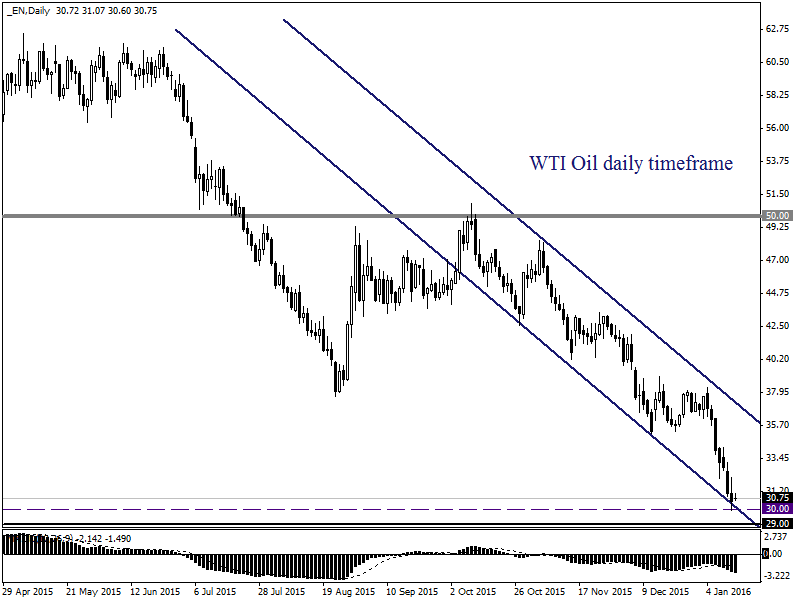

WTI Oil momentarily dipped below the $30 psychological support hitting fresh lows at $29.95 in the late part of Tuesday’s trading session as concerns over factors such as the unrelenting oversupply in the markets and sluggish global demand for oil continued to haunt investor attraction. The pain of falling prices has already started to cause disagreements among OPEC members with Nigeria’s minister of state for petroleum resources Emmanuel Kachikwu suggesting an emergency meeting, but this idea was rapidly discarded by UAE Energy Minister Suhail bin Mohammed al-Mazroui who believes that the OPEC strategy is working effectively. Current prices show that oil is heavily depressed, and with no clear signs of an emergency OPEC meeting taking place it may only be a matter of time before WTI hits $29 and possibly lower.

