The EURUSD pair is still capped below 1.0900. One of the reasons is definitely opposite fundamental reasoning between ECB and FED. Draghi implied that the next round of QE could come in December while Yellen gave a possible hint for a rate hike in December. Market is expecting good NFP numbers but we can never be sure about the exact number until we see the actual result.

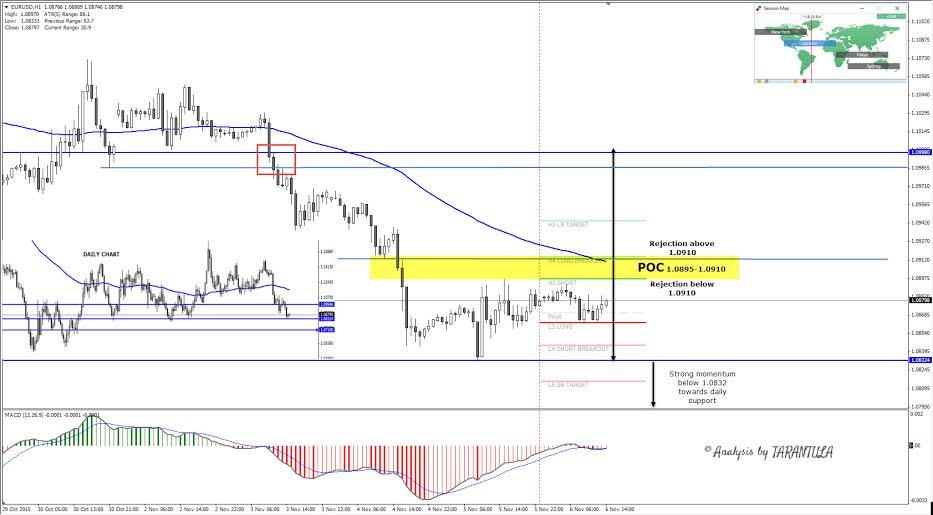

We need to pay attention to technical, that is why I have included an overlay of daily chart. Typically for PRE NFP movement, volatility dries off and pairs are ranging. Due to low ATR (88 pips –last 5 days) Daily Pivot points are very close so we need to pay attention to Daily Price Support and Resistance (manually drawn horizontal levels of support and resistance/historical buyers and sellers). POC comes in 1.0895-1.0910 zone (H3/H4 , EMA 89, now moment sellers) and strong rejection above 1.0910 (or T-89 pattern) will propel the pair up to 1.0945 and 1.0985-1.0998 where we see historical sellers and RETEST point (red rectangle). I expect sellers to show in the zone if the pair rallies.

While EURUSD is capped below 1.0910 the POC should reject the pair towards 1.0830 IMPORTANT daily support. If EURUSD proceeds below 1.0830 with a strong momentum next target is 1.0815 and 1.0710. 1.0710 is DAILY historical support and it could be reached if EURUSD drops below 1.0830 and 1.0815. Pay attention to NFP Friday but also NFP Monday as the price usually follows up.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.