EUR/USD

(Still) trading in range.

EUR/USD has bounced back from hourly support at 1.0796 (07/12/2015 low). Stronger support lies at 1.0524 (03/12/2015 low). Expected to target resistance at 1.1096.

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

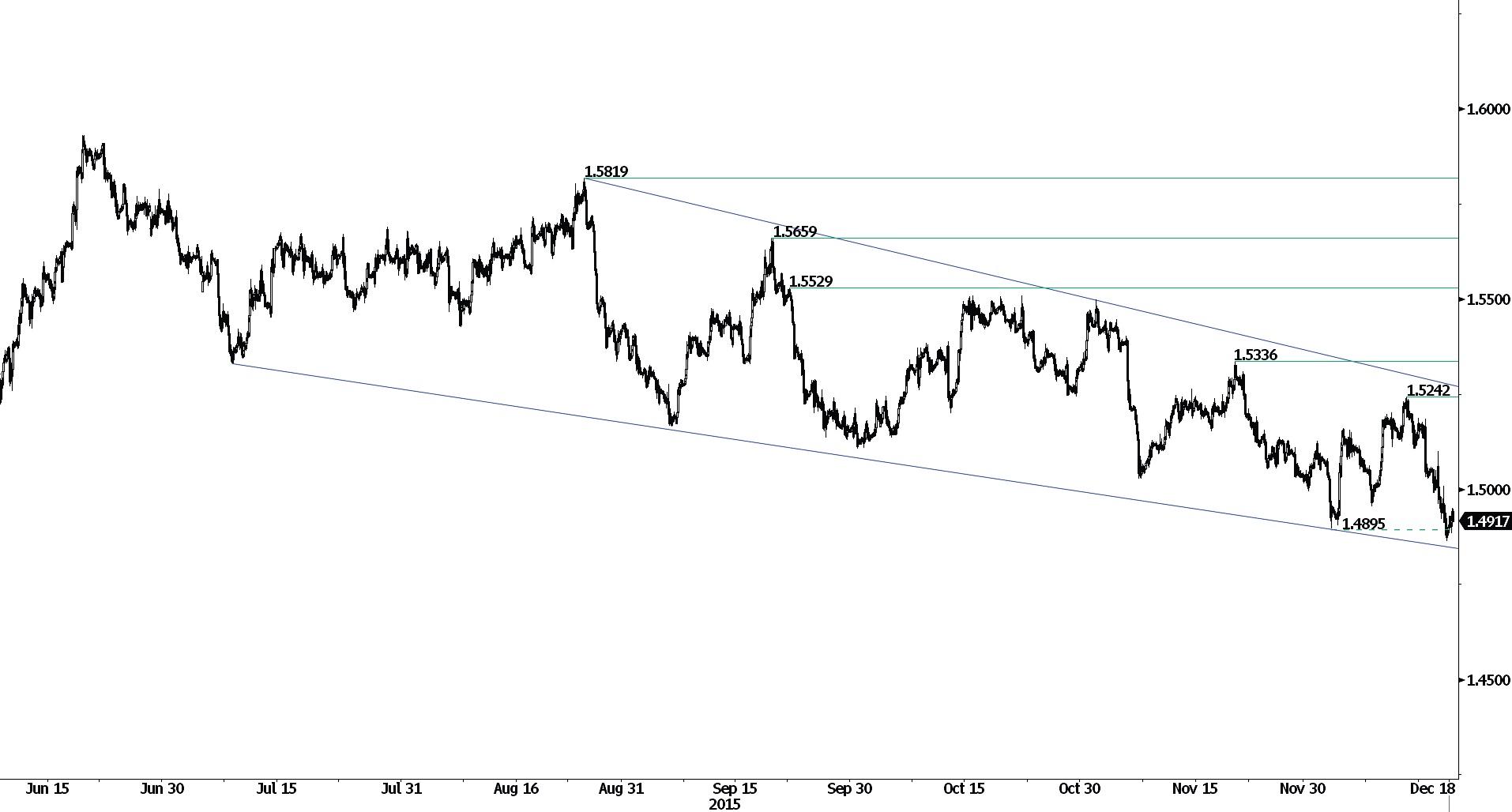

GBP/USD

Riding downtrend channel.

GBP/USD's medium-term downside momentum remains lively. The pair is riding the downtrend channel. Hourly resistance is given at 1.5242 (13/12/2015 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Hourly support at 1.4985 (02/12/2015 low) has been broken. Expected to further bounce back.

The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Weakening.

USD/JPY has moved strongly up and down after BoJ meeting. Hourly support can be found at 120.07 (28/10/2015 low). Hourly resistance lies at 123.76(18/11/2015 high) has been broken. Expected to further consolidate.

A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF

Holding below parity.

USD/CHF is rising toward hourly resistance at 1.0034 (04/12/2015 high). Hourly support can be found at 0.9786 (14/12/2015 low). Yet, the shortterm technical structure shows an upside move. Expected to show further consolidation.

In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.

