EUR/USD

Breaks Resistance at 1.3833

EUR/USD has broken hourly resistance at 1.3833 and is ready to challenge the resistance at 1.3851 (16/04/2014 high). The short-term technical configuration remains positive as long as the support at 1.3830 (old resistance holds.

In the longer term, EUR/USD is still in a dominate uptrend, suggesting additional upside can be anticipated. A significant resistance now lies at 1.3876 (24/03/2014 high).

Await fresh signal.

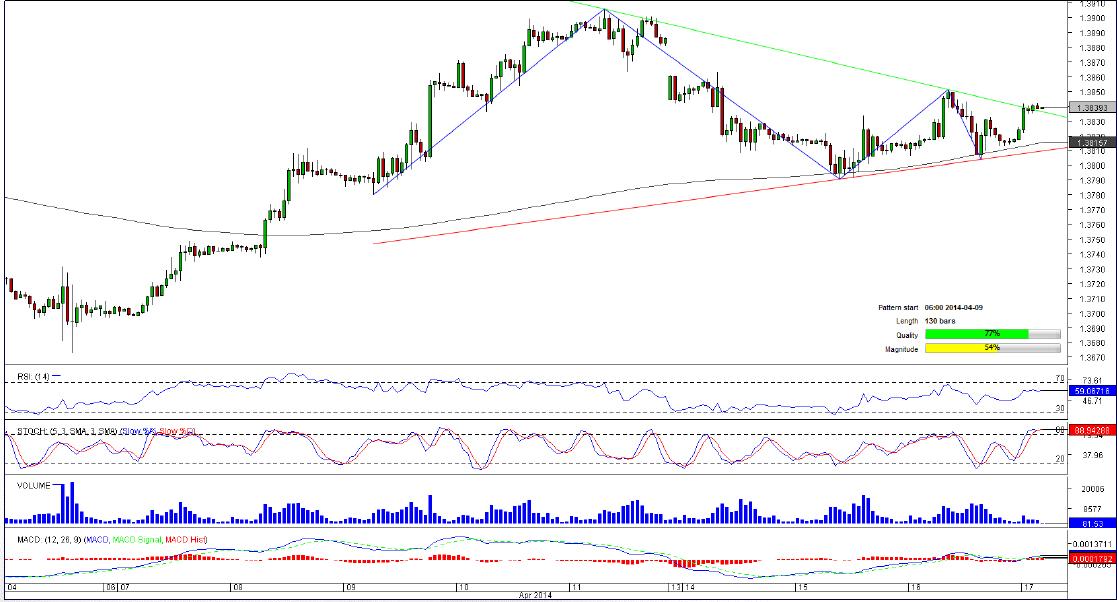

GBP/USD

Challenging resistance at 1.6823

GBP/USD has breached the fibo level at 1.6823. A solid break above would validated a short-term bullish trend reversal formation. The next resistance can be found at 1.7043 (11/11/2011). The short-term bullish momentum is intact as long as the hourly support at 1.6684 (previous resistance) holds.

In the longer term, prices continue to move in a rising channel. As a result, a bullish bias remains favoured as long as the support at 1.6460 holds. A major resistance stands at 1.7043 (05/08/2009 high).

Await fresh signal.

USD/JPY

Support for a continuing bounce

USD/JPY has bounced near the key support at between 101.20 and 100.76, As long as the hourly support at 101.80 (intraday low) holds, a further short-term rise is favoured. Hourly resistances are at 102.45 (16/04/2014 high) then a distant 104.21 (04/04/2014 high)

A long-term bullish bias is favoured as long as the key support area given by the 200 day moving average (around 100.80) and 99.57 (see also the rising trendline from the 93.79 low (13/06/2013)) holds. A major resistance stands at 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Bounce is fading

USD/CHF has faded near the hourly resistance at 0.8830 (17/12/2013 low). Monitor the hourly support at 0.8745 (12/02/2014 low). Then, bearish momentum suggests a challenge to key support at 0.8699 (13/03/14). A key resistance lies at 0.8930 (04/04/2014 high).

From a longer term perspective, the structure present since 0.9972 (24/07/2012) is seen as a large corrective phase. The recent technical improvements suggest weakening selling pressures and a potential base formation. A decisive break of the key resistance at 0.8930 would open the way for further medium-term strength.

