EUR/USD

Unimpressive bounce thus far.

EUR/USD needs to break the hourly resistance at 1.1460 (see also the declining trendline) to suggest something more than a temporary bounce. Another hourly resistance lies at 1.1541 (20/01/2015 low). Hourly supports can be found at 1.1224 (27/01/2015 low) and 1.1098.

In the longer term, the symmetrical triangle favours further weakness towards parity. Key supports can be found at 1.1000 (psychological support) and 1.0765 (03/09/2003 low). A resistance lies at 1.1679 (21/01/2015 high), while a key resistance stands at 1.1871 (12/01/2015 high).

Await fresh signal.

GBP/USD

Fading near the resistance at 1.5274.

GBP/USD is showing some signs of weakness as prices are getting closer to the key resistance at 1.5274. Hourly supports can be found at 1.5060 (27/01/2015 low) and 1.4952. Another resistance is given by the down trendline (around 1.5405).

In the longer term, the technical structure is negative as long as prices remain below the key resistance at 1.5274 (06/01/2015 high, see also the declining trendline). A full retracement of the 2013-2014 rise is likely.

Await fresh signal.

USD/JPY

Short-term momentum is weakening.

USD/JPY remains below the resistance at 118.87. Monitor the symmetrical triangle (continuation pattern) as a break would likely hint at the next short-term trend. A support stands at 117.18. A key resistance can be found at 119.96 (see also the declining channel).

A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Even if a medium-term consolidation is likely underway, there is no sign to suggest the end of the long-term bullish trend. A major resistance stands at 124.14 (22/06/2007 high). A key support can be found at 115.46 (17/11/2014 low).

Long 1 unit at 116.10, Obj: Close unit 1 at 119.30., Stop: 116.83 (Entered: 2015-01-16).

USD/CHF

Challenging the resistance at 0.9132.

USD/CHF is bouncing after its massive sell-off. Monitor the test of the key resistance at 0.9132/0.9168 (see also the 61.8% retracement). Another resistance can be found at 0.9368 (15/10/2014 low). Hourly supports stand at 0.8936 (27/01/2015 low) and 0.8765 (26/01/2015 low).

Following the removal of the EUR/CHF floor, a major top has been formed at 1.0240. We expect a broad consolidation phase. A key resistance stands at 0.9132, whereas a key support can be found at 0.8353 (intraday low).

Await fresh signal.

USD/CAD

Moving above the key resistance at 1.2506.

USD/CAD is rising above its key resistance at 1.2506. Hourly support can be found at 1.2380 (27/01/2015 low) and 1.2314 (22/01/2015 low).

In the longer term, the technical structure looks like a rounding bottom whose maximum upside potential is given by the strong resistance at 1.3065 (09/03/2009 high). A key support stands at 1.1803 (15/01/2015 low), whereas a key resistance lies at 1.2506 (21/04/2009 high).

Await fresh signal.

AUD/USD

Making new lows.

AUD/USD is making new lows, confirming an underlying bearish trend. The short-term technical structure is negative as long as prices remain below the hourly resistance at 0.8054 (23/01/2015 high). Another resistance can be found at 0.8136 (22/01/2015 high).

In the long-term, there is no sign to suggest the end of the current downtrend. The breach of the strong support area between 0.8067 (25/05/2010 low) and 0.7947 (61.8% retracement of the 2009-2011 rise) favours further weakness. Other supports can be found at 0.7704 (13/07/2009 low) and 0.7451 (18/05/2009 low). A break of the key resistance at 0.8376 (11/12/2014 high) is needed to invalidate our bearish view.

Await fresh signal.

GBP/JPY

Weakening short-term bullish momentum?

GBP/JPY has bounced near the support at 175.85, which could be the start of a potential short-term base formation. However, the recent succession of lower highs (see short-term declining trend) still suggests persistent selling pressures. A key resistance area stands between 180.28 and 180.94. An hourly support can now be found at 177.66.

In the long-term, the lack of any medium-term bearish reversal pattern favours a bullish bias. A support is given by the 200-day moving average (around 176.20), while a strong support area lies between 169.51 (11/04/2014 low) and 167.78 (18/03/2014 low). A strong resistances stands at 190.00 (psychological threshold).

Await fresh signal.

EUR/JPY

Remains weak.

EUR/JPY has bounced near the support at 131.15 (08/10/2013 low). However, as long as prices remain below the hourly resistance at 135.06 (23/01/2015 high), the short-term technical structure is negative. Another resistance stands at 137.64. An hourly support now lies at 132.40.

In the longer term, the break of the strong support at 134.11 (20/11/2013 low) invalidates the long-term succession of higher lows. The resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. More sideways moves are now expected. A key support stands at 124.97 (13/06/2013 low).

Await fresh signal.

EUR/GBP

Weak bounce thus far.

EUR/GBP is consolidating near its key support at 0.7392. Hourly resistances can now be found at 0.7517 (intraday high) and 0.7596 (16/01/2015 low).

In the long-term, the break of the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) confirms an underlying downtrend. Monitor the test of the support at 0.7392 (28/01/2008 low). Another support can be found at 0.7089 (03/12/2007 low). A key resistance now lies at 0.7875 (25/12/2014 high).

Await fresh signal.

