Sentiment towards WTI Oil received another shattering blow during trading on Monday with prices descending to yet another milestone low at $31 as concerns intensified over both global growth and the persistent oversupply of the commodity in the market. This commodity has been depressed for an extended period and the resumption of fears over China’s economic slowdown and growing tension between Iran and Saudi Arabia have rapidly erased any surviving expectations that OPEC may agree on a production cut, and this is not helping sentiment. With the oil markets hitting further lows, we are expecting further pressure on the equity markets as trading resumes on Tuesday especially if fears arise that it is only a matter of time before WTI hits $30.

Persistent oversupply in the oil markets has been the name of the game for traders when it comes to pricing in declines for over a year, and the recent reports from the Energy Information Administration (EIA) that showed a sharp rise in U.S gasoline stocks have pressured continual fears around the oversupply and consequently diminished any remaining confidence that prices could make a significant recovery. WTI Oil remains under intense pressure and the dangerous combination of both sluggish global demand combined with the unrelenting oversupply have left gates wide open for prices to trade to extremely low levels. If the current bearish momentum holds, sellers may be encouraged to send prices to levels not seen since April 2003 at $25 and this would send shockwaves throughout the global markets.

It remains very clear that OPEC is willing to leave production unchanged in a bid to regain market share and push away other competitors from the markets. With any expectations of an immediate production cut swiped away, investor attraction towards WTI looks set to diminish further. This commodity is fundamentally bearish and when Iran starts to unleash its own supply of oil into the already saturated markets, prices are likely going to be left vulnerable and open more losses.

From a technical standpoint, the candlesticks are trading below the daily 20 SMA and the MACD has also crossed to the downside. The breakdown below $32 should encourage sellers to send prices towards $29.

China woes pressure Asian equities

China markets experienced another brutal selloff during trading on Monday with China shares sinking to a three-month low after confusion about the direction of the Renminbi rattled Asian stock markets. The Shanghai Composite Index concluded Monday’s session -5.33% lower dragging other Asian equities to their lowest in more than four years following the mounting fears that Chinese authorities were unable to quell the recent turmoil in its financial markets. Concerns have elevated over China’s ailing economy and with investors remaining uneasy over the possibility that Beijing may not be able to revive economic growth; global sentiment may remain under pressure. Sentiment remains bearish towards the China markets, and further signs of China importing less from overseas would fuel more concerns about the economy slowing down and raise anxiety about China’s main export partners because at the end of the day, it is those economies that are going to get used to declining demand from China. Market participants remain very jittery and with the growing unease over China’s growth, increased geopolitical tensions elsewhere and falling commodity prices chipping away at confidence, investors have been encouraged to flock away from riskier assets. This terrible mixture of various concerns which have haunted investor attraction towards risk, combined with the aggressive decline in oil prices, may expose global equities to further losses.

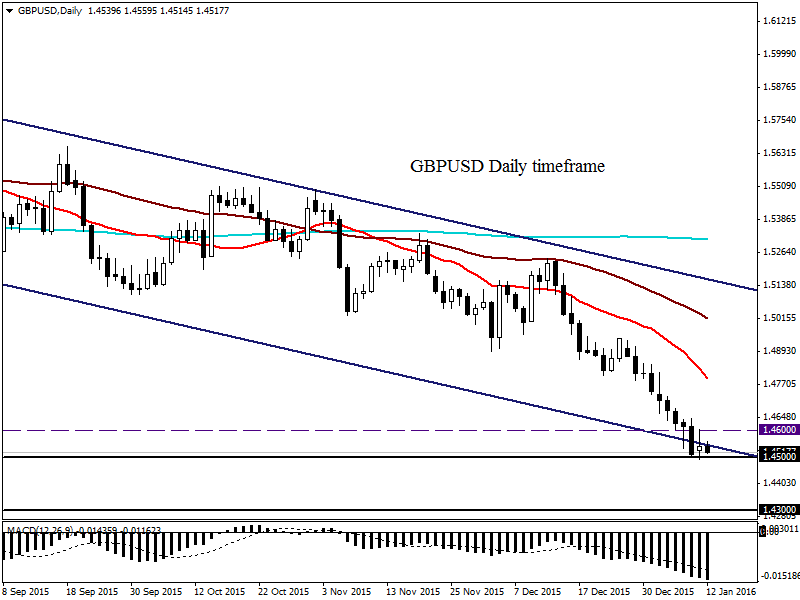

Commodity spotlight – GBPUSD

Sterling bears received ample encouragement last week with the GBPUSD slumping to a fresh five-year low at 1.449 as expectations around a UK rate hike in 2016 rapidly faded following the gloomy outlook for the domestic and world economies. Sentiment towards the pound is heavily depressed and recent reports discussing the potential that the UK pound may be the most overvalued currency in the world have diminished investor attraction further. The tepid UK wage growth in 2015 complimented with the deterioration of economic data have attributed to the Bank of England’s clear reluctance to raising UK interest rates and this has left the Sterling open to further losses. The GBPUSD remains fundamentally bearish and if Manufacturing Production for the UK fails to meet expectations today, then sellers may be encouraged to send prices towards 1.43.

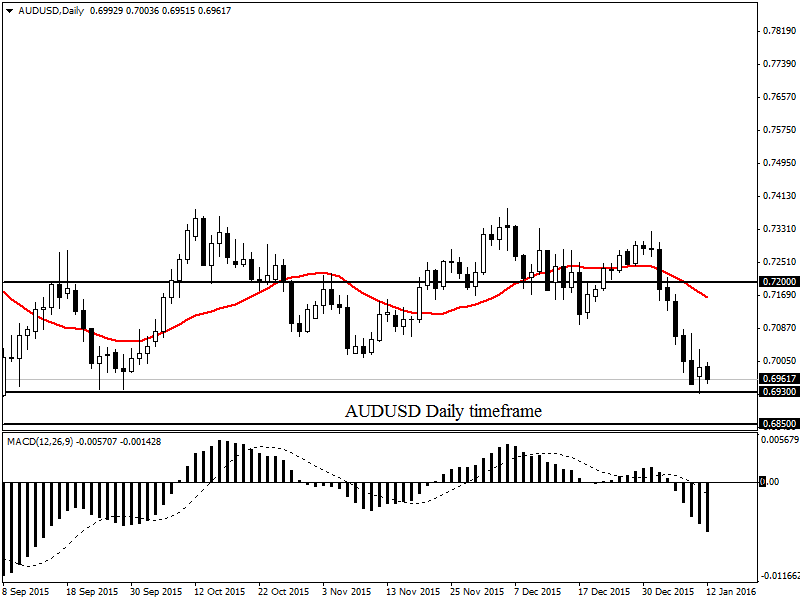

AUDUSD

The AUDUSD is technically bearish on the daily timeframe as there have been consistently lower lows and lowers highs. Prices are trading below the daily 20 SMA and the MACD has also crossed to the downside. A breakdown below 0.6930 should encourage a further decline towards 0.6850.

NZDJPY

This pair is heavily bearish on the daily timeframe as prices are trading below the 20 SMA, while the MACD has also crossed to the downside. A breakdown below 76.50 should offer an opportunity for sellers to send prices lower towards 75.00.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.