Await fresh signal.

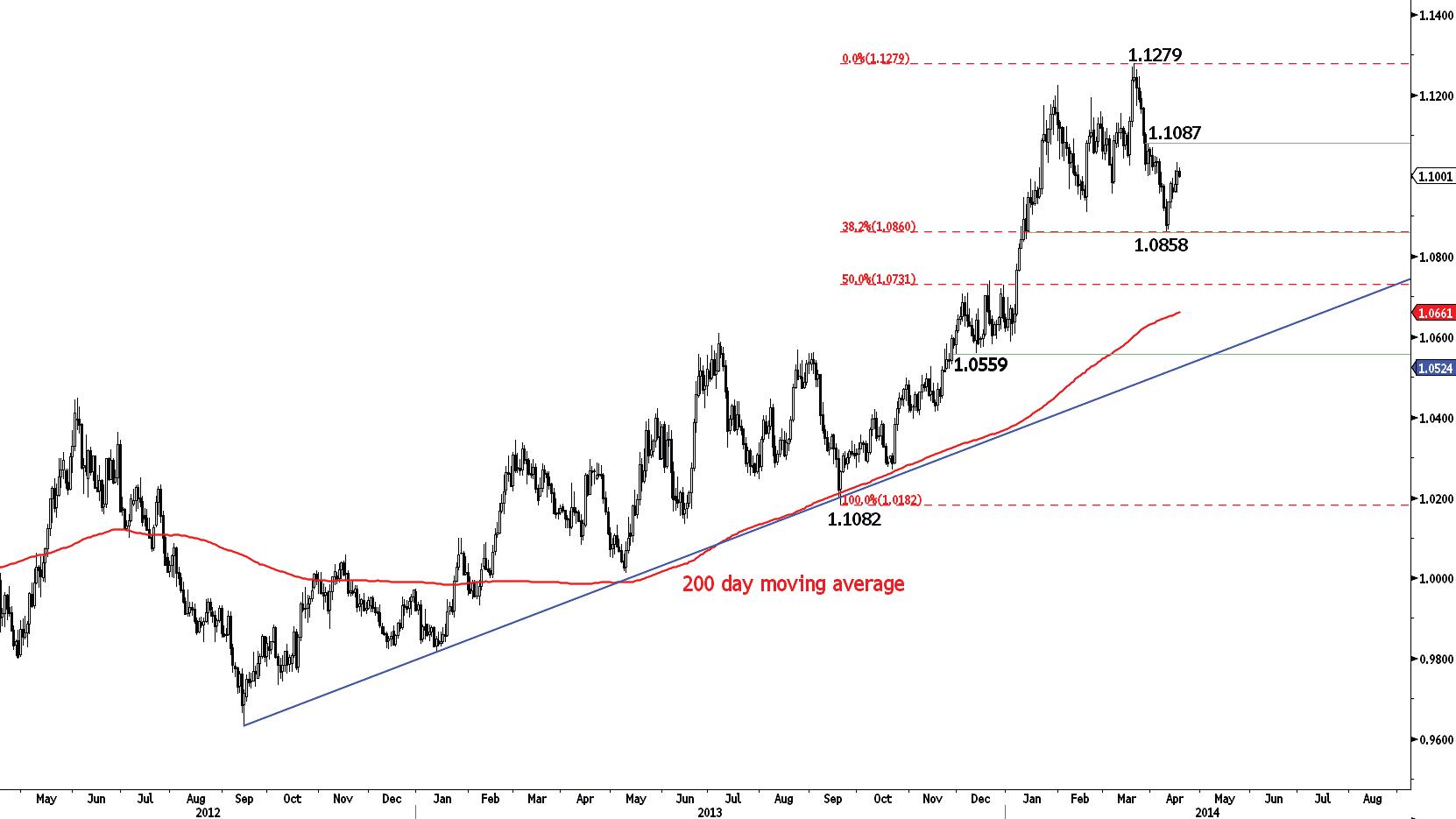

USD/CAD

Monitor the key resistance at 1.1087

USD/CAD failure to break Fibo support at 1.0860, hurt bearish momentum. Resistances for a short-term bounce still stands at 1.1010 (07/04/2014 high) and 1.1087 (16/04/2014 high). Other supports are given by 1.0860 (see 38.2% retracement) and 1.0738 (20/12/2013 high).