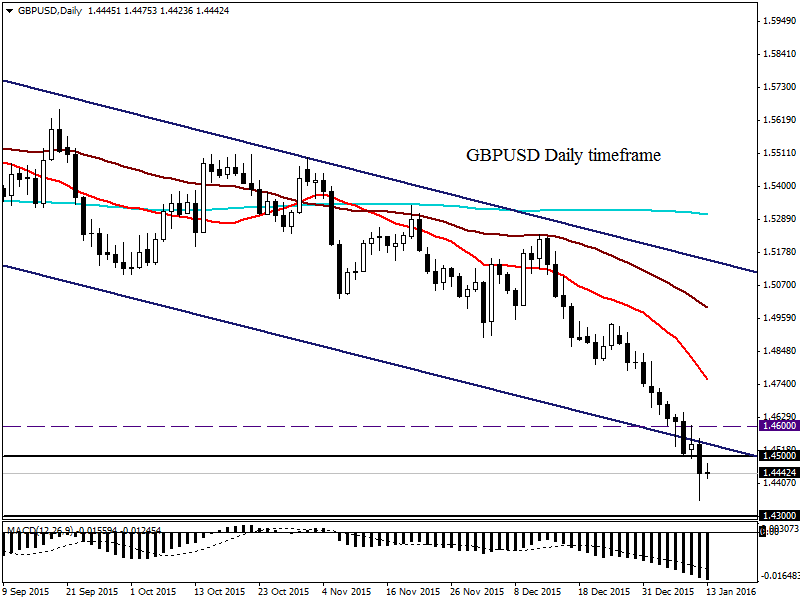

GBP under intense pressure

The Sterling encountered another aggressive decline on Tuesday with the currency depreciating against all 16 of its major partners during trading yesterday. The catalyst behind another round of heavy selling for the UK currency was an unexpected set of weak data from the economy, which follows previous disappointing data such as the -0.7% decline in U.K industrial output during November to which investors reacted unfavourably. This was complimented with a slowing manufacturing output of -0.4% which has prompted further concerns over a visible slowdown in the UK’s manufacturing sector. Even Chancellor George Osborne is sounding downbeat on the UK economy just months after publicly speaking positively about the robust recovery and the recent economic data is fuelling anxiety that GDP prospects are slipping lower.

Investor sentiment towards the pound is clearly bearish and with slowing domestic growth rapidly reducing any expectations around the UK economy picking up in the fourth quarter of last year, the Bank of England (BoE) remains unpressured to raise interest rates from the record low of 0.5%.

The GBPUSD plunged on Tuesday with prices slamming through the 1.45 support and sinking to another fresh five and a half year low at 1.4355. Despite encountering excessive losses already in the early trading weeks of 2016, the GBPUSD outlook is still for further declines. We are breaking below significant technical support levels that are just encouraging sellers to push prices as low as possible, and it is still difficult to pinpoint where a possible floor in selling will be located.

UK interest rate expectations are being repeatedly pushed back and Friday’s positive US NFP release has reinforced the short term interest rate differential between the Bank of England and Federal Reserve. With the fundamentals and technicals on the GBPUSD all pointing to the downside, prices may decline towards 1.4300 and potentially lower still.

From a technical standpoint, there have been consistently lower lows and lower highs, while prices have traded below both the daily 20 and 200 SMA. Previous support at 1.45 should now act as a dynamic resistance which may encourage sellers to attack prices lower. A daily close below 1.4400 should also invite an opportunity for a further decline towards 1.4300.

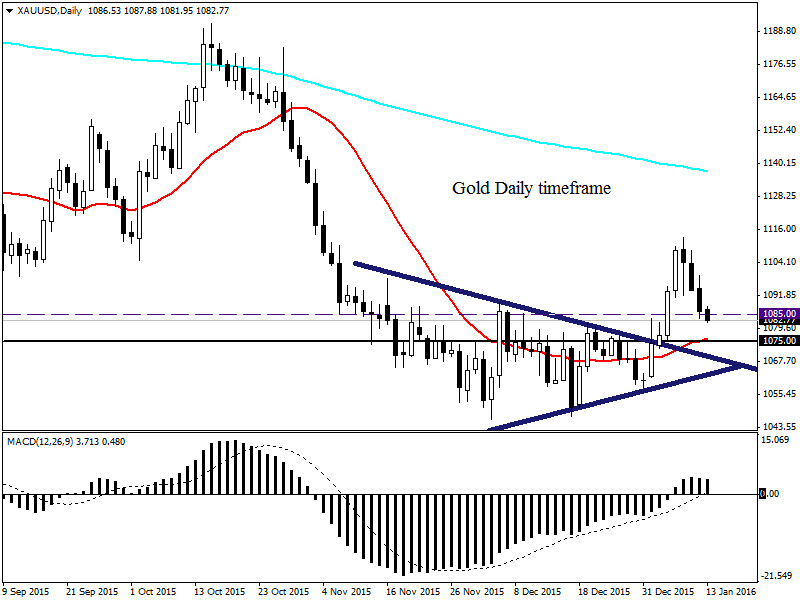

Gold dips below $1090

Gold posted its third straight trading day of losses on the back of an appreciating Dollar, and has now dropped back from its highs last week to trade at $1083. Despite the recent gains promoted from the risk-off trading environment, this precious metal remains fundamentally bearish and pressured by US interest rate hike expectations for 2016. Friday’s firm NFP release has renewed the possibility that US rates could be increased once more before the end of the current quarter and this should limit how high prices could rise, especially if Federal Reserve policymakers continue to repeat an intention to raise rates a possible four times in 2016. With bears already installing another wave of selling momentum into this zero yielding metal, a solid breakdown and daily close $1085 should invite a further decline towards $1075.

