Durable Goods Soar

According to US Commerce Department figures, orders for goods meant to last for three years or more soared in the month of December by 4.6% - gaining for the fourth straight month. The advance beats estimates of a 2% gain in orders, with core figures showing a subsequent addition of 1.3%. Core figures strip more volatile transportation equipment from the headline number.

The better than expected figure is estimated to shed optimistic light on the US economy when the world’s largest economy releases advanced Gross Domestic Product figures this week. Advanced estimates are anticipated to the show a 1.1% annualized pace of growth, positive but still slower than the 3.1% seen earlier.

Counters Housing Decline

The positive durable goods figure overshadows relatively negative reports from the National Association of Realtors. According to the trade group, pending home sales declined in the month of December, the first time since the end of the summer. Overall, the index of sales declined by 4.3%, as both Western and Northeastern parts of the US were hit hard by slowing sales. West Coast pending sales decreased by 8.2% while Northeastern interest declined by 5.4%.

Although widely negative, as pending homes account for 90% of the market, the figure seems to be digested as normal pullback from the recent string of gains for the report. The notion places increasing emphasis on next month’s figures.

What Will the Fed Do

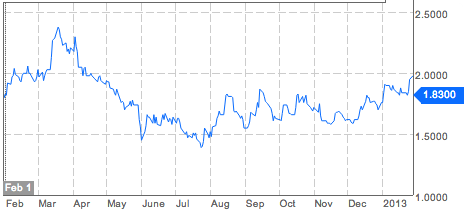

Given that baseline economic fundamentals remain well supported, through retail sales and manufacturing, speculation is growing that Fed policymakers may hint at an early exit from recently implemented monetary stimulus as the notion of a rebound continues to surface. With the Fed balance sheet growing to $3 trillion in the last month, the potential scenario has become more of reality now. And, any innuendos of a retraction of stimulus would be particularly bullish for bond yields, which could translate into US dollar strength in the medium term.

Source: Bloomberg

Source: Bloomberg

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.