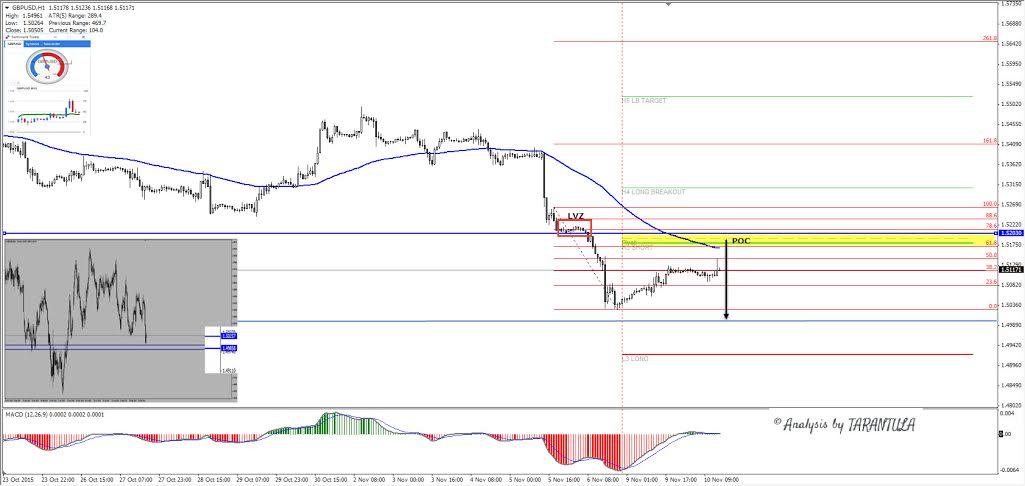

The GBPUSD is currently in retracement mode but is still in a strong bearish trend. The BOE was dovish on its last statement as traders expect a rate hike delay in late 2016. Additional GBPUSD tanking was boosted by strong NFP report.

Technically the pair dropped after LVZ pattern was formed ( Low Volatility Zone ) which has historically been shown as a pre breakout consolidation pattern. This time LVZ is a part of POC zone which comes around 1.5170-90 (H3,WPP,61.8, EMA 89) and if the pair rallies to POC we could expect next leg of selling providing that 1.5220 stands firm (78.6, LVZ high). Alternatively the pair could show a T-89 pattern which will be the cue that the price has finished the retracement and is getting back into trending zig zag.

From targets perspective we need to watch important historical levels of support. 1.5025-1.4985 zone is the target zone for bearish move. I have put a Daily chart overlay on the top of intraday to show historical levels of support.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.