Recent history from early last year is returning to haunt the Pound and we are once again currently witnessing the currency suffer from a complete lack of investor attraction. There are a number of different reasons around why the Pound is suffering from low investor attraction with the most recent being pressure on the global equity markets, which whether being due to continuously depressed commodity markets or increased geo-political tensions, is inviting a risk-off trading environment from investors. We first noticed that the Pound suffered from a risk-off trading environment following the historical events of Black Monday in late August 2015, and this is very much a trend that is resuming throughout the early weeks of January.

There are also other reasons why the Pound is suffering from minimal investor attraction with this including continued inflation weakness, a recent deterioration of economic data which is creating downside pressures to GDP prospects and also a regular occurrence or perhaps even prolonged pushed back UK interest rate expectations. These risks to investor sentiment do not even include the negative market implications a Brexit vote would bring, which could be severe regardless of how far the Pound has already dropped. Recent reports in major publications about the Pound being the most overvalued currency in the world and some speculating that it could potentially fall as low as into the 1.20’s against the USD will also prevent the potential for a recovery.

Notoriously low inflation is also providing Bank of England (BoE) policy makers with a compounding reason to repeatedly push back UK interest rate expectations. If I am being honest and if it wasn’t for the unexpected inflation risks following the dramatic decline in the price of commodities, UK interest rates would have moved forward by now and most now believe that the ship for a UK interest rate rise anytime soon has now sailed. One of the most hawkish members of the Monetary Policy Committee (MPC) Martin Weale has now backtracked and publically stated that the case for rate rises is less immediate than before while more recent claims from Chancellor George Osborne that the UK economy could be dragged into the decline by a wide mixture of risks abroad is strong enough ammunition to close the door on any potential increases in UK interest rates.

Traders should also see the potential around a possible Brexit vote as a huge risk, despite the acceleration of Pound losses in recent weeks and even if a potential referendum has yet to be confirmed. The threat to the UK markets and the Pound would be severe if a referendum was announced and that’s even if the market expectations over a Brexit outcome were low. There would be all sorts of risks for investors to consider with this including threats of capital outflow and concerns that enterprises would threaten vacating UK operations. It should also be worth remembering that if BoE Governor Carney managed to encourage market anxiety by just expressing that the Grexit concerns last year would have an impact on UK financial stability, you would only have to imagine what his stance would be if a referendum was confirmed.

