Global sentiment received an unexpected uplift during this trading week following Janet Yellen’s heavily dovish comments which rapidly extinguished the inflated expectations over a US rate rise in April. Her cautious tone towards the Fed’s implementation of future rate increases overshadowed the hawkish views of other Fed officials, while providing the clarity which investors had long sought. It seems likely that the unstable financial economic landscape has sabotaged any opportunity of the Fed raising US rates anytime soon and the fears over faltering inflation in the United States only adds insult to injury. This visible clash of opinions between Fed officials does raise questions about the overall unity of the central bank, and it will be interesting to see what the official minutes of March’s statement will have to say. Market participants may focus their attention towards Friday’s NFP, which after Yellen’ comments will have very little impact in providing a compelling case for an April rate hike. Although this may be the case, an impressive figure could add to the building blocks for the Fed to take action sometime in July.

The Dollar received a crippling blow following Yellen’s dovish rhetoric and this can be seen in the Dollar Index which sunk to a five month low at 94.60. This Index was already technically bearish, but with the fundamentals suggesting Dollar weakness is taking center stage in the global currency markets, sellers may be encouraged to attack prices at any opportunity. From a technical standpoint, prices are trading below the daily 20 SMA while the MACD has crossed to the downside. Previous support at 95.50 may transform into a dynamic resistance which could trigger a further decline towards 94.00.

Stocks receive a boost

Stock markets were offered a lifeline during trading on Tuesday following Janet Yellen’s dovish comments which renewed risk appetite and encouraged investors to seek riskier assets following the clarity provided. A burst of volatility powered the European markets that were previously shackled by risk aversion with most mining stocks consequently surging, sending equities into green territory. This positive move from Europe complimented American stocks that were already enjoying a weaker dollar amid fading expectations of a US rate rise. Asian markets failed to retrieve this feel good effect as the lingering signs of risk aversion continued to boost appetite for the safe-haven Japanese Yen, which in turn capped Asian equities.

This stock market rally is thought provoking and raises many questions about the skewed nature of the financial markets. A dovish Yellen who cites concerns over slowing global growth and ongoing China woes should send jitters across the markets with risk aversion punishing riskier assets but the opposite has occurred. I feel that with fears over slowing global growth still lingering in the background and falling oil prices periodically chipping away at confidence towards the global economy, global stocks may be poised to fall eventually.

Brexit fears power Sterling bears

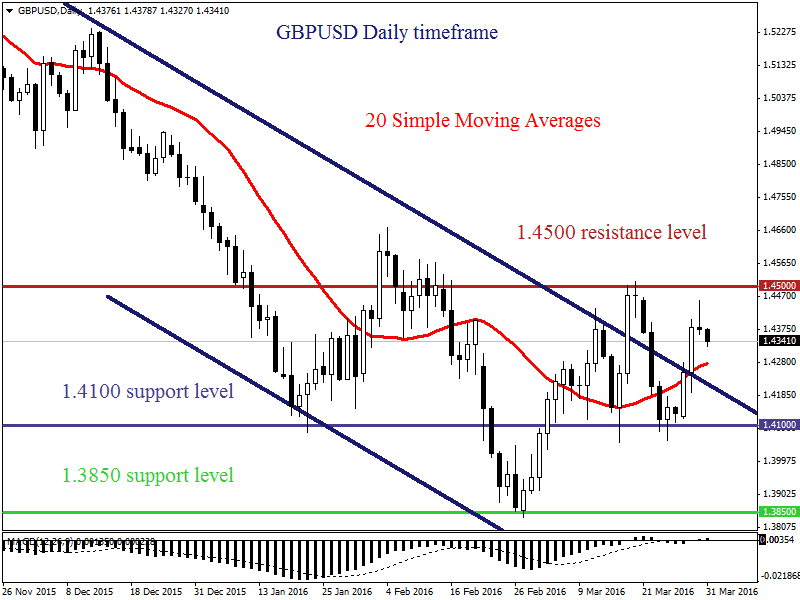

The Sterling/Dollar experienced a sharp appreciation this week and this has nothing to do with an improved sentiment towards the Sterling, but is due to Dollar weakness from the fading expectations of a US rate rise. Sentiment continues to remain immensely bearish towards the pound and the mounting Brexit concerns have provided a foundation for bearish investors to chip away at the Sterling at any signs of weakness. Mark Carney will be speaking today in Tokyo about financial stability and may likely dodge any questions thrown in regards to the Brexit topic, but any subtle signs of caution from his tone may trigger another selloff in the Sterling.

