EUR/USD

Trading sideways.

EUR/USD has consolidated lower but the short-term momentum is now bullish. Hourly resistance can be found at 1.1043 (09/12/2015). Hourly support lies at 1.0796 (07/12/2015 low). Stronger support lies at 1.0524 (03/12/2015 low). Expected to target resistance at 1.1096.

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD

Short-term bullish.

GBP/USD's medium-term downside momentum remains lively. Yet, the short-term momentum is bullish. . Hourly resistance is given at 1.5242 (13/12/2015 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Hourly support can be found at 1.4985 (02/12/2015 low). Expected to bounce back at upper bound implied by the downtrend channel.

The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Momentum reversal.

USD/JPY keeps on weakening. Hourly support at 121.08 (09/12/2015 low) has been broken. Stronger stronger support can be found at 120.07 (28/10/2015 low). Hourly resistance still lies at 123.76 (18/11/2015 high). Expected to pursue declining momentum toward support at 120.07.

A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF

Monitoring support at 0.9806.

USD/CHF is heading downwards toward hourly support at 0.9876 (27/10/2015 low) while hourly resistance is given at 1.0034 (04/12/2015 high). Expected to show further decline.

In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.

USD/CAD

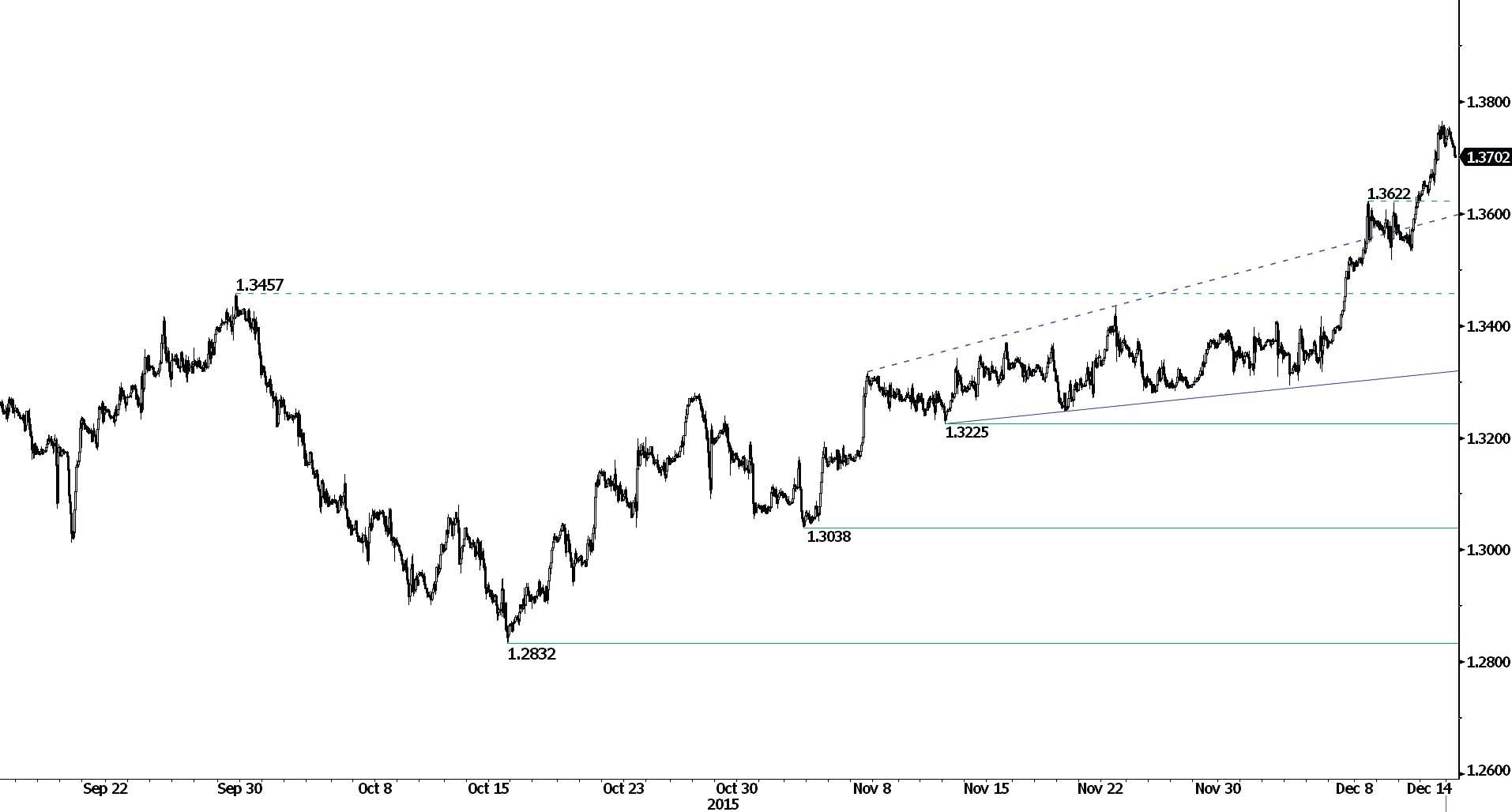

Consolidating around 1.3700.

USD/CAD's bullish momentum is still very strong as every intraday resistance is broken the day after. Significant support stands at 1.3225 (12/11/2015 low). Expected to show continued bullish momentum as uptrend is still in play.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

AUD/USD

Consolidating.

AUD/USD is moving sideways. The technical structure suggests that the pair has entered into a trading in range phase between hourly support at 0.7160 (intraday high) and hourly resistance at 0.7385 (12/04/2015 high). Expected to show further decline.

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair remains well below the 200-dma which confirms selling pressures.

EUR/CHF

Fading on support at 1.0789.

EUR/CHF is pausing around hourly support at 1.0789 (18/11/2015 low) while still moving sideways from 1.0800 to 1.0950. Stronger resistance can be found at 1.0982 (25/09/2015 high). Expected to show further weakness on the short-term.

In the longer term, the technical structure remains negative as long as prices remain below the resistance at 1.1002 (02/09/2011 low). The ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Bearish move.