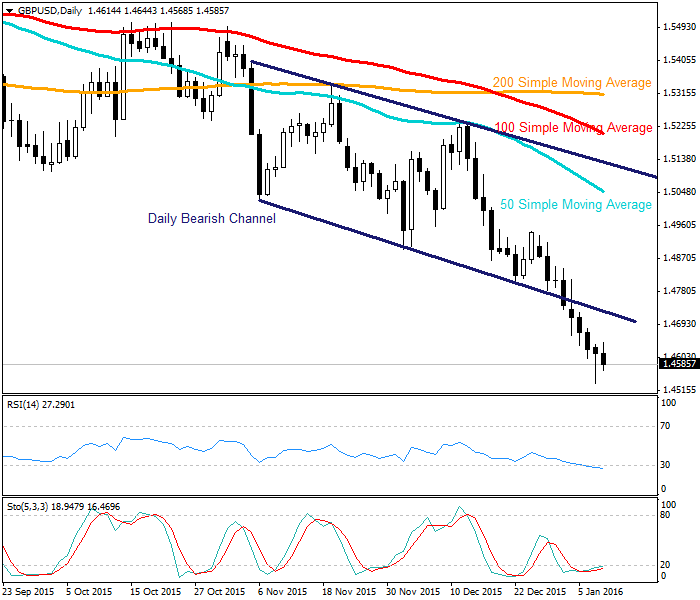

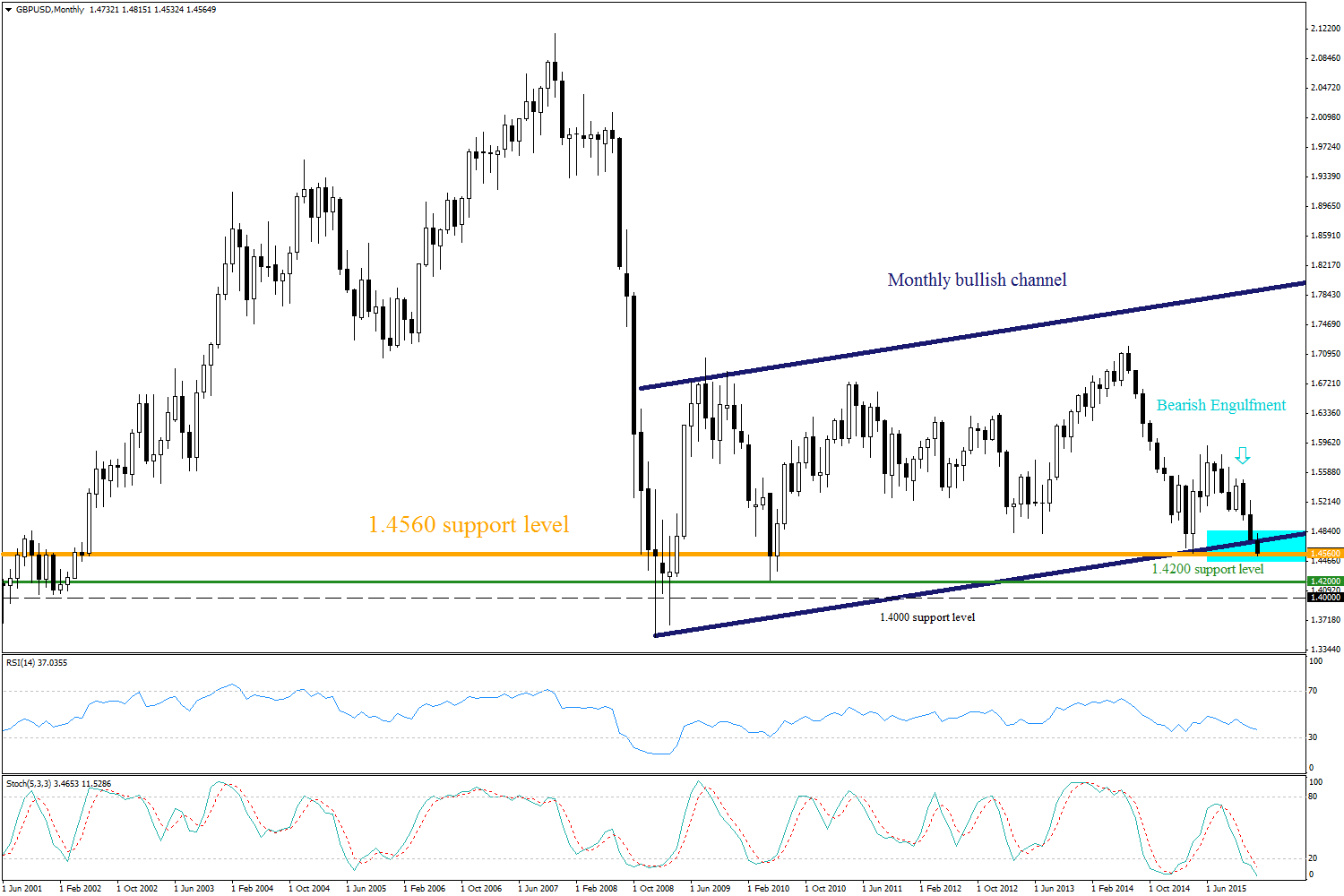

If it wasn’t already enough that the more negative than previously documented fundamental picture is representing risks to the Pound, the current weak technicals are also heavily encouraging traders to push prices even further lower. We noted regularly towards the final quarter of last year that traders watching the daily timeframe could see gains in the GBPUSD strictly limited to some of its main 50,100 and 200 moving averages and we have now moved onto a more depressing picture on both the weekly and monthly charts. The GBPUSD has now even slipped below its bearish channel on the weekly chart and we are focusing on the 1.4560 area being seen as huge psychological support on the monthly chart. Once the GBPUSD cleanly slips below 1.46, market expectations are going to substantially increase that the pair could fall to 1.42 and then possibly 1.40.

GBPUSD Daily Chart:

GBPUSD Weekly Chart:

GBPUSD Monthly Chart:

Comparebroker is a comparison site and we spend hundreds of hours to keep the information up to date. However, users are advised to do their own due diligence and nothing can be perceived any advise. The content on the website is purely for education purposes only

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.