The Trend Trader helps to identify the current trend status of your favorite ETF markets. It not only helps us to stay on the right side of market direction, but also helps us avoid those without a trend. You can even use the grid as a spread matrix too - buying strength and selling weakness.

Pivot Point analysis is merely a tool and should be used with other technical indicators. It can be used to enter a trade, or exit a trade and when combined with average true range is a powerful money management tool. Once you enter a trade, you are no longer a trader, you are a risk manager and should monitor your trades on a weekly or daily basis depending on volatility. When you enter a trade assume you are wrong and let the market prove you are right. This will diminish the hubris and arrogance that is common to many traders. Please use these Pivot Points as a guide to better trading.

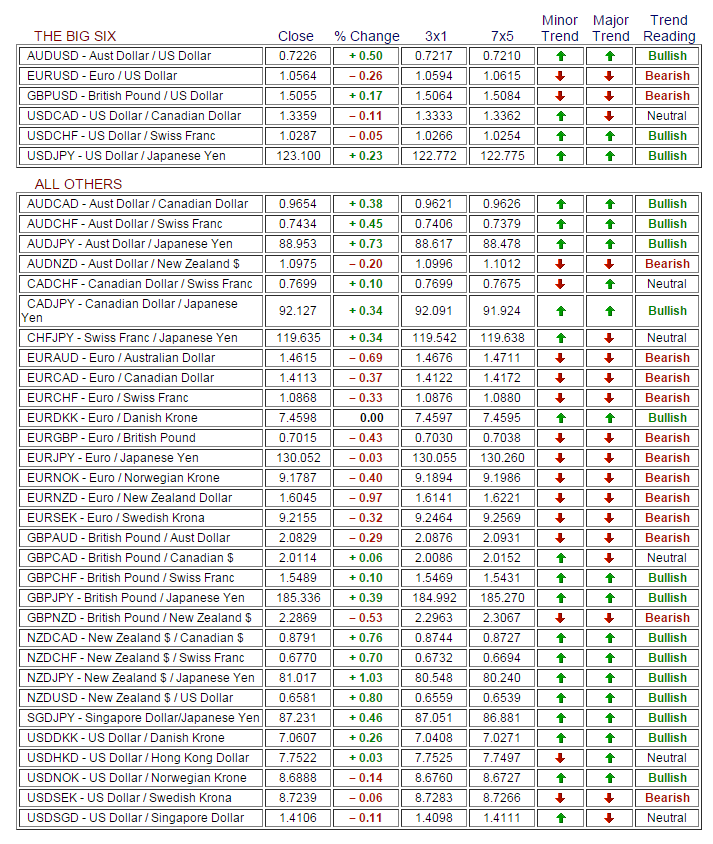

As you examine the work sheet, please note where there are two arrows confirming a trend. Be it long or short, a close must occur above or below two trend arrows to confirm a strong trend.

The short term trend is a three day moving average of the Daily Pivot. The long term trend is the Weekly Pivot. So we are comparing a short term moving average with a long term simple weekly average.

Remember, the 3x1 is a moving average of the Daily Pivot. If you are daytrading and the price of your commodity or financial instrument trades through the 3x1, you may want to stop and reverse.

Rules:

Price > than 3x1 and 7x5...Buy

Price < than 3x1and 7x5... Sell

Price > above 3x1 but < 7x5...minor buy

Price < below 3x1 but > 7x5...minor sell.

If you choose to ignore these guidelines, you will be a counter trend trader. There is usually more risk associated with trading against the trend.

You can use the grid as a spread matrix too - buying strength and selling weakness.

Pattern Trapper reports are compiled from sources believed to be reliable, but their accuracy cannot be guaranteed. There is substantial risk of loss in futures trading. There is no warranty, express or implied, in regards to the fitness of this information for any particular purpose. Past performance is not a guarantee of future results. All materials are copyright © 2009 by Bob Hunt. No part of these resources may be reproduced, stored or transmitted without the prior written permission of the copyright holder.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.