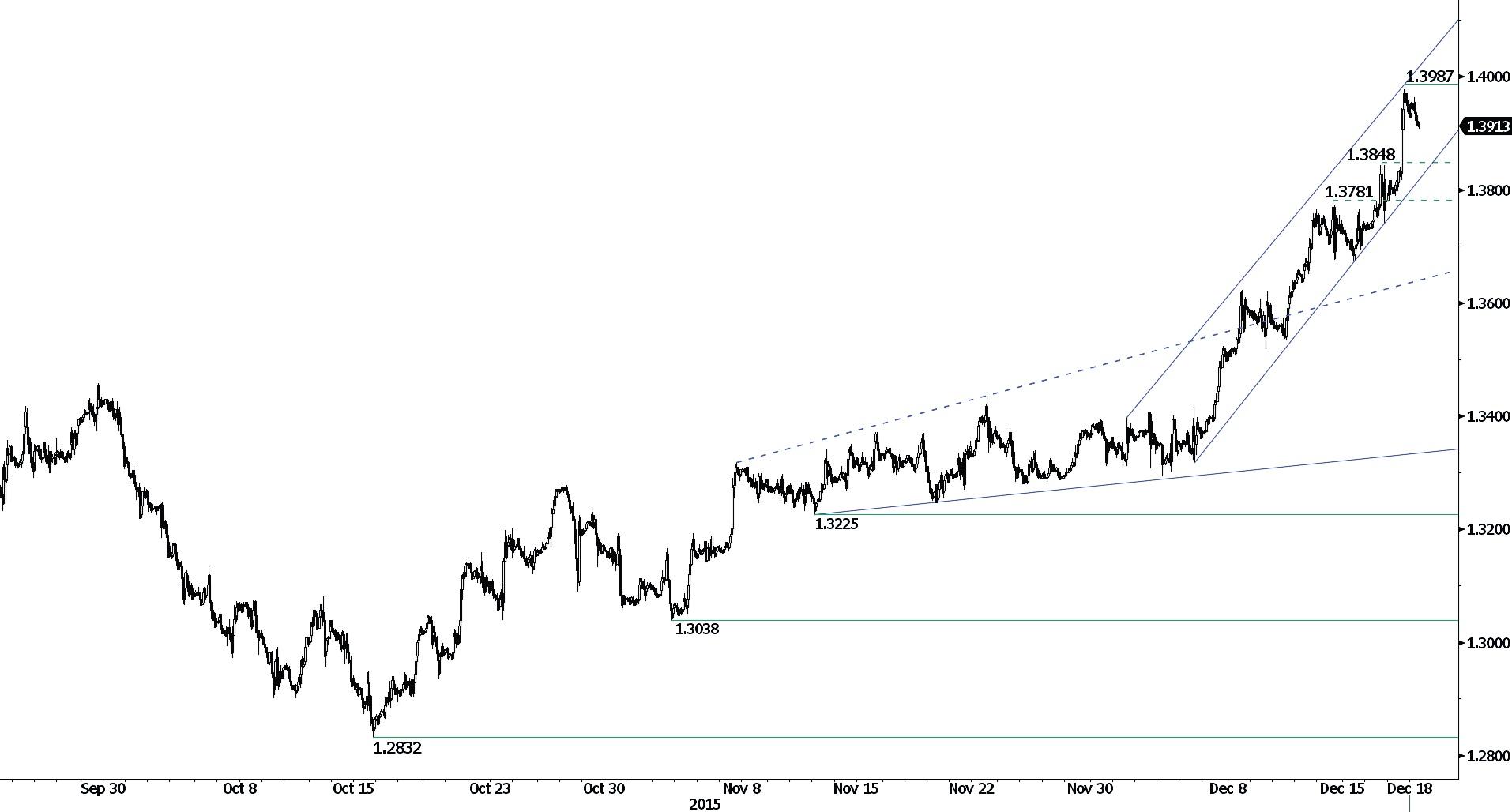

USD/CAD

Bearish consolidation.

USD/CAD has set again a new 11-year high at 1.3987 before consolidating. Significant support stands at 1.3225 (12/11/2015 low). Expected to show continued bullish momentum as uptrend is still in play.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Strong resistance is given at 1.4002 (18/05/2004). Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

AUD/USD

Bearish breakout.

AUD/USD is weakening. The pair has broken the lower bound of the symmetrical triangle which suggested a downside channel. Hourly support can be found at 0.7017 (08/11/2015 low) and hourly resistance at 0.7385 (12/04/2015 high). Expected to show further weakening.

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair remains well below the 200-dma which confirms selling pressures.

EUR/CHF

Weakening.

EUR/CHF is trading lower but remains between hourly support at 1.0733 (28/08/2015 low) and hourly resistance at 1.0956 (29/09/2015 high). Expected to show further weakness on the shortterm toward 1.0733.

In the longer term, the technical structure remains negative as long as prices remain below the resistance at 1.1002 (02/09/2011 low). The ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Sharply declining.

EUR/JPY is now pushing strongly lower. Hourly resistance lies at 134.60 (04/12/2015 high). Stronger resistance is located at 137.45 (17/09/2015 high). Hourly support lies at 129.67 (27/11/2015 low). The technical structure still suggests a downside momentum. Expected to show further decline.

In the longer term, the break of the support at 130.15 validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key supports stand at 124.97 (13/06/2013 low) and 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Ready to bounce.

EUR/GBP is trading sideways but remains in an upside channel. Hourly resistance lies at 0.7373 (21/10/2015 high) and hourly support is given at 0.7164 (07/12/2015 low). The technical structure suggests that an upside momentum may be gaining some traction. Expected to show further increase.

In the long-term, prices are in an underlying declining trend. The general oversold conditions suggest a limited medium-term downside potential. A key resistance lies at 0.7592 (03/02/2015 high).

GOLD (in USD)

Back to key support.

Gold's downside momentum keeps going. Strong support area is given by the hourly support at 1046 (03/12/2015 low) and by key support at 1044 (05/02/2015 low). Hourly resistance is given at 1110 (06/11/2015 high). Expected to show further weakness.

In the long-term, the underlying downtrend (see declining channel) continues to favour a bearish bias. A break of the resistance at 1223 is needed to suggest something more than a temporary rebound. A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Consolidating.

Silver is back below 14.00. The metal keeps on pushing lower. Strong support lies at 13.51 (19/08/2009 low). Hourly resistance can be found at 15.45 (declining channel) seems way too far. Yet, the overall technical structure suggests to see back further weakness toward hourly support at 13.51.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.