The Trend Trader helps to identify the current trend status of your favorite ETF markets. It not only helps us to stay on the right side of market direction, but also helps us avoid those without a trend. You can even use the grid as a spread matrix too - buying strength and selling weakness.

Pivot Point analysis is merely a tool and should be used with other technical indicators. It can be used to enter a trade, or exit a trade and when combined with average true range is a powerful money management tool. Once you enter a trade, you are no longer a trader, you are a risk manager and should monitor your trades on a weekly or daily basis depending on volatility. When you enter a trade assume you are wrong and let the market prove you are right. This will diminish the hubris and arrogance that is common to many traders. Please use these Pivot Points as a guide to better trading.

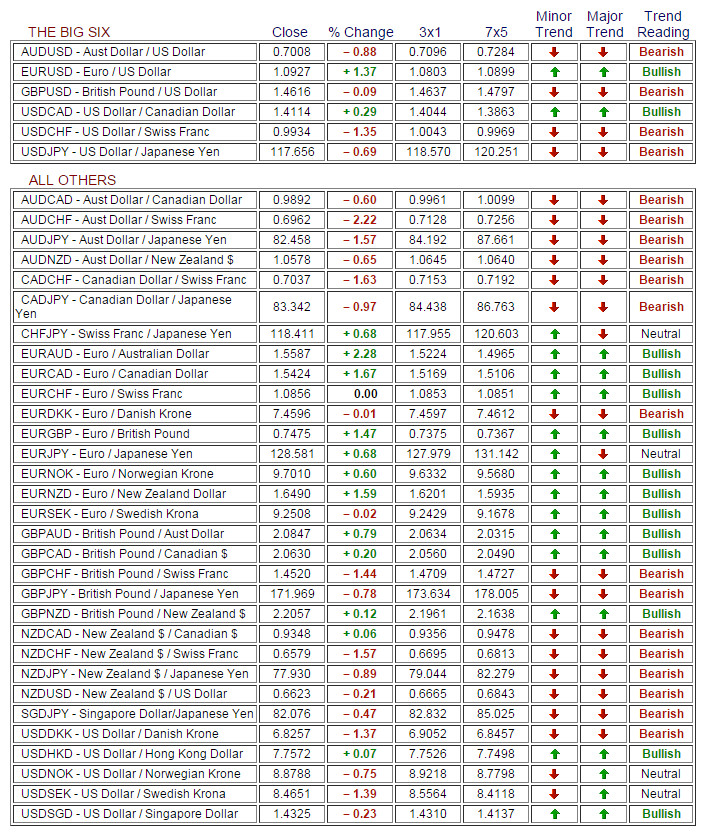

As you examine the work sheet, please note where there are two arrows confirming a trend. Be it long or short, a close must occur above or below two trend arrows to confirm a strong trend.

The short term trend is a three day moving average of the Daily Pivot. The long term trend is the Weekly Pivot. So we are comparing a short term moving average with a long term simple weekly average.

Remember, the 3x1 is a moving average of the Daily Pivot. If you are daytrading and the price of your commodity or financial instrument trades through the 3x1, you may want to stop and reverse.

Rules:

Price > than 3x1 and 7x5...Buy

Price < than 3x1and 7x5... Sell

Price > above 3x1 but < 7x5...minor buy

Price < below 3x1 but > 7x5...minor sell.

If you choose to ignore these guidelines, you will be a counter trend trader. There is usually more risk associated with trading against the trend.

You can use the grid as a spread matrix too - buying strength and selling weakness.

Pattern Trapper reports are compiled from sources believed to be reliable, but their accuracy cannot be guaranteed. There is substantial risk of loss in futures trading. There is no warranty, express or implied, in regards to the fitness of this information for any particular purpose. Past performance is not a guarantee of future results. All materials are copyright © 2009 by Bob Hunt. No part of these resources may be reproduced, stored or transmitted without the prior written permission of the copyright holder.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.