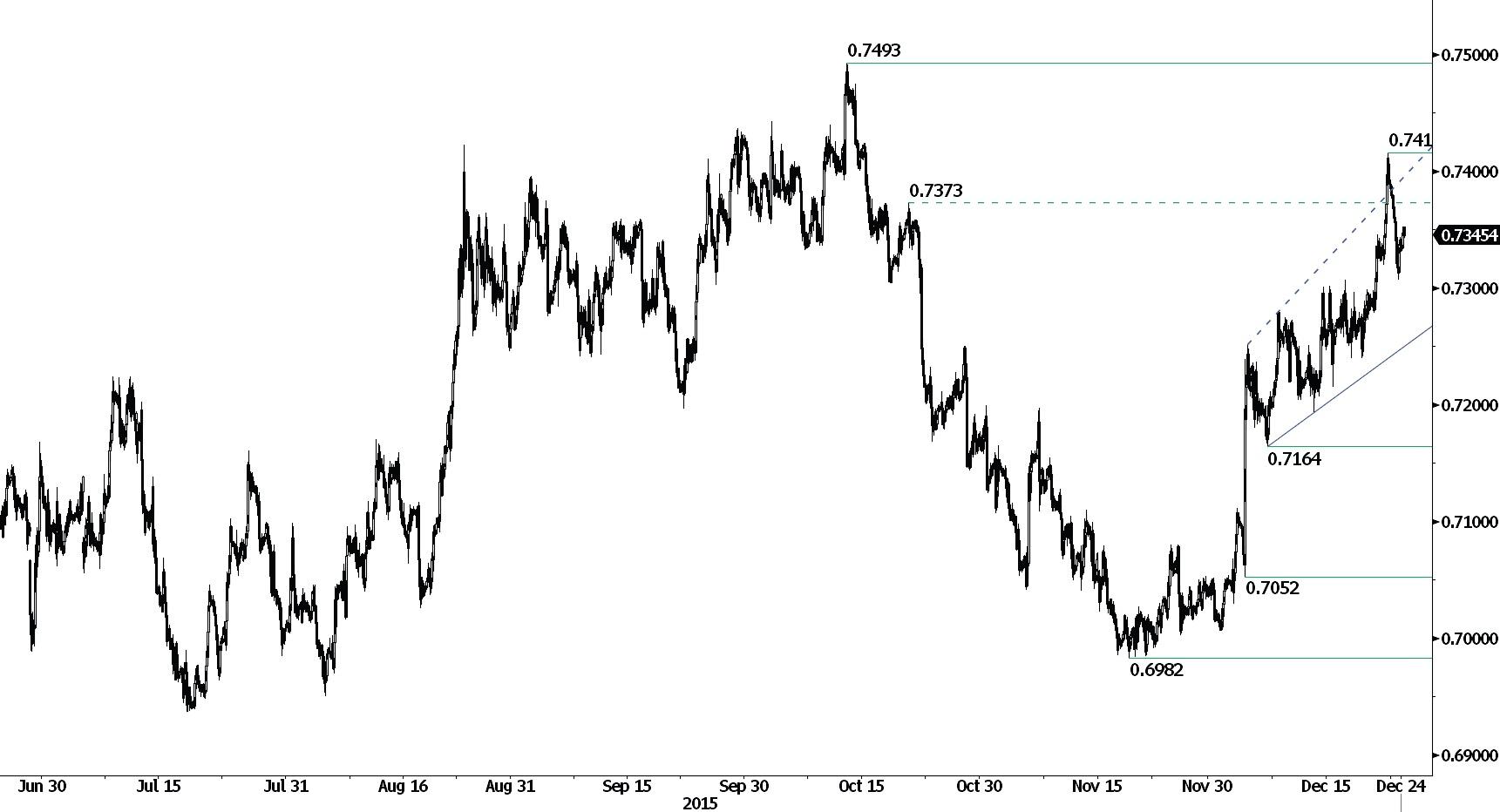

AUD/USD

Sharp bullish rally.

AUD/USD is heading higher after a brief consolidation phase. Hourly support can be found at 0.7017 (08/11/2015 low). The break of hourly resistance at 0.7283 (15/12/2015 high) is necessary to confirm a medium-term trend reversal.

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair remains well below the 200-dma which confirms selling pressures.

EUR/CHF

Bouncing.

EUR/CHF is having some difficulties to confirm the exit of the symmetrical triangle. Hourly support lies at 1.0733 (28/08/2015 low) and hourly resistance can be found at 1.0847 (10/12/2015 high). Expected to show further consolidation around 1.0850.

In the longer term, the technical structure remains negative as long as prices remain below the resistance at 1.1002 (02/09/2011 low). The ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Slight bullish bounce.

EUR/JPY has recovered slightly. Hourly resistance lies at 134.60 (04/12/2015 high). Stronger resistance is located at 137.45 (17/09/2015 high). Hourly support lies at 129.67 (27/11/2015 low). Expected to show further decline.

In the longer term, the break of the support at 130.15 validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key supports stand at 124.97 (13/06/2013 low) and 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Direction-less.

EUR/GBP continues to trade in a volatility pattern. The pair has broken the upside channel but failed to hold the bullish position. Hourly resistance at 0.7373 (21/10/2015 high) has been broken and hourly support is given at 0.7164 (07/12/2015 low). There are still strong buying interest but unable to get directional momentum. Expected to further consolidate before entering into another rising phase.

In the long-term, prices are in an underlying declining trend. The general oversold conditions suggest a limited medium-term downside potential. A key resistance lies at 0.7592 (03/02/2015 high).

