EUR/USD

Bearish breakout of the support at 1.0900.

EUR/USD has broken the support at 1.0900 reversing completely the recent short-term recovery bounce. Hourly supports can now be found at 1.0879 (04/08/2015) and 1.0812 (21/07/2015). Hourly resistances stand at 1.0883 (intraday high) and 1.0968 (04/11/2015).

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

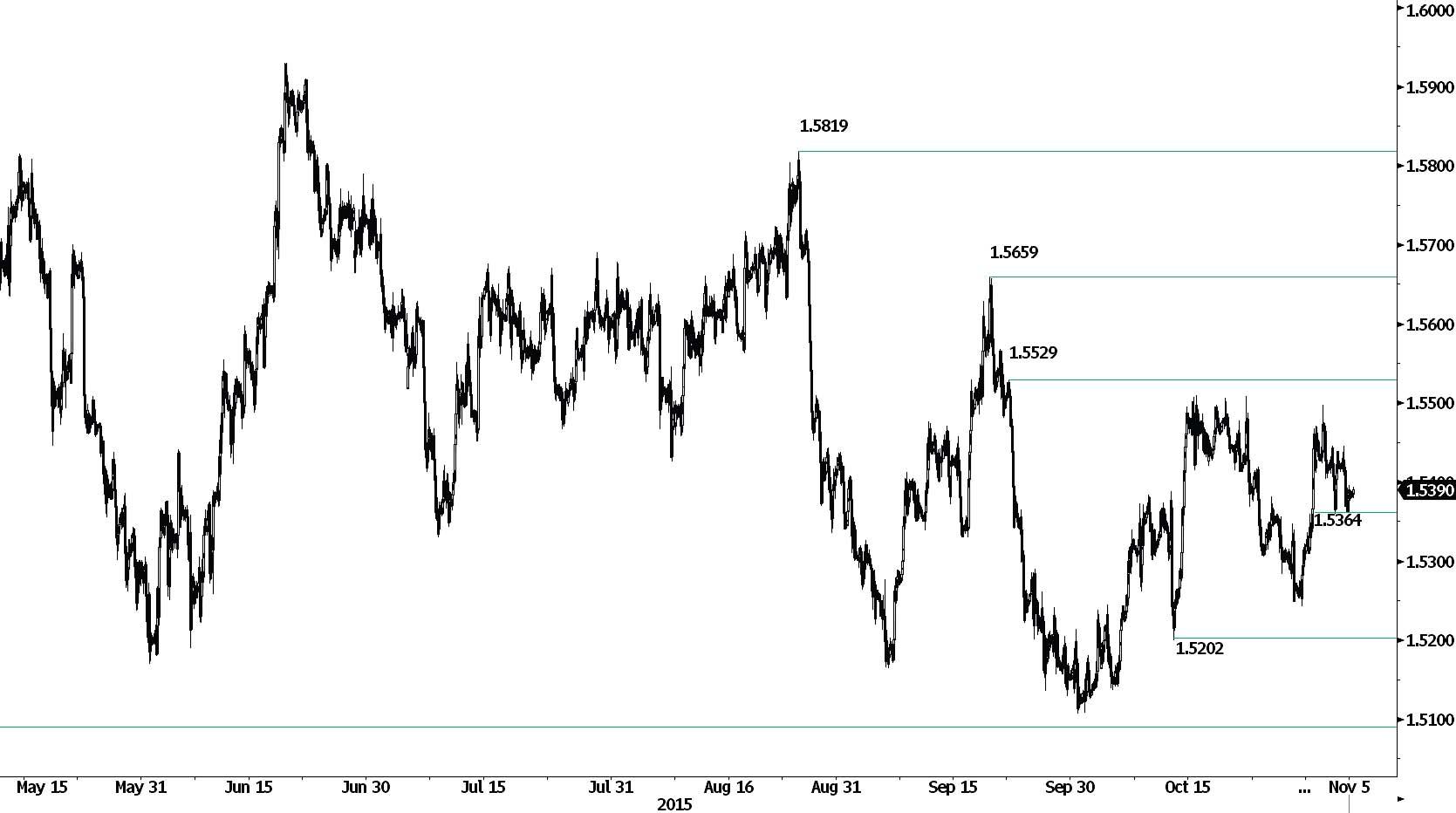

GBP/USD

Support holds.