From the start of the year the pound has been victim to unrelenting selling from Brexit concerns, while domestic data from the UK has provided little incentive for the Bank of England to raise UK interest rates. The GBPUSD remains bearish and may be poised to decline later in the week as the bearish pressure intensifies. From a technical standpoint, prices are trading below the daily 20 SMA while the MACD has crossed to the downside. A breakdown below 1.41 should open a path towards 1.40 and potentially lower.

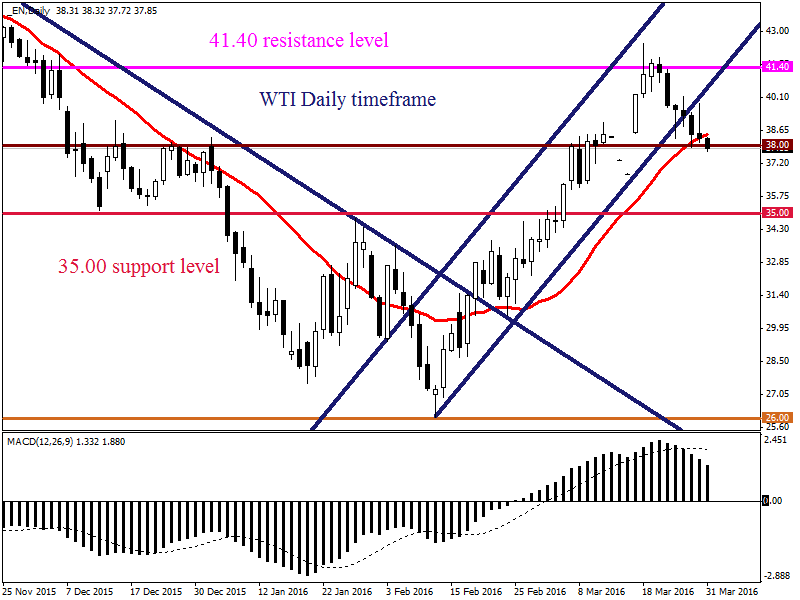

WTI Oil breaches $38

The heightened anxieties over the unrelenting oversupply of oil in the heavily saturated oil markets have provided a foundation for bearish investors to send WTI below $38 this trading week. This commodity is heavily bearish and the incessant build up in crude stock piles continues to haunt investor attraction consequently sabotaging any recovery in prices. It seems that the overextended relief rally which took prices to the highs of $42.45 may have come to an abrupt end with a further decline towards $35 sealing the deal. With expectations rapidly fading over an effective deal in the April meeting in curtailing the supply glut, further declines in WTI may be expected. From a technical standpoint, prices are trading below the daily 20 SMA while the MACD has crossed to the downside. A breakdown below $38 should open a path towards $35 and potentially lower.

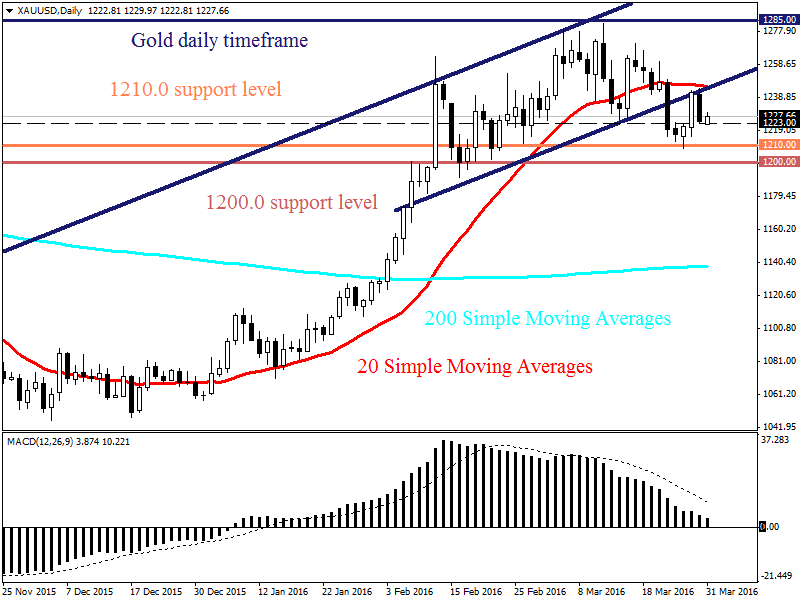

Commodity spotlight – Gold

Gold bulls exploited the diminishing expectations over future US rate rises and this offered a foundation for the precious metal to surge to fresh weekly highs at $1244. This yellow metal remains fundamentally bullish and may continue to flourish as Dollar weakness takes center stage across the global markets. With the Fed futures displaying a low 7% chance of a US rate hike in April, the shackles have been removed and bulls provided with the leeway to venture higher. If Friday’s NFP fails to meet expectations then Gold may surge as Dollar weakness provides the ticket needed for prices to surge back towards $1250 and potentially higher.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.