USDCAD is in a corrective mode right now and the move started after CAD overnight rate surprised the investors, remaining at 0.50 % vs 0.25 % which was expected. CAD inflation rate rose to 1.6 % vs 1.7 % expected and we can try to align the data with technical zones to predict future price movement.

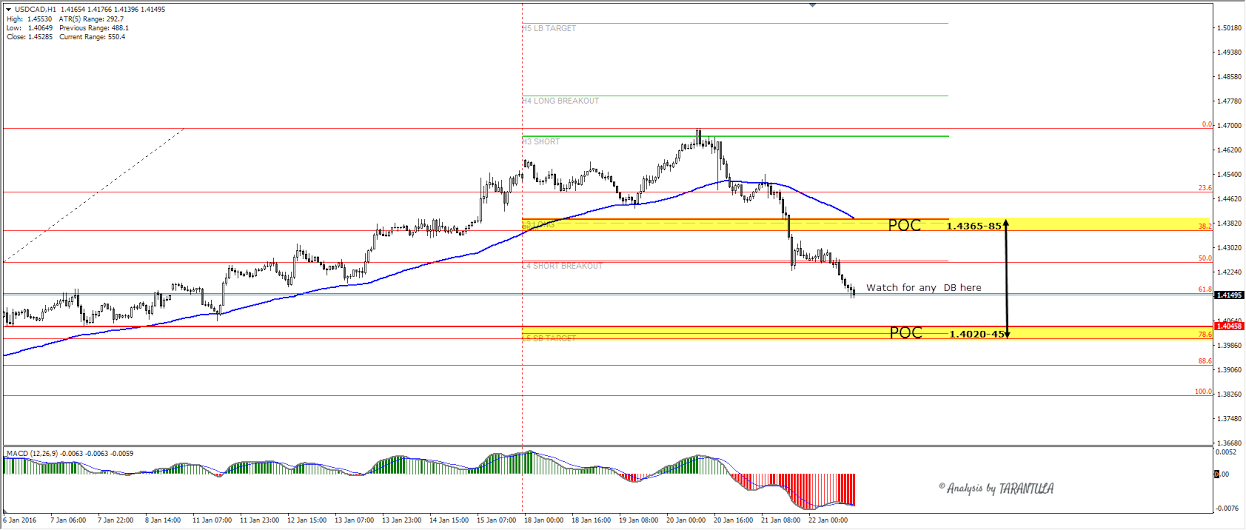

At the time of writing the price is around 1.4150 zone (see the chart below) and its exactly 61.8 of last swing L/H. Any double bottom here might spike the price up towards 1.4250. Another zone to watch for comes within 1.4020-45 (L5, previous triple bottom, 78.6) and if the price retraces to the zone we could see the bounce towards 1.4150 and 1.4250.

However if the price reaches upper POC (EMA89,WPP,L3) 1.4365-85 we should see NOW MOMENT sellers who are aligned with historical sellers and the price should reject. So USDCAD can be traded both ways as the price is still in uptrend but the retracement is deeper.

-------Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.