XAG/USD 1H Chart: Channel Down

Comment: The outlook on silver is strongly bearish, being that it has recently tested the upper bound of the falling wedge in the weekly chart, though we should be wary of a potential rally, considering the nature of the long-term pattern. During the next few days, the metal is expected to cover the distance between the upper and lower trend-lines that form the short-term channel. Even though the hourly and daily technical indicators are bullish, the price should bounce off of 15.39/36 and fall about 60 cents before there is a notable upward correction. The distribution between the bulls and bears in the SWFX market is in favour of a sell-off, as the precious metal is overbought—74% of open positions are long.

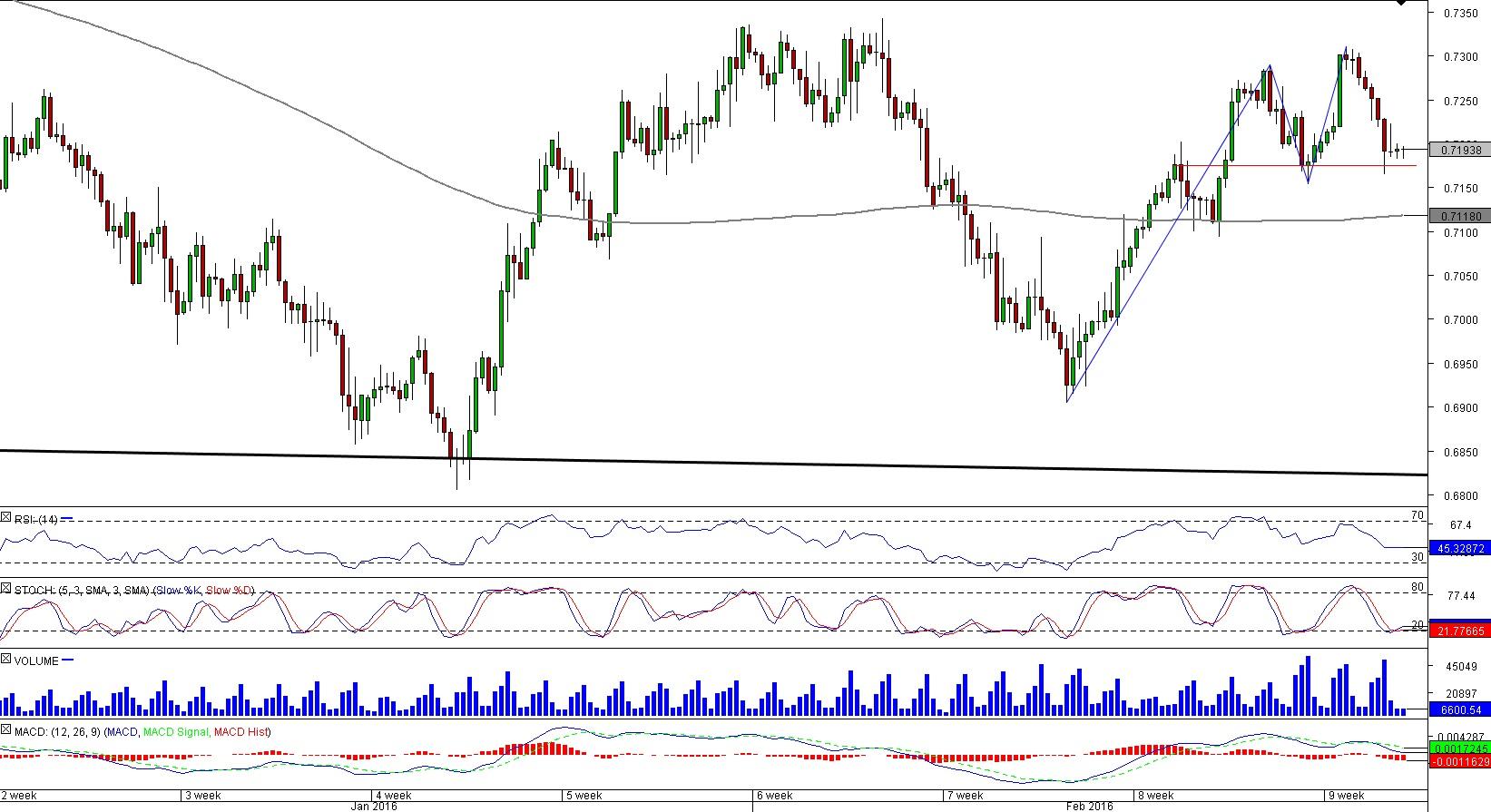

CAD/CHF 4H Chart: Double Top

Comment: CAD/CHF is completing a double top in the middle of the major falling wedge (weekly chart). If the rate manages to close beneath the demand area at 0.7180/57, the pair will be set for a 150-pip decline. The technical studies confirm that this scenario is highly likely. However, there is also a notable support level at 0.7118, represented by the long-term moving average.

In case the bulls overpower their counterparts, the focus will shift to the solid 0.7342/07 supply zone, which is capable of stopping any recovery. As for the sentiment in the SWFX market, the attitude towards CAD/CHF is only slightly bearish—44% of positions are long and 56% are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD stays firm amid BoE, Fed commentary and US data

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.