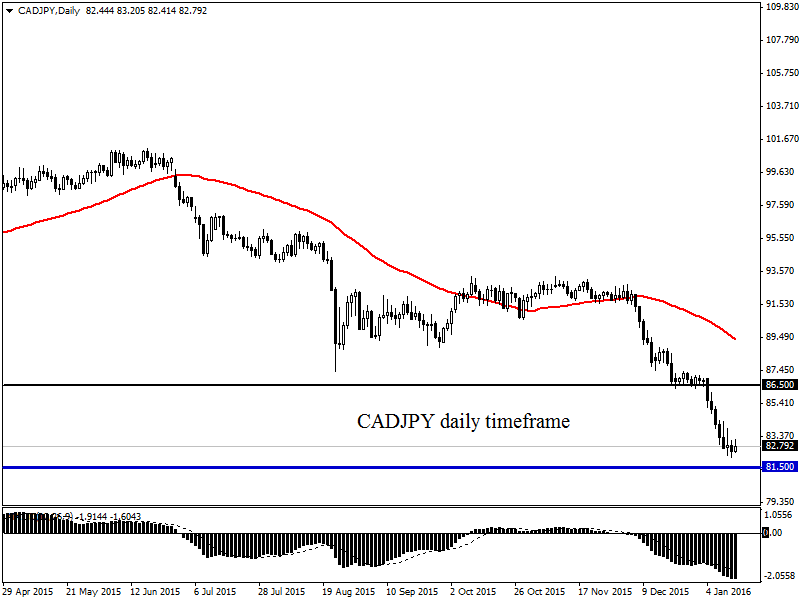

CADJPY

The CADJPY is technically bearish on the daily timeframe as there have been consistently lower lows and lower highs. Prices are trading below the daily 20 SMA and the MACD has also crossed to the downside. This current bearish momentum may send prices towards 81.50.

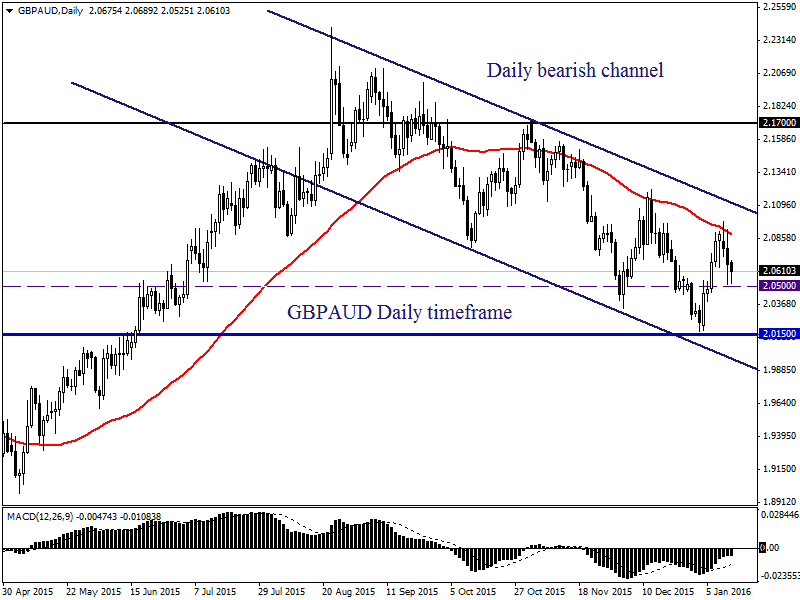

GBPAUD

This pair is technically bearish on the daily timeframe and currently trades within a bearish daily channel. Prices are trading below the daily 20 SMA and the MACD has also crossed to the downside. A breakdown below 2.050 should encourage a further decline towards 2.0150.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.