HKD/JPY 1H Chart: Rising Wedge

Comment: HKD/JPY has been locked in a narrowing trading range bounded by two steadily converging, upward-sloping lines for the last 64 hours.

Now the pair of two Asian currencies is headed towards the lower trendline of the rising wedge pattern but the 50-hour SMA at 13.0911 is preventing HKD/JPY from confirming the pattern’s limit one more time. Technical indicators suggest the pair is not likely to overcome this resistance in the next hour but there may be a rebound in the mediumterm followed by a decline in one-day perspective.

EUR/CHF 1H Chart: Triangle

Comment: After being in the down-trend during almost two months ended early July, EUR/CHF levelled off and by the middle of the month entered a symmetrical triangle that is circa a hundred-bar long.

The instrument now is vacillating in only a five-pips wide range and the trading area is likely to continue narrowing since the triangle trend-lines are due to converge a day later. Meanwhile, the direction of the looming exit still seems unclear. On the one hand, the pair is on the way of falling to the lower boundary of the pattern, on the other hand, the SWFX data reveals almost 70% of traders bet on appreciation of the pair in the hours to come.

USD/HKD 1H Chart: Rising Wedge

Comment: A two-week period of unusual tranquillity ended in mid-July, when the U.S. Dollar embarked upon a rapid appreciation versus its Hong Kong counterpart. However, now the upswing may have come to an end since USD/HKD has plunged below the lower limit of the rising wedge pattern the pair shaped throughout its advance. If the pair extends its losing streak – the likelihood of bearish scenario is rather high – USD/HKD may slide to the 7.7513/2 (daily S1; four-hour S1). In case this obstacle fails to mollify selling pressure, the pair may test 7.7509/6 (four-hour S2, S3; daily S2; 200-hour SMA), below which the mark of 7.7505 (daily S3) may become the last stop before a massive sell-off.

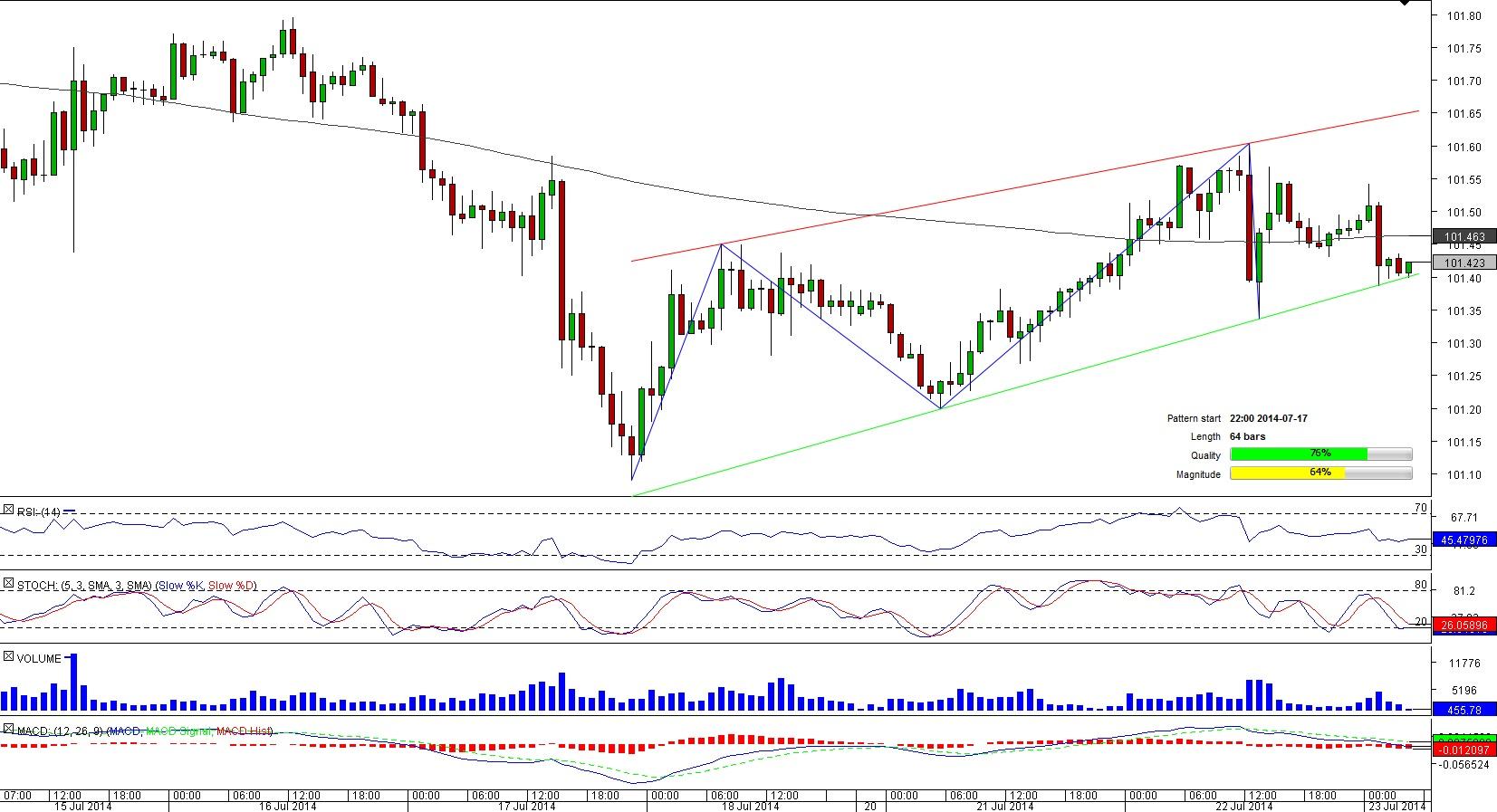

USD/JPY 1H Chart: Rising Wedge

Comment: The Hong Kong Dollar was not the only Asian currency that lost some value against the greenback in the second part of July. The U.S. Dollar also managed to notably solidify its position against the Japanese Yen by entering a 64-bar long rising wedge pattern on Jul 17.

However, in contrast to USD/HKD trend, the upturn of USD/JPY is not likely to end before long given the SWFX sentiment. The SWFX indeed data boosts optimism – two traders out of three hold long positions even at a time when the 50-hour SMA at 101.41 pressed USD/JPY to the pattern’s support line and is likely to act as a formidable resistance if the pair attempts to materialize traders’ expectations.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.