GBP/USD has remained weak after its failure to challenge resistance at 1.5509. However, a break of the support at 1.5364 (30/10/2015 low) is needed to suggest a deeper corrective phase. Hourly resistances stand at 1.504 (intraday high) and1.5529 (18/09/2015 high). Another support lies at 1.5202 (06/06/2014 high).

In the longer term, the technical structure looks like a recovery as long as support given at 1.5089 stands. A full retracement of the 2013-2014 rise is expected.

USD/JPY

The key resistance at 121.75 has held thus far.

USD/JPY continues to rise within its range after failing to challenging its recent lows at 120.80 (28/10/2015 low). Lack of technical drivers indicate that range trading should continue. Strong resistance is given at 121.75 (28/08/2015 high). Expected to show continued increase before targeting again resistance at 121.75.

A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

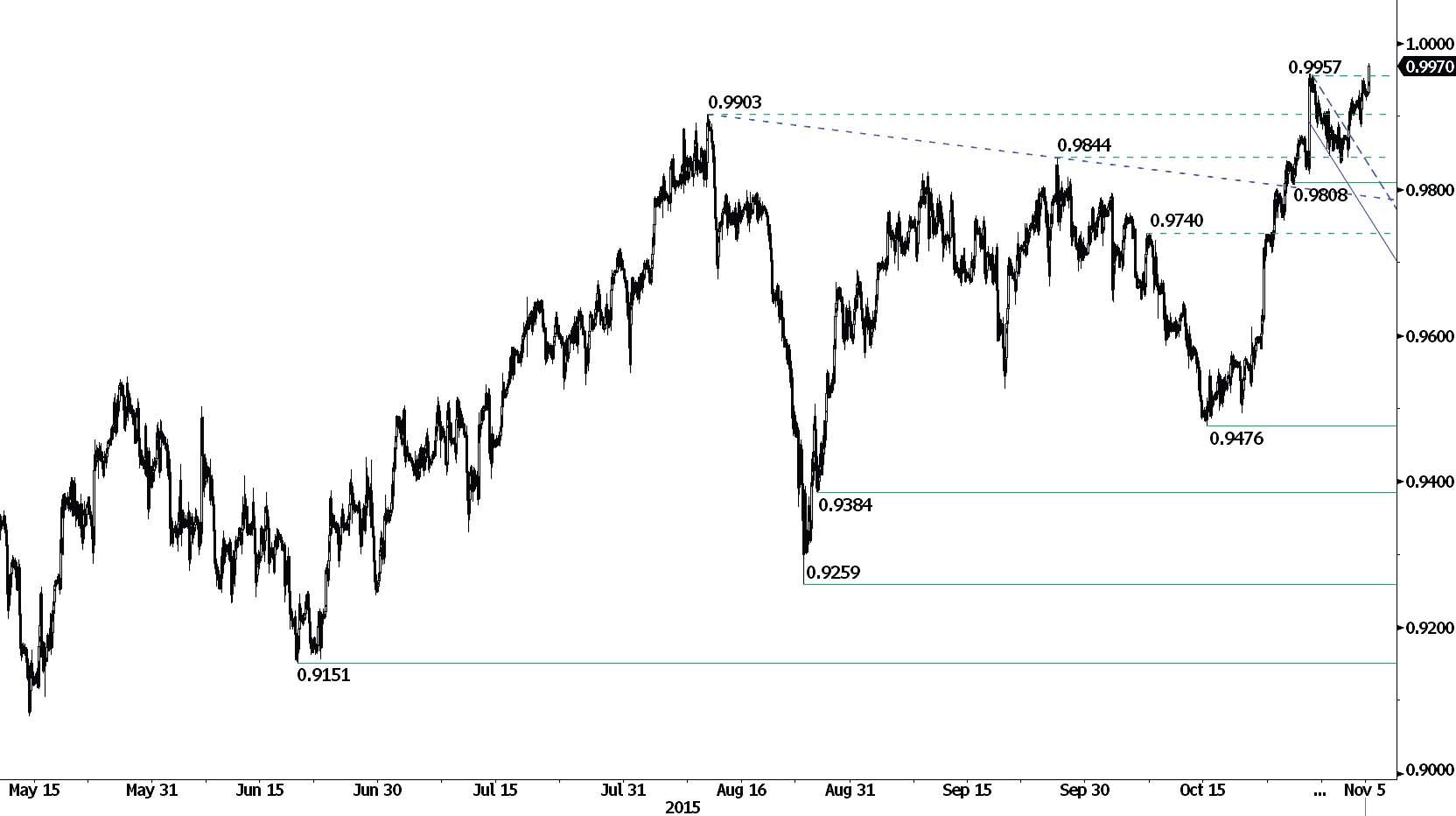

USD/CHF

Bullish breakout at 0.9957.

USD/CHF has broken the resistance at 0.9957 (28/10/2015 range high and long term decliing trendline), confirming an increasing buying interest. As long as the support at 0.9808 (27/10/2015 low) holds, the technical structure looks to further bullish momentum. Additional hourly support is given at 0.9476 (15/10/2015 low).

In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.

USD/CAD

Bullish bounce underway.

USD/CAD has bounced close to the support at 1.3042. Resistances can be found at 1.3195 (304/11/2015) then 1.3280 (28/10/2015 high). Significant supports stand at 1.2949 (Fibo 38% retracement level).

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Support can be found at 1.1731 (06/01/2015 low).