GOLD (in USD)

Short-term lower highs.

Gold's downside momentum is not going to end. The metal is trading between 1050 and 1080. Strong support area is given by the hourly support at 1046 (03/12/2015 low) and by key support at 1044 (05/02/2015 low). Hourly resistance is given at 1098 (16/11/2015 high). Expected to show further weakness.

In the long-term, the underlying downtrend (see declining channel) continues to favour a bearish bias. A break of the resistance at 1223 is needed to suggest something more than a temporary rebound. A major support can be found at 1045 (05/02/2010 low).

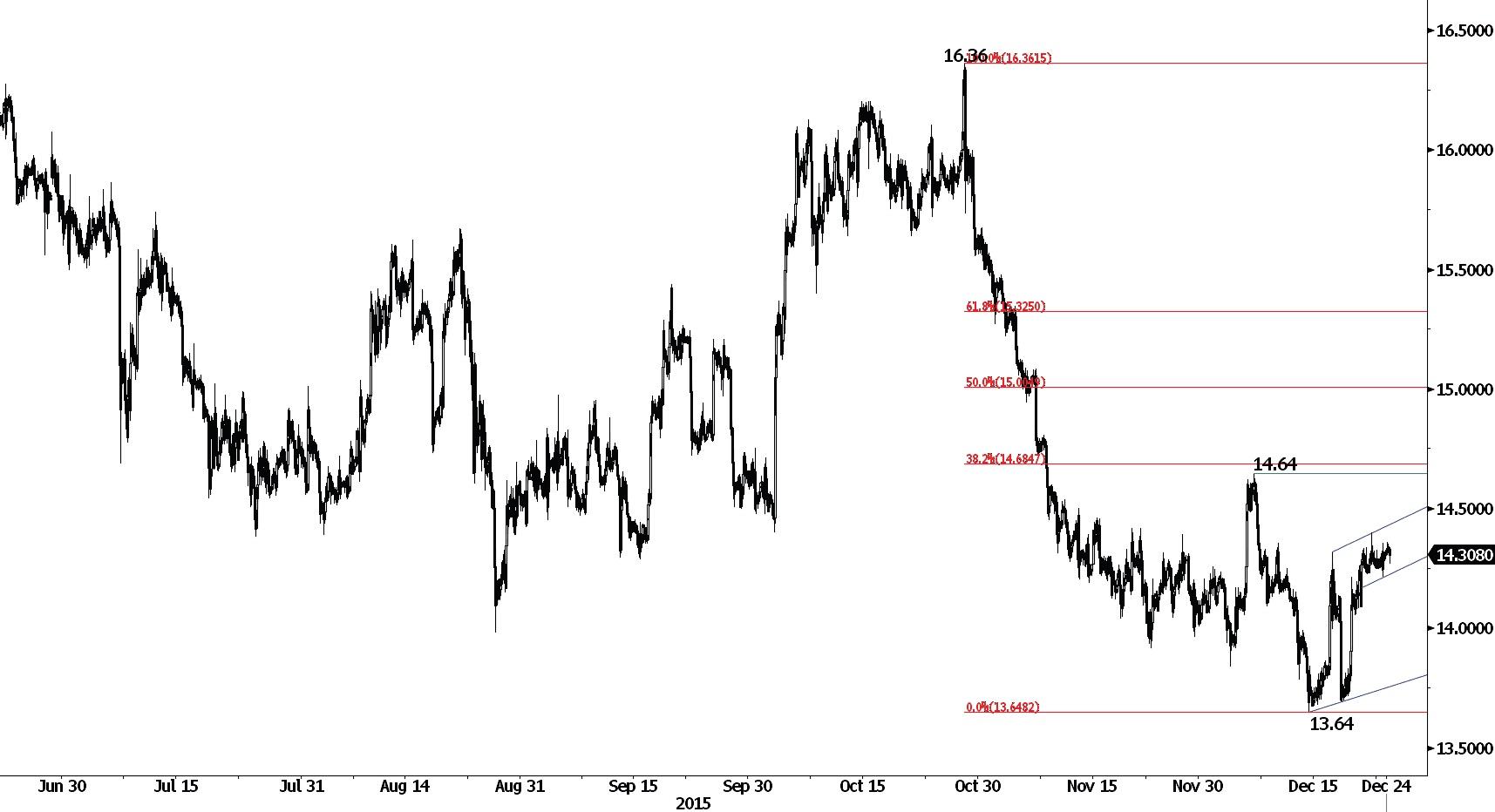

SILVER (in USD)

Moving sideways (with bullish overtones).

Silver keeps moving sideways with slight buying interest. Strong support lies at 13.51 (19/08/2009 low). Hourly resistance at 14.64 is approaching but still seems far. Yet, the overall technical structure (high volatility) suggests to see back further weakness toward hourly support at 13.51.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

Crude Oil (in USD)

Testing 37.88 resistance

Crude oil has had a strong recovery bounce. Now is testing key resistance at 37.88. The medium-term technical structure remains clearly negative in a context of oil oversupply. Expected to show continued weakness. We see this bounce as temporary.

In the long-term, crude oil has not shown signs of recovery. Strong support lies at 37.75 (24/08/2015) has been broken and 32.40 (18/08/2015 low) is now on target. Nonetheless, crude oil is holding way below its 200-Day Moving Average (setting up at 50). An very unlikely break of the resistance at 60.72 (05/07/2015) would confirm an underlying uptrend.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.