AUD/CHF 1H Chart: Triangle

Comment: While at first it seemed as if AUD/CHF was forming a bearish channel, later on it turned out to be a triangle pattern.

The currency pair is now ready for the break-out since the triangle’s apex has been reached. Taking into account that since September the market has been more or less bearish there is an increased likelihood of a decline, which could potentially extend towards the daily S1 at 0.8258. However, the majority of the SWFX market participants expect a bullish break-out since as many as 73% of them have opened long positions. In the shorter term technical studies are more to the upside; although, there is no unanimity.

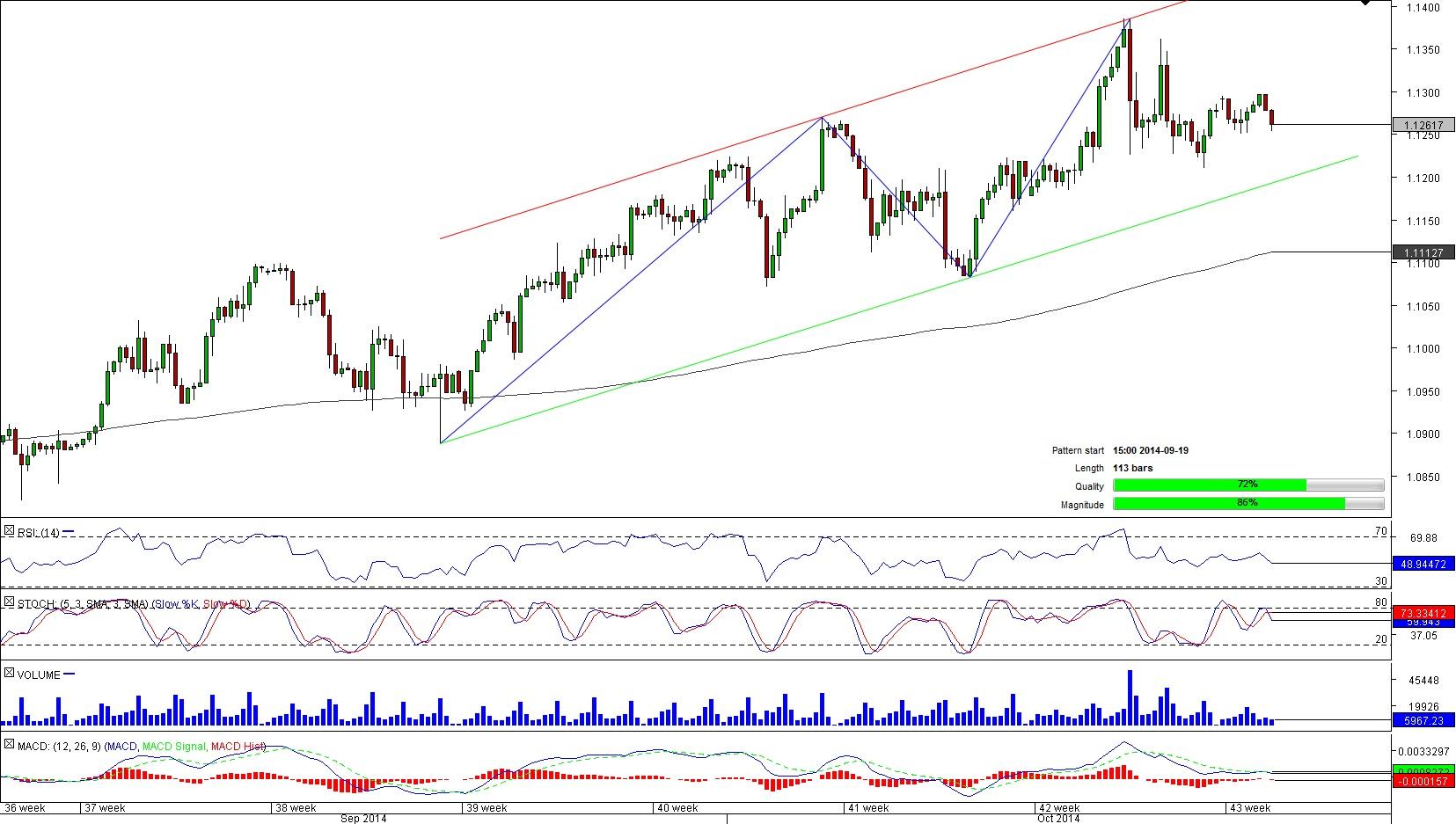

USD/CAD 4H Chart: Channel Up

Comment: Since the pair fell to this year’s lower levels around 1.06 at the beginning of July, the US Dollar has outperformed the Canadian counterpart rather heavily. More recently (at the middle of September) the pair started to form a channel up pattern.

Currently, USD/CAD is sliding towards the lower trend-line that is located around 1.12 level. Nonetheless, to our mind the pattern is likely to remain in effect since the pair seems well-supported around the 1.12 mark by the 100-period SMA and weekly S1. Moreover, the daily and weekly technical studies are largely bullish, as well as a distinct majority (72%) of the SWFX traders’ are long on the pair.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.