EUR/CHF 4H Chart: Channel Up

Comment: Although the quality of the pattern is poor, there is a high chance of EUR/CHF developing the ascending channel further. First, the currency pair is facing a solid demand area around 1.0840, created by the weekly S1, monthly PP, up-trend, and 200-period SMA. Secondly, the single currency is oversold, being that 72% of open positions are short, and therefore there is not much room for new bears to enter the market. At the same time, even though the signals are weak, the daily and weekly indicators are mostly pointing north. Accordingly, the base scenario is a rally from 1.0840 up to the October’s high at 1.0950. In case of a dip beneath the key support there should be a sell-off at least to 1.0770/55.

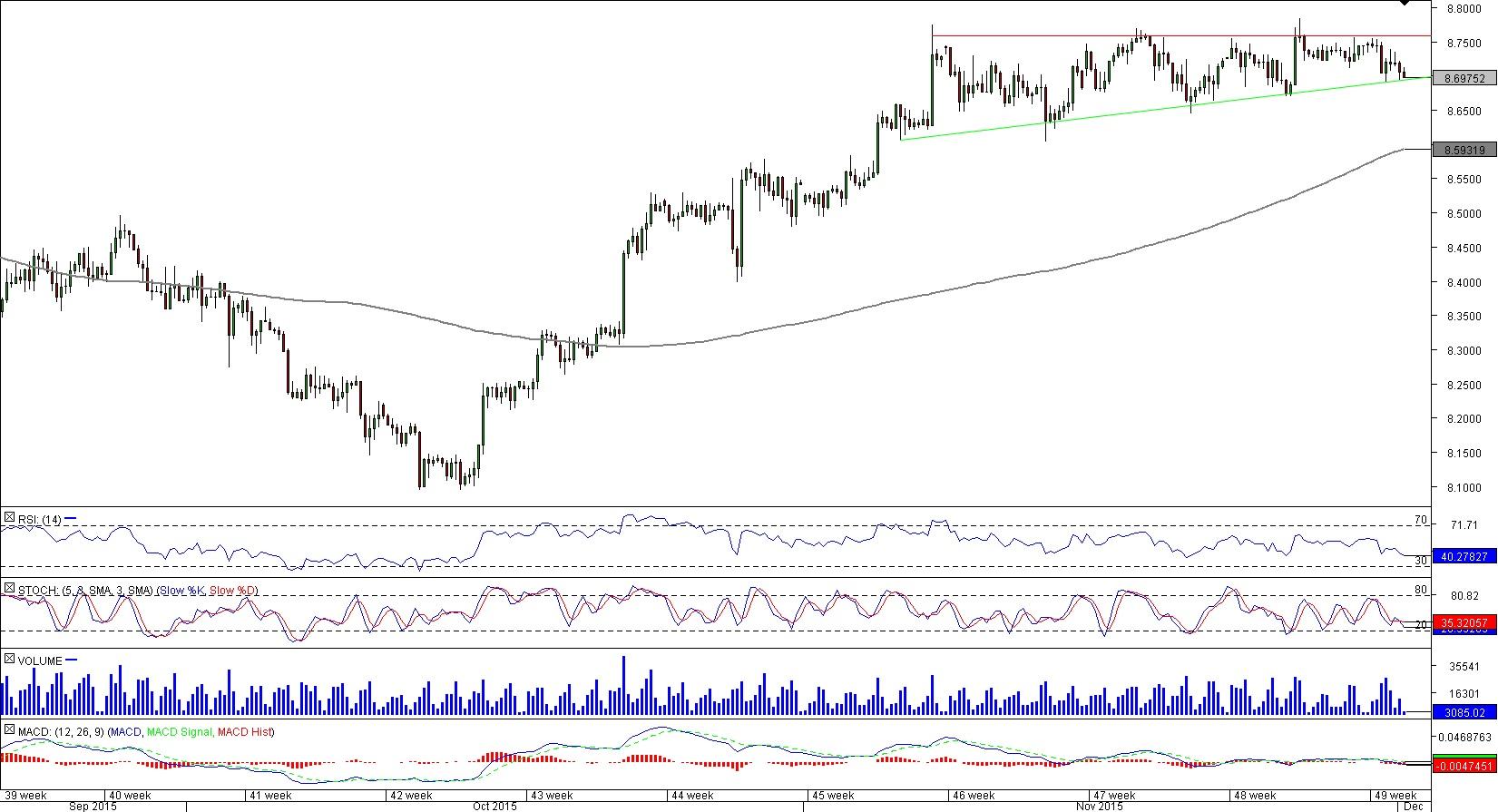

USD/SEK 4H Chart: Ascending Triangle

Comment: USD/SEK is currently struggling at 8.76, but eventually the bulls should be able to push through this resistance. The ascending triangle the pair is forming suggests that demand is building up, and a break-out to the upside is the likely resolution to the pattern, which developed after the Oct 15-Nov 6 advancement.

We therefore expect the price to close above 8.76 this week and start its journey towards 8.84, where the rate should meet the monthly R1 and August high. In the meantime, the main support is between 8.70 and 8.67, violation of which will expose the 200-period SMA and monthly S1 at 8.5800/8.5550.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.