EUR/SEK 1H Chart: Channel Up

Comment: There is a bullish pattern emerging in the hourly chart of EUR/SEK. However, we do not expect an immediate rally, being that the currency pair is currently trading right at the upper boundary of the pattern. Moreover, there is an additional formidable supply area nearby, namely 9.40, created by the January high, weekly R2, and daily R1. The near-term outlook is therefore bearish, and the price is expected to dip through the weekly R1 level towards the support trend-line at 9.3050, where it is reinforced by the 200-hour SMA and weekly PP. This should be enough to trigger another round of buying. Meanwhile, the sentiment in the SWFX market is negative—69% of positions are short.

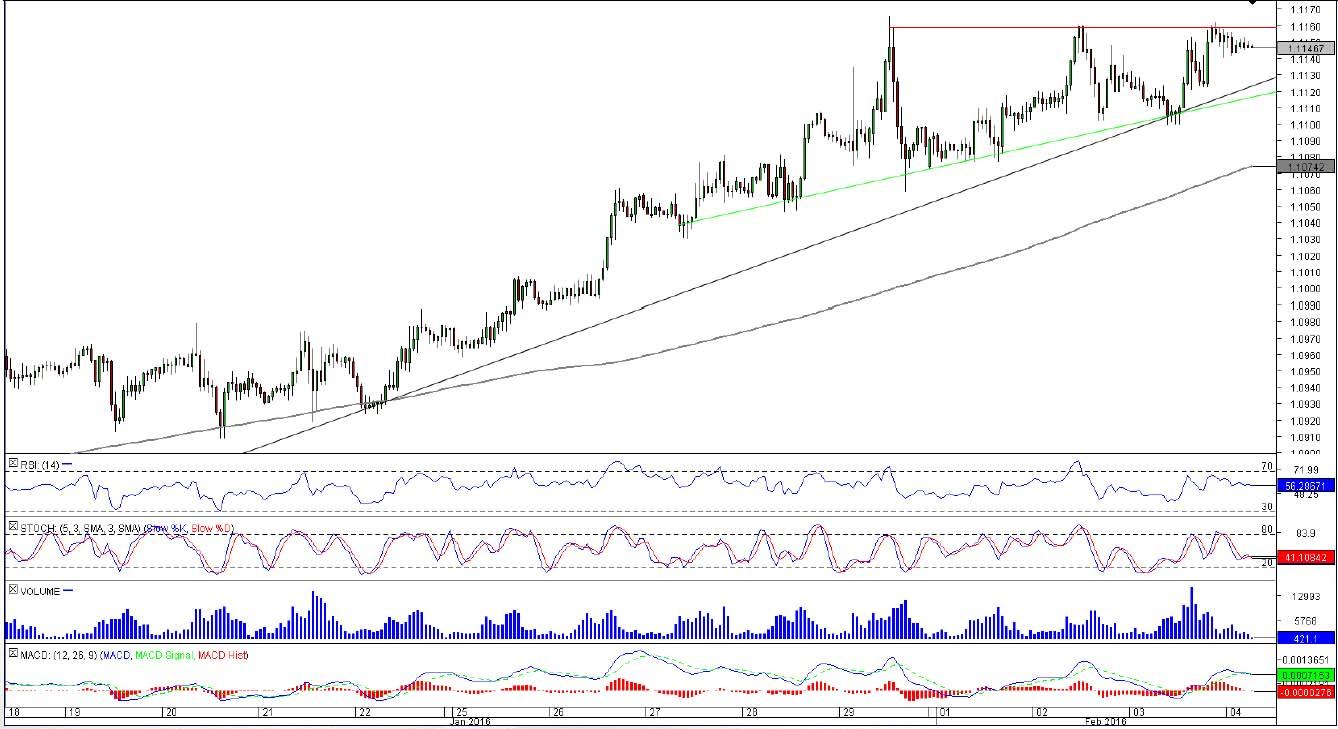

EUR/CHF 1H Chart: Ascending Triangle

Comment: EUR/CHF is in a good position to resume its journey further north, as an ascending triangle implies growing demand for the Euro. In the very short term the price is likely to move away from 1.1160, but the decline should be limited by the up-trend at 1.1115. Eventually, however, resistance at 1.1160 is expected to be broken. Such a scenario is also confirmed by the technical indicators on all three relevant timeframes. The rate should then aim for the weekly R1 level at 1.1180. Next potential target will be only at 1.1277 (weekly R2). On the other hand, if EUR/CHF closes under 1.1115, the pair will probably stabilise near 1.1075/70, where the weekly PP joins forces with the 200-hour SMA.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.