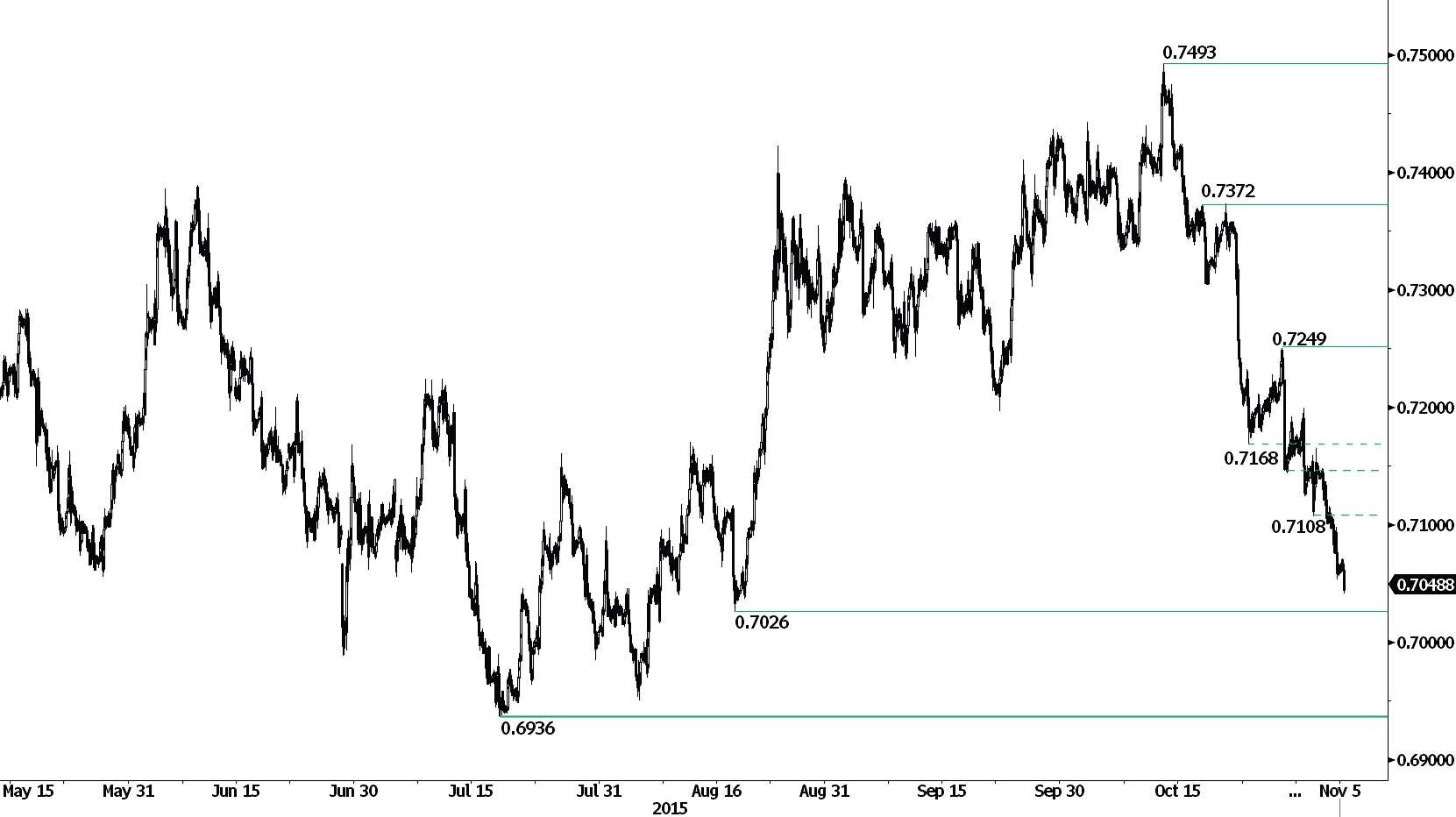

AUD/USD

Fading near the declining trendline.

AUD/USD bullish momentum has improved but prices have thus far failed to decisively break their declining trendline at 0.7220. An hourly support can be found at 0.7120 (03/11/2015 low). As the pair has broken hourly support at 0.7165 (08/10/2015 low) underlying downside trend is dominate.

In the long-term, there is no sign to suggest the end of the current downtrend. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair remains well below the 200-dma which confirms selling pressures.

