The Sterling/Dollar unexpectedly surged during trading on Monday and this has nothing to do with an improved sentiment towards the Pound, but ongoing Dollar weakness from diminishing US rate hike expectations. Since the start of the year, the Sterling has been victim to a vicious sell-off from the intensifying Brexit concerns while risk aversion continues to haunt investor attraction consequently leaving prices heavily depressed. Sentiment is clearly bearish towards the Pound and the bears have been provided with a foundation to incessantly send the currency lower as optimism rapidly fades over the Bank of England raising UK rates in 2016. It is widely known that UK inflation has been notoriously low for an extended period and if UK CPI follows the same negative path today, then sellers could exploit this opportunity to send the GBPUSD back down towards 1.4100.

From a technical standpoint, the GBPUSD remains bearish and may stumble lower if the Bank of England doves show face. Prices are trading below the daily 20 SMA while the MACD still trades to the downside. A breakdown back below 1.42 could open a path towards 1.41 and potentially lower.

BoJ under pressure

The Bank of Japan is under immense pressure as concerns over its ineffective use of monetary policy and inability to weaken the Yen has raised critical questions about the practicality of Abenomics. Japan is a nation currently suffering from deflationary risks from a strengthening Yen that has made exports less competitive, while heightened fears of a slowdown in economic momentum have fueled expectations of a potential technical recession forthcoming. Central banks remain cautious as the BoJ may be the first major example of the diminishing returns of monetary policy, in which central bank intervention simply exacerbates the problems further. With the nation hosting the G-7 summit in May, any opportunity for a shock intervention by the BoJ may have been obstructed as member nations are restricted from manipulating their currency. This combination of risk aversion, Yen appreciation and faltering central bank intervention by the BoJ spells punishment for the Japanese economy.

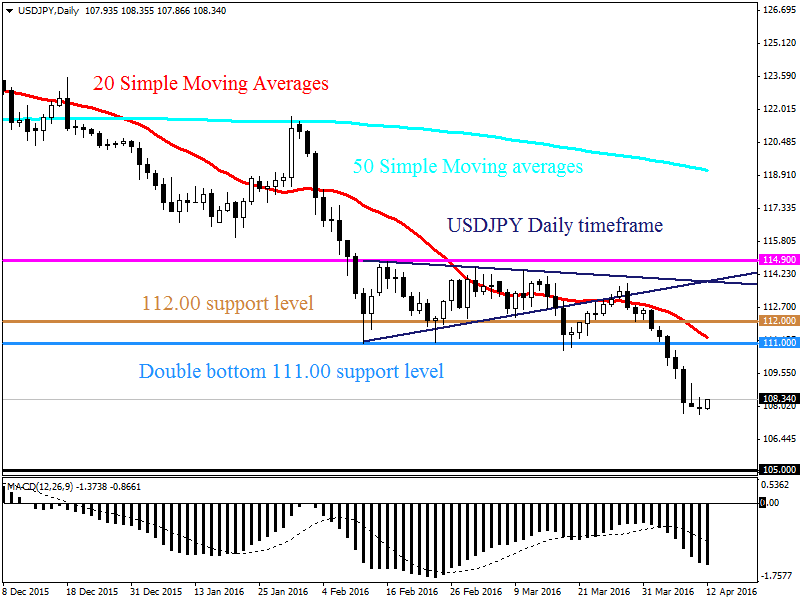

The USDJPY is heavily bearish as there have been consistently lower lows and lower highs. Prices are trading below the daily 20 SMA while the MACD has crossed to the downside. Previous support around 111.0 could become a dynamic resistance for a further decline towards 105.00.

WTI balances above $40

Although WTI Crude managed to close above $40 for the first time since late March, the commodity remains bearish and could be poised for further declines as the oversupply concerns envelop the technical bounce. While a weak US Dollar may have attributed to the uplift in oil prices, the fading optimism over an amicable output freeze deal at the Doha meeting this Sunday should provide a foundation for bearish investors to send prices back below $40. This incompatible jigsaw of potential record high output freezes, Iran’s defiance to join the deal and the visible conflict of interest within OPEC may be a recipe for disaster that could benefit the bears. We remain fundamentally bearish on WTI and the horrible combination of oversupply woes and faltering demand should limit ho high prices can appreciate.

From a technical standpoint, bears need to break back below $38 for a potential decline back to $35.

Commodity spotlight – Gold

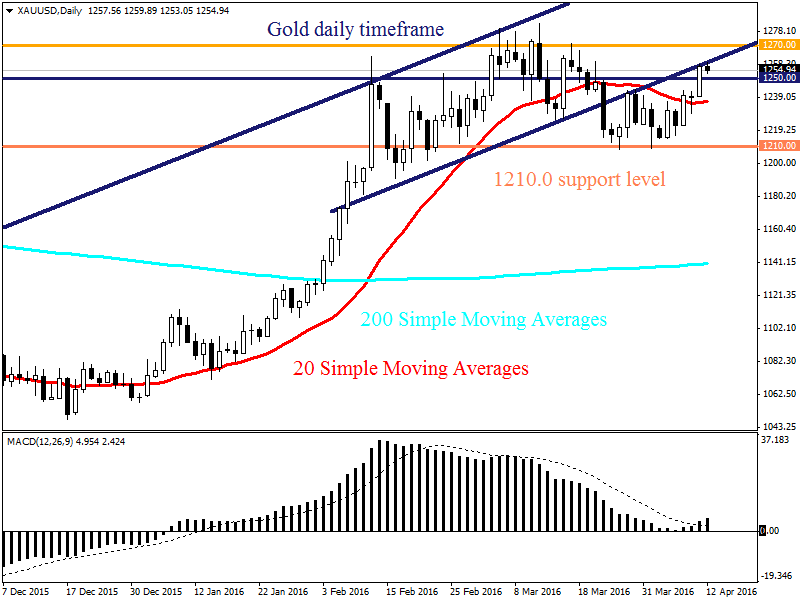

A mixture of risk aversion and dwindling expectations over the Fed raising US rates in Q2 may have created a foundation for bullish investors to install another round of buying momentum in Gold. This yellow metal is fundamentally bullish and the elevated concerns over slowing global growth complimented with a vulnerable Dollar could continue to boost Golds allure. With China data and central bank decisions likely to heighten anxiety this week, investors may flock to safe-haven investments which could consequently boost the price of Gold. Dollar weakness may act as a key signal for bulls to pounce again sending prices towards $1270 and potentially higher. From a technical standpoint, previous resistance around $1250 could act as a dynamic support for a surge towards $1270.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.