China markets received further punishment on Monday as anxious investors rejected the efforts by the Peoples Bank of China (PBoC) to support the Renminbi in a move to calm concerns about a competitive devaluation. The Shanghai Composite Index already under intense pressure plunged by 5% dragging other Asian equities to their lowest in more than four years following the growing unease around Beijing’s ability to jumpstart the visible slowdown in economic momentum. Fears have heightened over China’s ailing economy and with confusion towards the unexpected devaluations leaving market participants questioning Beijing’s overall policy intentions; global sentiment may remain heavily depressed. Market participants are bearish towards the China markets and with December’s subdued CPI of 1.6% outlining further weakness in China, concerns may elevate further ahead of the China trade balance report which will be released on Wednesday.

Despite the boost to confidence which the US economy received on Friday following the impressive jobs numbers for December, most major US equities closed in the red territory as the pain in stocks and global concerns outweighed the positivity of the employment data. Markets participants are quite jittery and with the unease over China’s growth, increased geopolitical tensions elsewhere and falling commodity prices chipping away at confidence, investors have been encouraged to scatter from riskier assets. This dangerous combination of various concerns which have weighed heavily on investor sentiment, complimented with the continued weakness in commodity markets, may expose global equities to further declines in the near future.

Speaking of commodities, WTI oil collapsed over 2% on Monday as mounting concerns over China’s economic slowdown diminished any remaining confidence that prices could make a significant recovery. This commodity remains heavily bearish and the growing tensions between Iran and Saudi have slashed any expectations that OPEC members may agree on a production cut anytime soon. Last week’s report from the Energy Information Administration (EIA) illustrating the sharp rise in U.S gasoline stocks simply reinforced the fears over the aggressive oversupply in the global markets and traders have begun to lose patience as crude oil stock piles continue to rise consistently. WTI Oil remains under intense pressure and renewed fears of a decline in global demand mixed with the unrelenting oversupply may encourage sellers to attack prices lower towards $32.

From a technical standpoint, prices are trading below the daily 20 SMA and the MACD has also crossed to the downside. Currently, the candlesticks are trading in a bearish channel and a breakdown below $32 should encourage sellers to send prices towards $29.

Commodity spotlight – Gold

The riskoff trading environment created from the increasing geopolitical tensions between Saudi Arabia and Iran combined with an unexpected nuclear test from North Korea have boosted appetite for safe haven assets consequently sending Gold prices to a monthly high at $1113. Regardless of recent gains, this metal remains fundamentally bearish and with December’s impressive NFP report reinforcing the possibility that US rates could be increased once more this quarter, bears have been provided an opportunity to install another round of selling onto this zero yielding metal. This relief rally may come to a halt below $1120 if an appreciating Dollar encourages sellers to participate in sending prices back down towards $1090.

USDTRY

The USDTRY is technically bullish on the daily timeframe as there have been consistently higher highs and higher lows. Prices are trading above the daily 20 SMA and the MACD has also crossed to the upside. As long as prices can keep above 2.98, there may be a further incline towards 3.07.

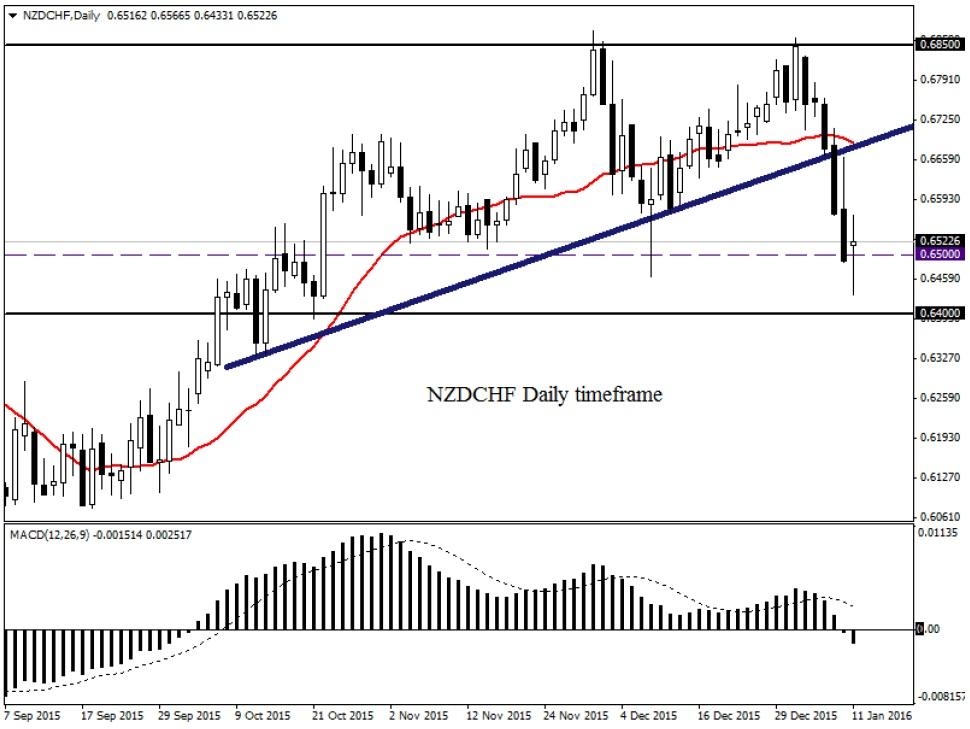

NZDCHF

The NZDCHF is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. A solid break below 0.6500 should encourage sellers to send prices towards 0.6400.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.