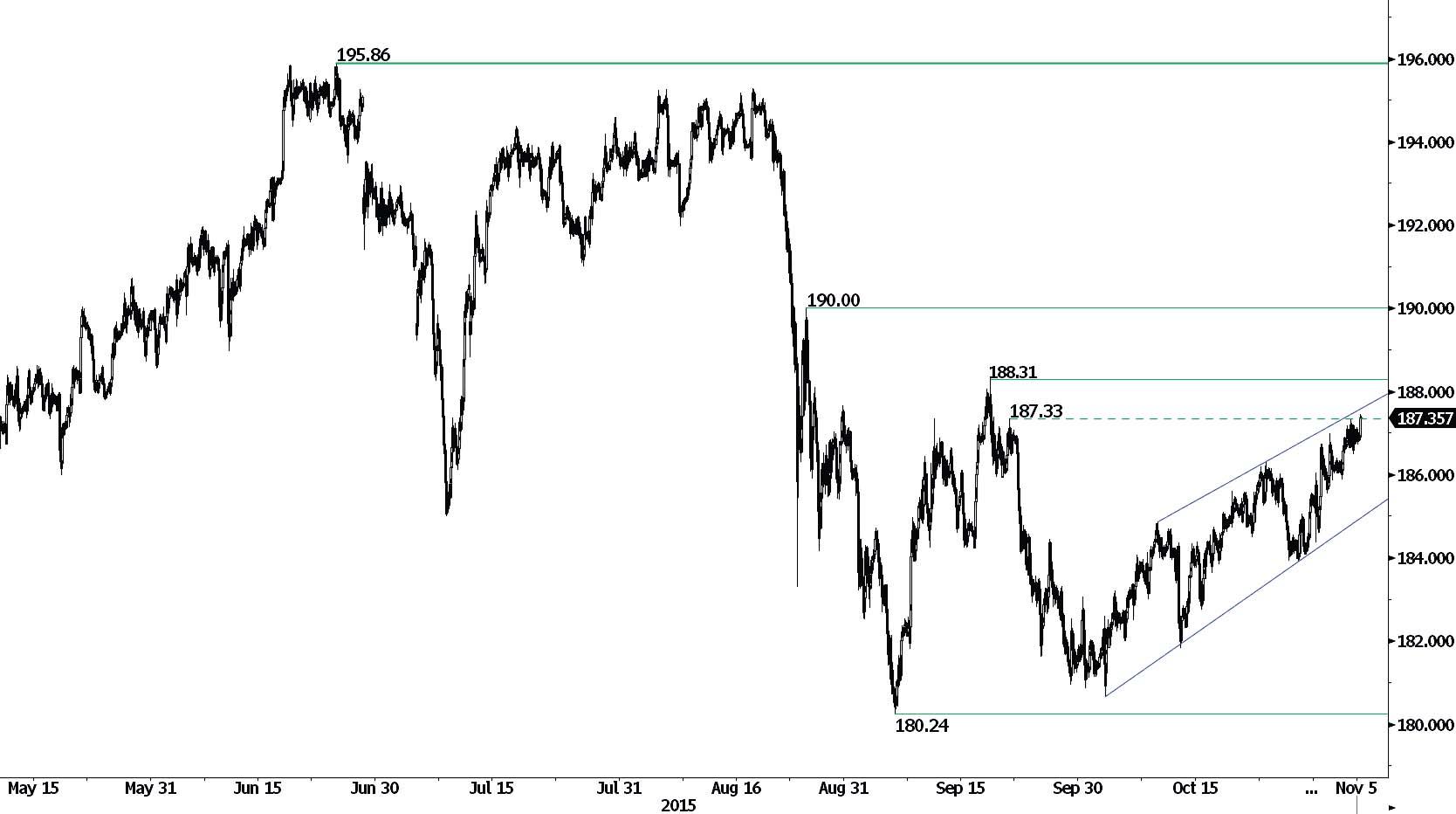

GBP/JPY

Bullish recovery in the uptrend channel.

GBP/JPY rebound challenging the key support area at 184.30/40 (see also the rising channel) is thus far impressive. A daily break and close of the resistance at 187.33 (21/09/2015 high) is needed to suggest further short-term strength.

In the long-term, the lack of any medium-term bearish reversal pattern favours a bullish bias. The successful test of the strong support at 175.51 (03/02/2015 low) signals persistent buying interest. Key resistances stand at 197.45 (26/09/2008 high). A major support area can be found between 169.51 (11/04/2014 low) and 167.78 (18/03/2014 low).

EUR/JPY

Remains weak but support is holding.

EUR/JPY is bouncing after breaking support at 132.23 (04/09/2015 low). Hourly resistance is located at 132.88 (declining downtrend channel) and hourly support lies at 132.24 /09/04/2015 low). Expected to show continued weakness.

In the longer term, the break of the support at 130.15 validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key supports stand at 124.97 (13/06/2013 low) and 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Remains weak thus far.

EUR/GBP short-term succession of lower lows indicates the technical structure is negative. Monitor the support at 0.7026 (18/08/2015 low). Hourly resistance can be found at 0.7077 (inraday high) and 0.7108 (02/11/2015 low). Structural pattern indicates continued weakness.

In the long-term, prices are in an underlying declining trend. The general oversold conditions suggest a limited medium-term downside potential. A key resistance lies at 0.7592 (03/02/2015 high).

EUR/CHF

Minor bullish bounce.

EUR/CHF is moving sideways off support, though a bearish bias is favoured given the recent lower highs. Hourly support lies at 1.0783 (intrday low) and 1.0733 (16/10/2015 low). Hourly resistance can be found at 1.0908 (declining channel resistance). Expected to fall below 1.0800.

In the longer term, the technical structure remains negative as long as prices remain below the resistance at 1.1002 (02/09/2011 low). The ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

