One of the hottest topics during this election could be the future of the UK’s position in the EU. The rise of UKIP, an anti-EU party, has focused minds on whether the UK should stay in the European Union. The Conservatives, which has a powerful anti-EU faction, has promised to hold an in-out EU referendum in 2017 if it wins power. However, if it was to join a coalition with UKIP, a potential referendum could be pushed forward. The Labour party has not committed to a referendum on UK EU membership, so this may only be an issue if we see a Tory government or a Tory-led coalition.

This could be the biggest concern for the FX market in the aftermath of the election. Since a referendum is unlikely to be scheduled for a few years, it could lead to a protracted period of weakness for sterling.

Our concerns for the pound that may arise from the uncertainty around the UK’s EU membership is:

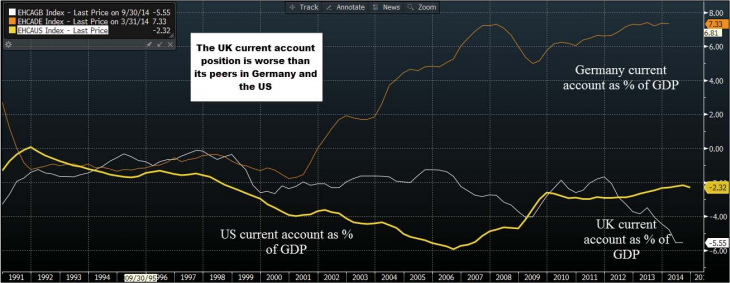

- Its large UK current account leaves it vulnerable to a shift in international sentiment towards the pound and UK debt. Right now the international market is happy to fund the UK’s defi cit, but this may not be the case if it looks like it is going to leave the EU.

- The FTSE 100 is also a major hub for international companies to list. Part of the UK’s attractiveness is its proximity to Europe and membership of the EU. If it leaves the EU this could reduce the desire of foreign fi rms to list in the UK and others could try and move to a different index, which could weigh on UK stock markets.

But this does not mean that a Labour victory would trigger a rally for UK assets. Instead, we think that a Conservative/Lib Dem coalition or a Labour/Lib Dem coalition would be the best outcome for UK asset prices. The Lib Dems could keep UK politics fairly centrist which may avoid any lurches to the left or right.

If there is uncertainty around the UK’s EU membership then we may see UK risk premia rise, which could push up UK bond yields. A rise in bond yields, even from historic lows, is unlikely to benefi t the pound, which would also come under pressure from uncertainty about the UK’s position in Europe.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.