In the longer term, the decisive break of the major resistance at 1.0870 validates a multi-year basing formation whose minimum upside potential is around 1.1910. The key resistance given by the 50% retracement (around 1.1236) of the decline from the September 2009 peak at 1.3065 remains thus far intact. A key support stands at 1.0911 (19/02/2014 low).

Await fresh signal.

AUD/USD

Short-term fade near resistance

AUD/USD is trying to make a base formation, whose resistance is at 0.9448. The short-term technical configuration remains positive as long as prices remain above the hourly support at 0.9335 (16/04/2014).

In the medium-term, the decisive break of the strong resistance at 0.9168 (02/12/2013 high, see also the 200 day moving average) favours a further rise towards the key resistance at 0.9448. Above that resistance at 0.9758 (23/10/2013 high) looms.

Longer term, the underlying downtrend still favours a bearish bias.

We have raised the stop-loss of our strategy.

Long 2 units at 0.9175, Obj: Close unit 1 at 0.9429, remaining at 0.9691, Stop: 0.9278 (Entered: 2014-03-26).

GBP/JPY

Developing symmetrical triangle

GBP/JPY has shifted into a sideways range after making new monthly lows earlier in the week, confirming a weak price momentum. Developing symmetrical triangle should be monitored. A break of the triangle resistance at 172.85 is needed to negate the current shortterm bearish momentum. A support can be found at 169.70 (triangle floor).

The break of the major resistance at 163.09 (07/08/2009 high) calls for further long-term strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support area defined by 163.89 (04/02/2014 low) and the 200 day moving average (see also the long-term rising trendline from the February 2013 low) holds.

Await fresh signal.

EUR/JPY

Developing symmetrical triangle

EUR/JPY remains in a consolidation pattern in the daily time frame, with a break under 139.20 required to trigger a further extension lower. However, the medium-term trend is neutral and a significant support is at 140.40 (see rising trend). A resistance lies at 142.80 then key resistance area can be found between 143.38 (13/03/2014 high) and 143.79.

Despite the key support at 136.23 (04/02/2014 low, see also the 200 day moving average), the long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. A strong resistance can be found at 147.04 (16/09/2008 low).

Await fresh signal.

EUR/GBP

Support breaks

EUR/GBP has broken the support at 0.8231, validating a short-term top formation. The implied downside risk is at 0.8168. Supports are at 0.8206 and 0.8190 (28/02/2014 low). The shortterm technical configuration remains negative as long as prices remain below the hourly resistance at 0.8315.(03/04/2014 high) and key resistance stands at 0.8322.

In the longer term, the failure to make any follow-through after the break of the resistance at 0.8350 (06/02/2014 high) calls for caution as prices remain below the declining 200 day moving average. A key support area stands at between 0.8168 and 0.8158.

Await fresh signal.

EUR/CHF

Toppish

EUR/CHF is moving in a horizontal range between the support at 1.2104 (07/03/2014 low) and the resistance at 1.2253 (04/04/2014 high). The lack of follow-thru to succession of higher - highs, suggest a resumption of bearish trend towards key support at 1.2120 (26/02/2013) in the daily time frame. The break of the support at 1.2163 confirms an underlying bearish trend.

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the medium-term.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD (in USD)

Short-term bullish bias possible

Gold has broken key support at 1301 (09/04/2014 low). Now is moving sideways between the support at 1293 (16/04/2014 low) and the resistance at 1305 (15/04/2014 high). Monitor the hourly resistance as a break would favor a short-term bullish bias.

Longer term, we are skeptical of a long-term bullish reversal pattern. A move back to the previous lows at 1181 (28/06/2013 low) is eventually favoured. A major resistance stands at 1434 (30/08/2013 high).

Await fresh signal.

SILVER (in USD)

Bearish drift

Silver is moving sideways, after sharp sell-off, as it has thus far been unable to break the resistance at 20.38 to improve the technical structure. An hourly support lies at 19.23 (15/04/2014 low). Another support stands at 19.03. A key resistance remains at 20.67 (15/04/2014 high).

In the long-term, the trend is negative. However, the potential higher low at 18.84 (31/12/2013 low) and the break of the resistance at 20.52 suggest a phase of stabilisation. A key resistance stands at 23.09.

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.