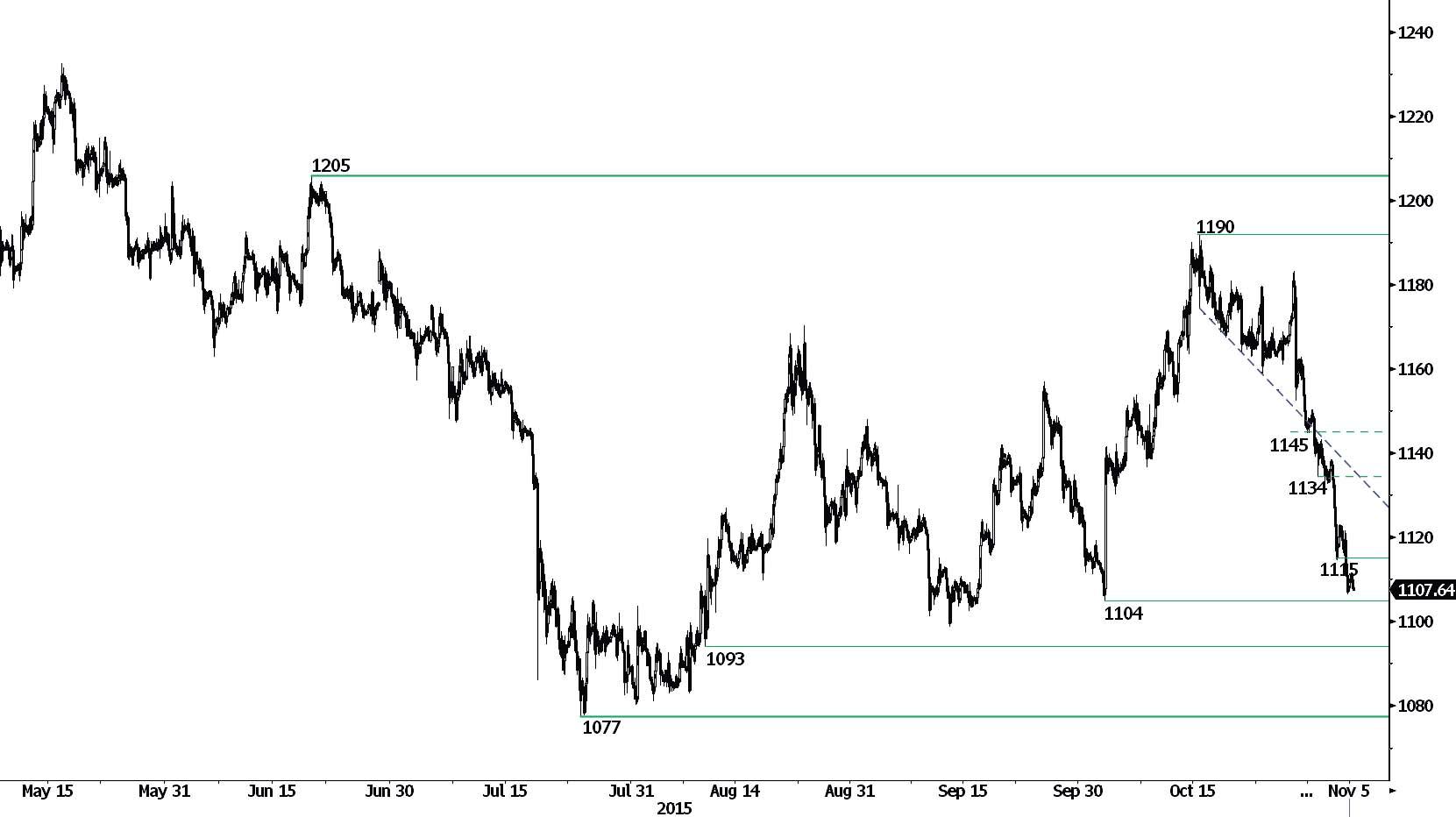

GOLD

Grinding lower.

Gold has broken the key support at 1115 (03/11/2015low). and the short-term technical structure is negative. Short-term supports region can be found at 1104. Another support can be located at and 1093 (12/08/2015 low). Hourly resistance is given at 1115 (old resistance). Expected to show continued weakness.

In the long-term, the underlying downtrend (see declining channel) continues to favour a bearish bias. Although the key support at 1132 (07/11/2014 low) has been broken, a break of the resistance at 1223 is needed to suggest something more than a temporary rebound. A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Breaks support at 15.16.

Silver is still weakening after clear break of support. The potential medium-term base formation and the short-term challenge to range support favours a bearish bias. Support is given at a distant 14.79 (uptrend channel). The resistance at 15.45 (declining channel) has thus far held.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. The strong support at 14.66 (05/02/2010 low) has been broken and prices have then consolidated. A key resistance stands at 18.89 (16/09/2014 high).

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.