EUR/JPY is consolidating lower. Hourly resistance lies at 134.60 (04/12/2015 high). Stronger resistance is located at 137.45 (17/09/2015 high). Hourly support lies at 129.67 (27/11/2015 low). The technical structure still suggests a downside momentum. Expected to show further decline.

In the longer term, the break of the support at 130.15 validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key supports stand at 124.97 (13/06/2013 low) and 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Moving sideways.

EUR/GBP is consolidating. Hourly resistance lies at 0.7279 (08/12/2015 high) and hourly support is given at 0.7164 (07/12/2015 low). The technical structure suggests that an upside momentum may be gaining some traction. Expected to show further consolidation.

In the long-term, prices are in an underlying declining trend. The general oversold conditions suggest a limited medium-term downside potential. A key resistance lies at 0.7592 (03/02/2015 high).

GOLD (in USD)

Weakening.

Gold is moving slowly on the short-term. Hourly support lies at 1044 (05/02/2015 low). Hourly resistance is given at 1110 (06/11/2015 high). Expected to show further weakness.

In the long-term, the underlying downtrend (see declining channel) continues to favour a bearish bias. A break of the resistance at 1223 is needed to suggest something more than a temporary rebound. A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Downside traction.

Silver keeps heading toward strong support at 13.51 (19/08/2009 low). The metal is oriented to decline below 14.00. Hourly resistance can be found at 15.45 (declining channel) seems way too far. Expected to see back further weakness toward hourly support at 13.51.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

Crude Oil (in USD)

Where will it stop?

Crude oil keeps on weakening amid very high volatility. Hourly support now lies at 35.16 (intraday low). The medium-term technical structure is clearly negative in a context of oil oversupply. Expected to show continued weakness.

In the long-term, crude oil has not shown signs of recovery. Strong support lies at 37.75 (24/08/2015) has been broken and 32.40 (18/08/2015 low) is now on target. Nonetheless, crude oil is holding way below its 200-Day Moving Average (setting up at 50). An very unlikely break of the resistance at 60.72 (05/07/2015) would confirm an underlying uptrend.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.