EUR/TRY 1H Chart: Channel Down

Comment: EUR/TRY keeps trading within a well-defined descending channel we found last week, which implies that the overall outlook remains bearish. We expect a decline in the near term as well, considering that the currency pair is right at the upper boundary of the pattern. The gains are to be limited by the falling resistance line at 3.0350, while the target is 2.9880, where the lower trend-line merges with the daily S3 and weekly S1 levels. At the same time, the technical indicators in all time-frames are mixed, and we should not exclude the possibility of a rally through 3.0350, which will likely mean a recovery: first to 3.0440, then up to the earlier highs and 200-hour SMA circa 3.0650.

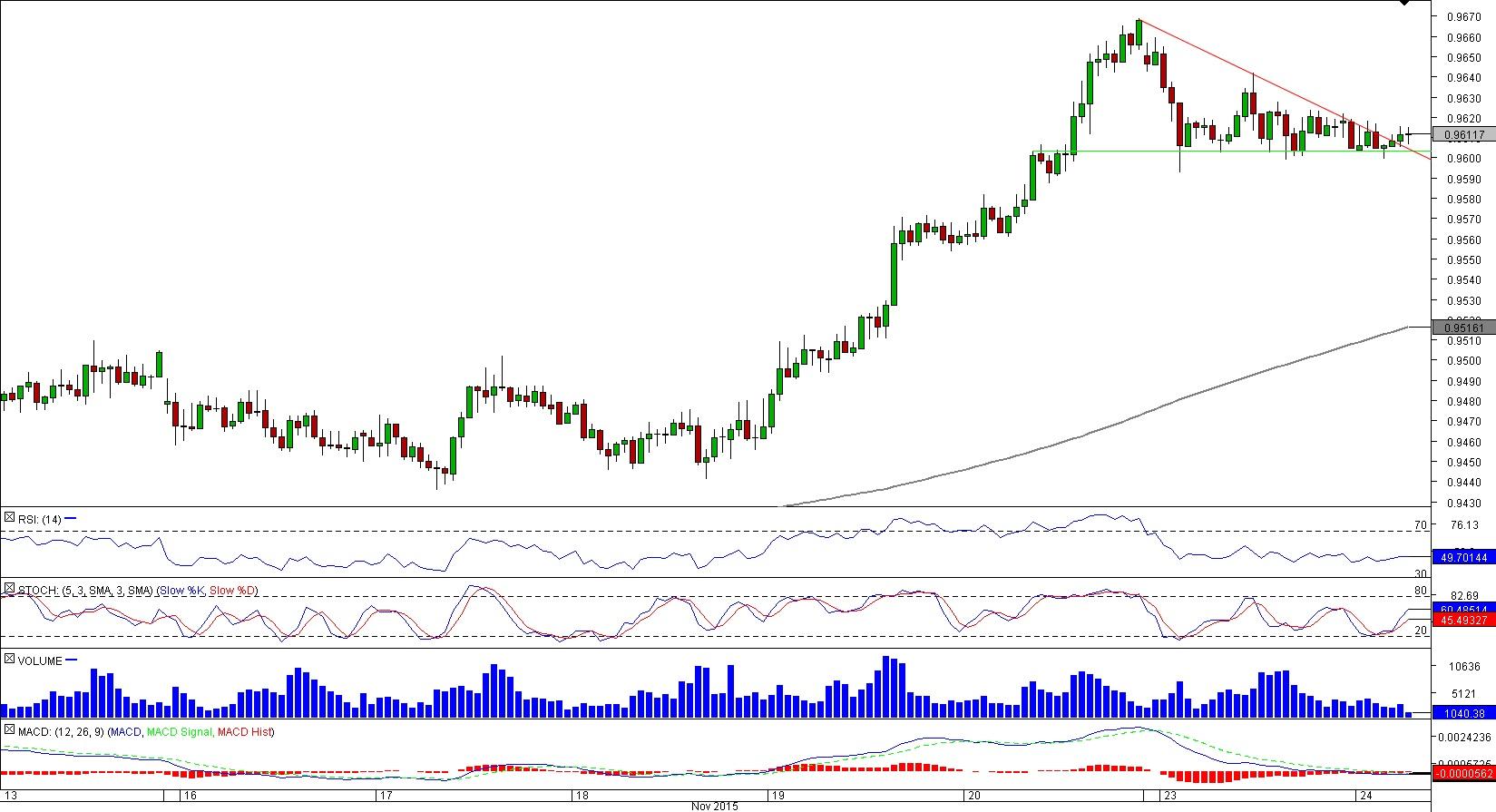

AUD/CAD 1H Chart: Descending Triangle

Comment: Although AUD/CAD has recently formed a descending triangle, which usually portends a sell-off, the pair resumed the rally from 0.9440, and it is now headed towards the Nov 20 high at 0.9668. If the latter resistance is broken as well, the next target could be 0.9750, namely the May high and weekly R1. On the other hand, violation of 0.96 will mean a change in the outlook. The next support will then be at 0.9590, but the price will likely decline deeper, down to a dense demand area around 0.9515, created by the daily S3, weekly S1 and 200-hour SMA. As for the sentiment, the SWFX market participants seem to be undecided: 48% of open positions are long and 52% are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.