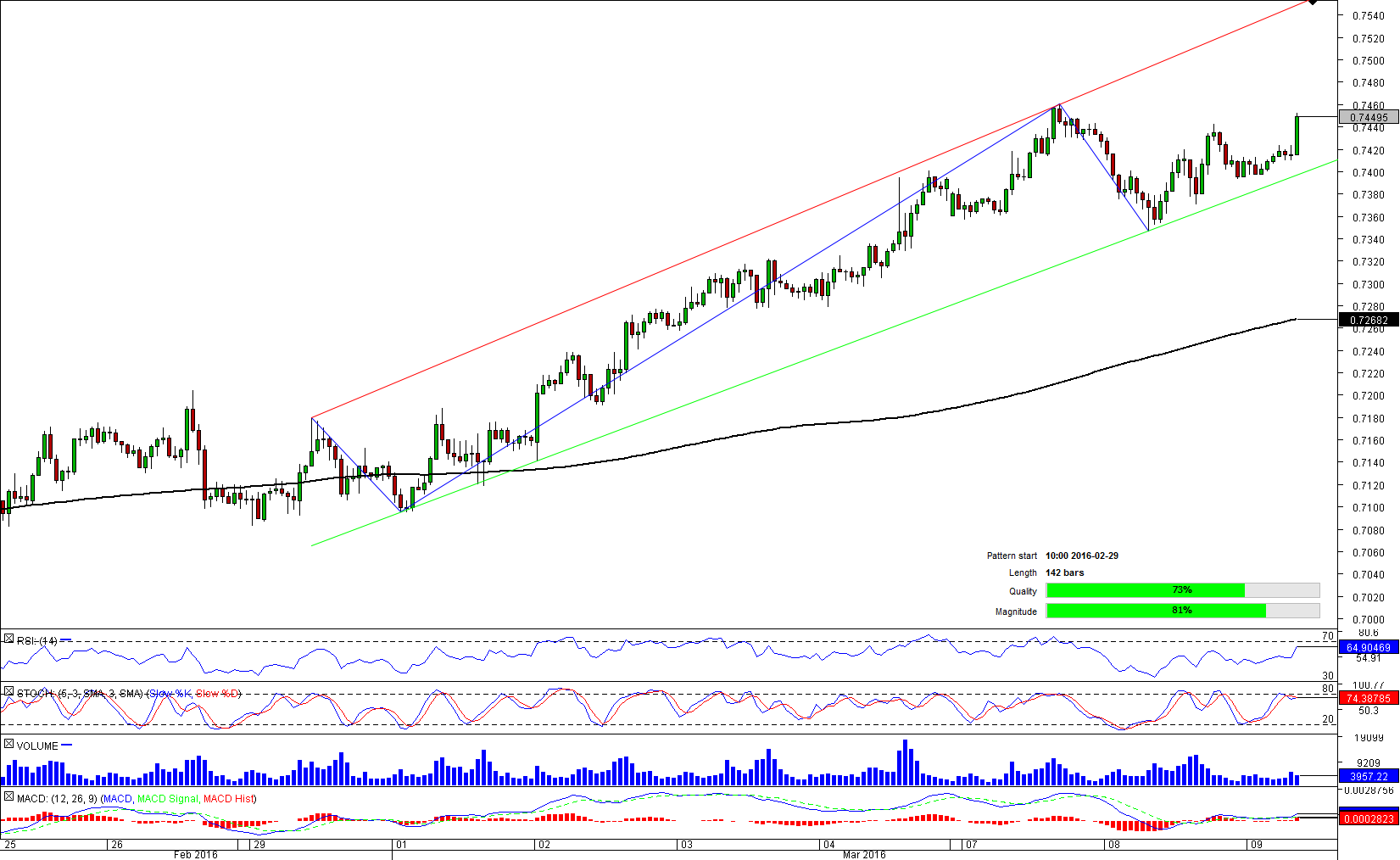

AUD/CHF 1H Chart: Channel Up

The Aussie will kick off a recovery versus the Swiss Franc in the nearest future. The cross is still placed in the lower part of the channel up pattern, but it seems that broadly nothing can prevent the pair from appreciating. The closest possible supply is placed within a couple of pips from the spot (0.7450) at 0.7460 represented by the local Monday high and daily R1. Success here will imply a surge to the first weekly resistance at 0.75 where the Aussie's positive performance may pave the way for a growth up to the red boundary of the channel at 0.7548. Meanwhile, there is a decent advantage of bullish (62%) positions over bearish ones (38%). On top of that, technical studies are giving AUD-long signals.

HKD/JPY 4H Chart: Rectangle

As the Hong Kong Dollar is trading within a rectangle pattern, there is a high probability it will be confirmed to the downside by the end of this working week. Downward pressure will grow, as the HKD/JPY pair has been hovering below the 200-period SMA since early February and this moving average will shortly enter the territory of the pattern. More supply is offered by the monthly pivot point and weekly R1 that currently underpin the 200-period SMA from below. After the bears deal with the weekly S1 at 14.4823, the focus will shift to the second weekly support at 14.3031, which is backing the lower edge of the pattern. Meanwhile, HKD is still overbought (70%) in the SWFX market, while technicals are bearish.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.