Global Markets

The global markets are anxiously awaiting the outcome of the Federal Reserve meeting tonight, in which the majority of investors anticipate that US interest rates will be increased for the first time in almost 10 years. Erratic movements continue to affect the currency markets as eager investors make the most of the incredible levels of volatility in the hope of being on the right side of one of the most anticipated financial events of 2015. While part of the unrestrained volatility in recent days could contribute towards the milestone lows found in the price of oil, there are still lingering concerns that the statement from the FOMC will be strictly dovish.

At the very least, it is highly expected that it will be reiterated once again that the pace of a US rate rise will be slow and controlled. Even though most equities have managed to claw back some losses from Monday, the firm expectations around the Federal Reserve raising US rates may spark a further selloff in global equities as speculations mount that higher US rates may trigger capital outflows from elsewhere.

The overflowing optimism around the likelihood that the Federal Reserve may raise US interest rates has limited how far Gold prices could advance and this has consistently threatened the bulls. This zero yielding metal is heavily bearish and with the Fed funds pricing an 80% chance of a US interest rate rise today, there is still a potential for Gold bears to install another round of selling momentum throughout metal trading in 2015. From a technical standpoint, prices are trading below the daily 20 SMA and the MACD has crossed to the downside. The breakdown below 1063 may encourage sellers to send the metal towards 1046.

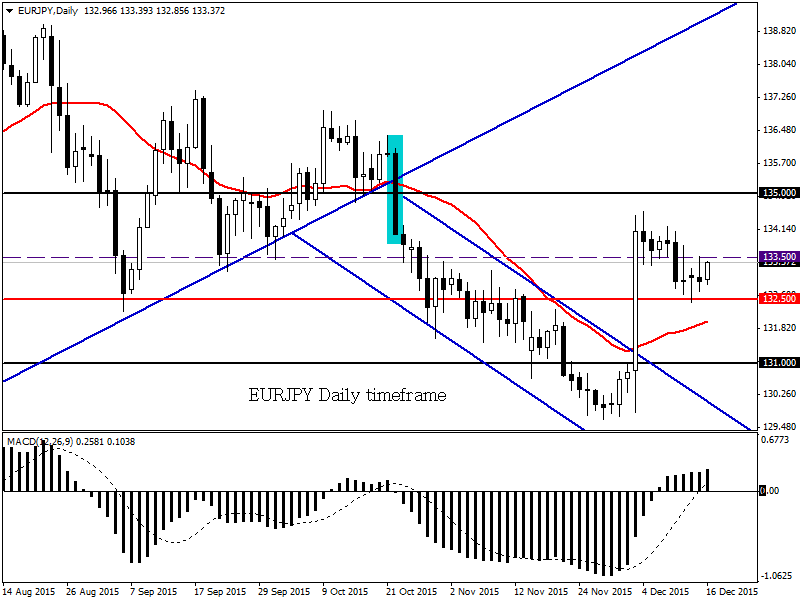

EURJPY

The EURJPY remains technically bullish on the daily timeframe as long as prices can keep above the 132.50 support. The impressive reaction around the ECB’s decision almost two weeks ago has created a flag pole for a potential bull flag formation. Prices are currently above the daily 20 and the MACD has crossed to the upside. An intraday breakout above 133.50 should encourage buyers to send prices towards 135.00.

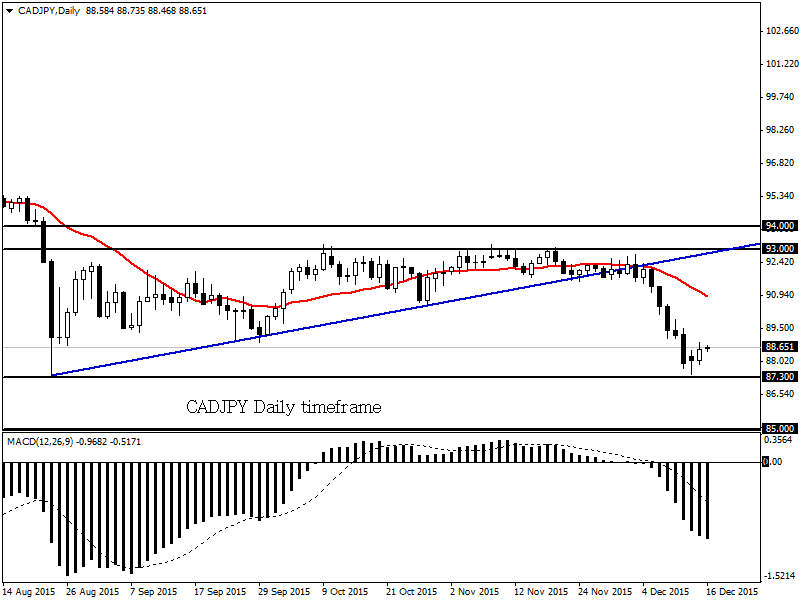

CADJPY

The CADJPY is technically bearish on the daily timeframe as there have been consistently lower lows and lower highs. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. A breakdown below 87.30 may invite an opportunity for a further decline towards 85.00.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.