EUR/CHF

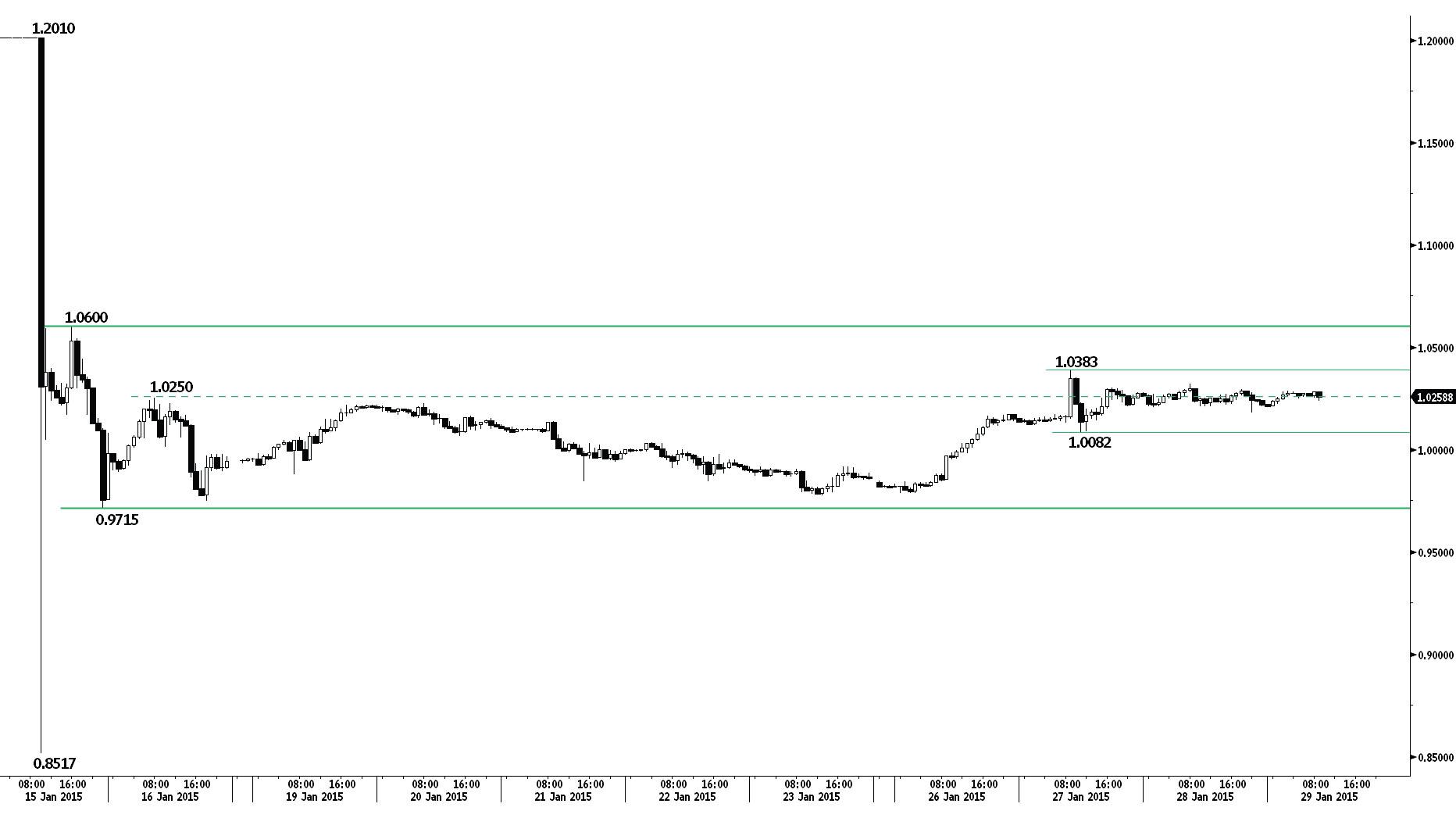

Moving sideways.

EUR/CHF is digesting the recent massive selloff. The sharp bounce near the key support at 0.9715 favours further sideways moves. An hourly resistance can now be found at 1.0383, while a key resistance stands at 1.0600. An hourly support now lies at 1.0082.

The EUR/CHF is again a free-floating currency and has declined to uncharted water. The ECB's QE programme is likely to cause persistent selling pressures on EUR/CHF. A key support stands at 0.9715. The 15 January low at 0.8517 is a strong support, which should hold in the coming months.

Await fresh signal.

GOLD (in USD)

Fading near the 1300 threshold.

Gold is in an uptrend as long as the support at 1255 (16/01/2015 low) holds. However, the recent failure to make any higher highs suggests a consolidation phase. An hourly support can be found at 1272 (19/01/2015 low). An hourly resistance lies at 1308 (22/01/2015 high). Another key resistance is given by the declining channel (around 1327).

In the long-term, the break of strong resistance at 1255 (21/10/2014 high) indicates an improving technical structure. However, the shape of this advance still looks like a countertrend move within an underlying downtrend (see also the declining channel). Another key resistance stands at 1345 (10/07/2014 high).

Await fresh signal.

SILVER (in USD)

The short-term rising trendline has been broken.

Silver has recently been unable to move above the resistance at 18.49, suggesting a weakening short-term bullish momentum. The break of the rising trendline confirms increasing selling pressures. As long as prices remain below the hourly resistance at 18.21 (27/01/2015 high), the short-term technical structure is biased to the downside. Hourly supports can be found at 17.48 (19/01/2015 low) and 17.23 (15/01/2015 high).

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Although the strong support at 14.66 (05/02/2010 low) has held thus far, the lack of any base formation continues to favour a long-term bearish bias. A key resistance stands at 18.89 (16/09/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.